Wednesday, February 24, 2021

The Last And Most Lethal Bubble: Economic Delusion

Tuesday, February 23, 2021

Meltdown 2.0: In Progress

The amount of rot and fraud under the hood of this Fed sponsored pump and dump is unprecedented in U.S. history. When it all explodes "without warning", the Idiocracy will be shocked at how much criminality they enjoyed while it was working in their favor...

On the anniversary of Meltdown 1.0, ALL of the COVID bubbles are imploding at the exact same time: Bitcoin, EV/Tesla, SPACs, MAGA cap Tech, Work from home, pot stocks, biotechs, and EM Tech...

Sadly, the usual bagholders have no possible way of knowing that the party is already over. One of the downsides of being addicted to bullshit.

Last year during the first week of meltdown, I noted that the BTFD impulse had conditioned gamblers to calmly self-implode. The slow motion implosion was a surreal moment, as it is right now. The perma-bullish financial media will take a few days or weeks to catch on to the fact that the party is over, because their audience is in no mood to believe it. By the time they figure it out, it will be far too late. Over the past week there have been four overnight selloffs that led to morning crashes in the U.S. - each one of a larger magnitude, and yet each one got bought.

Then as now, post-opex the Nasdaq 100 crashed into its 50 day moving average and backtested it from the underside. By Friday of that first week, the 200 dma was the first level of support. Which is another 10% lower from current levels.

The World's most popular ETF traded 600% of average volume today.

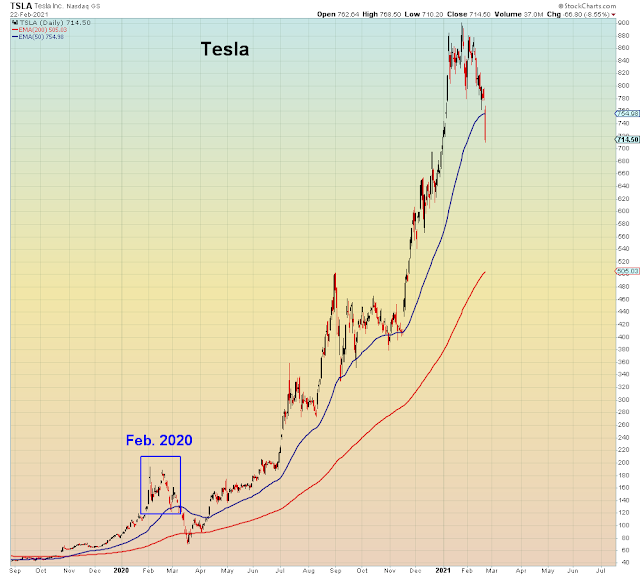

The largest holding of the Ark Funds is of course Tesla, which has now entered a bear market along with BitCasino. Two Ponzi schemes tied together to see if they'll float:

"Tesla shares have fallen into a bear market, down over 20% from the recent high, and some analysts suggest the company's ties to bitcoin are to blame as the currency takes a beating"

Ark Web's two largest holdings are Bitcoins and Tesla

I read a message board comment recently saying that Cathie Wood is the only Boomer who trades like a Millennial.

100% pump and dump and proud of it.

Speaking of which, Nasdaq selling pressure is at March 2020 levels of distribution. The smart money is hitting the dumb money bid.

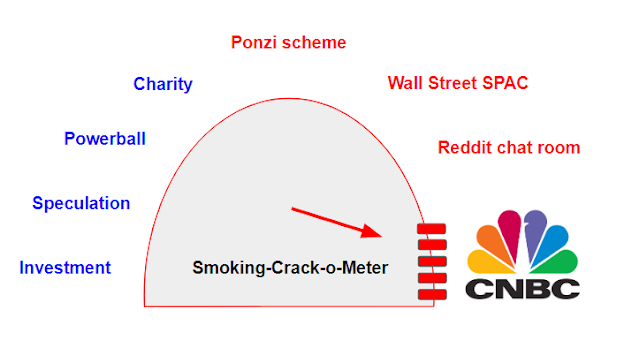

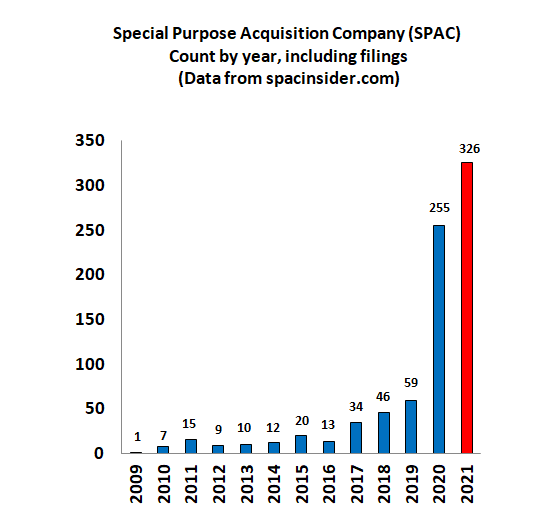

Today, one of the most high profile SPAC deals revealed itself to be another pump and dump at home gamer expense. Shocking as that may sound. These unregulated private equity vehicles are a con man's paradise.

"Amateur investors have crowded into Klein’s SPAC in the hope of backing the next Tesla Inc. They did so before knowing the terms of the proposed transaction or the state of Lucid’s finances. Gambling doesn’t always pay.

The big winner here is Lucid’s principal shareholder, the Public Investment Fund of Saudi Arabia"

Despite the widening overnight gaps, so far, the algos are keeping options volatility compressed. However, as we see below, last year volatility shorts were reducing their positions into the event, whereas this year they have been pressing their bets.

The potential for volatility explosion is far greater this time around:

Of course we never saw this much delusion a year ago:

There is an algo driven pattern to these Disney markets that is intended to monetize as many people as possible in both directions. Which means that when the bubble final explodes, most home gamers will be wiped out.

And then there will be nothing left to show for the virtual simulation of prosperity, and its acolyte QE, except for an enraged populace. Bilked by the usual psychopaths.

Again.

Monday, February 22, 2021

Lowering The Boom On Bullshit

Sunday, February 21, 2021

A RAGING HANGOVER

When the sheeple realize they got conned into human history's biggest one way pump and dump and obliterated on the eve of global economic depression, I predict there will be considerable societal "acrimony". The only benefit of imploding in human history's biggest moron bubble is being able to claim no one saw it coming...

Historians won't understand how the worst global pandemic in 100 years spawned the biggest asset bubble in human history. After all it's a well known fact that the economic dislocations from the pandemic are four times worse than the global financial crisis, however stoned gamblers have been fully euthanized by central bank monetary heroin. This manic RISK ON party only makes sense in the context of the non-stop monetary bailouts since 2008. Dopium stoned gamblers have been conditioned to believe that the decimation of the economy is "good news" for stocks. The hangover from this final delusion will be brutal.

“This has been the most severe crisis for the world of work since The Great Depression of the 1930s. Its impact is far greater than that of the global financial crisis of 2009”

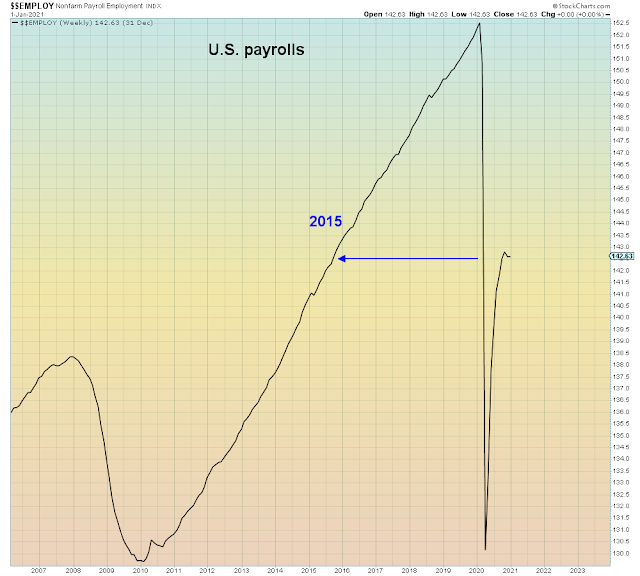

One year later from the beginning of the 2020 meltdown and gamblers are celebrating mass unemployment and record debt accumulation by bidding up stocks to insane valuations.

Depressionary interest rates and "free money" are the cat nip fueling this manic rally. There is no concern for the fact that these same 0% interest rates portend economic obliteration on the other side of global margin call.

Such is the overwhelming belief in free money that the "experts" on Wall Street can't think of anything to worry about right now. One minor pump and dump in Gamestop three weeks ago almost brought down the entire financial system, and yet professional money managers are too high on monetary crack to realize their careers will soon be ending.

“Whether it’s herd mentality, or fear of being left behind, that’s what you’re seeing.”

Dated from the last bear-market bottom, the boom cycle is young -- 11 months, versus five years for the median bull market...a majority of money managers in a Bank of America poll this month viewed the current bull market as being in a late stage"

Got that? According to today's "experts", this is a young bull market that is in its latter stages, so they are buying it with both hands. With that kind of logic it's clear they owe their careers to central banks. The inconvenient truth is that this was all just a headfake rally in a bear market that started one year ago. This was always how it was going to end. Money managers ALL IN at the top. Clearly when it explodes they will all look like fools, however the stampeding herd always believes there is strength in numbers.

I keep a chart list of what I call the "COVID implosion" stocks. These are the industries that have been blighted by this virus. What we notice is that they are all three wave corrective, which means they are in a bear market:

Energy stocks have been the worst performers since the March low. This overlapping correction shows wave 'c' is barely above wave 'a' which ended last June.

Among the most beaten down cyclicals, regional banks have enjoyed the deepest retracement

History will show that this COVID rally was the blow-off top in the risk rally that began back in 2008. Useful idiots bought the story that last year was late cycle, and the blowoff top was early cycle. You have to be brain dead to believe this shit, which is why few people questioned it.

They got conned by the usual psychopaths. What's new?

Friday, February 19, 2021

Ponzi Schemes Are The Hottest Asset Class

"Business borrowing “now stands near historic highs,” the U.S. central bank said in the report. Even though large cash balances, low interest rates, and renewed economic growth may dampen problems in the near term, “insolvency risks at small and medium-sized firms, as well as at some large firms, remain considerable."

Thursday, February 18, 2021

Dangerously Close To Explosion

This week we learned that Gamestop almost broke Disney markets. How will we explain this to the grandchildren. In 2008 we had a global credit crisis and in 2021 we had a Reddit-organized pump and dump scheme carried out on a candified iPhone app called "Robinhood", designed to entice all juvenile order flow to the world's wealthiest hedge fund. You can't make this shit up...

Tomorrow is the one year anniversary of the pre-COVID market top. What has changed since the pandemic began? MAXIMUM RISK TAKING and the gamification of markets. Unfortunately, the system can't handle this level of gambling...

“We have come dangerously close to the collapse of the entire system and the public seems to be completely unaware of that, including Congress and the regulators”

Imagine one year on from the worst market meltdown since 2009, and the greatest stress markets have seen during the entire pandemic was caused by a pump and dump scheme on a stock that started 2021 at $1 billion in market cap.

What changed during the past year? The rush of newbies into the market, the mass gamification of trading, and of course rampant pump and dump schemes.

All of these factors have continued to propel Nasdaq volume to new all time highs this week. As I've said several times, volume usually peaks on selloffs and recedes on rallies. So it's extremely ominous to see astronomical volume at an all time high. It does not portend well for a global RISK OFF event which is long overdue:

Of course what happened with Gamestop was merely a warning of what is about to take place. That particular short squeeze merely led to the type of epic volume that one would normally expect during a global selloff. If the machines almost crashed due to one tiny stock, imagine what happens when Tesla, Amazon, Apple, and Microsoft suddenly go bidless.

Which is where this all gets interesting, because one of the consequences of this late cycle headfake burst of inflation is that it has caused a massive rotation away from Tech/deflation trades.

For example the most popular Tech ETF, the Ark Innovation Fund has seen massive distribution (down volume) over the past week:

Chinese New Year ended yesterday and on the first day back, Chinese stocks got monkey hammered deja vu of last year:

Looking at this chart of new S&P 500 highs, we see several red flags. First and foremost the fact that new highs have been shrinking for three years now. Also we see that this year new highs peaked a month ago in January. It's the same pattern we saw last year - a peak in January and a lower peak in February during the terminal melt-up phase:

This is an interesting chart - Virgin Galactic went parabolic last year and again this year - top ticking the end of the rally. A propos of all of the virgin space cadets gambling right now, under the supervision of Dave Portnoy whose claim to fame is running an online sports betting operation. A skill that transferred seamlessly to the world of pump and dumps - someone always has to lose...

In summary, it would be extremely ironic and yet fitting if this Alice in Wonderland stock market rally exploded one year later from the pre-pandemic top. Last year they claimed somewhat dubiously over a month into the pandemic, that no one realized the global pandemic would spread to the rest of the world.

This year, we already know what they will say - exactly what they've been brainwashed to believe:

It was the beginning of a new cycle