“And we know the cases reported are an underestimate of what is out there ... we’re missing many cases because people aren’t getting tested. So the true number is much higher than what we’re actually seeing.”

Friday, November 13, 2020

The Hardest Crash In History

“And we know the cases reported are an underestimate of what is out there ... we’re missing many cases because people aren’t getting tested. So the true number is much higher than what we’re actually seeing.”

Looking Across The Valley. Of Death

"Two critical unemployment programs are set to expire at the end of the year, potentially leaving millions of Americans vulnerable to eviction and hunger and threatening to short-circuit an economic recovery that has already lost momentum."

Thursday, November 12, 2020

Rule By The Wicked. Is Ending.

In hindsight, biblical scholars will call MAGA the era of false witness. A time when criminals ran rampant and worshipped their modern day Caligula, while the empire imploded in real-time...

It took Mother Nature to put a stop to this farce.

As I said in my prior post, the sheeple are entirely unaware of their descent into squalor. It was gradual and hence it went unnoticed. For amnesiacs it's impossible to remember a time when "news" wasn't 100% circle jerk. A time when non-stop lying was considered abrogation of the Ninth Commandment, and not basis for re-election. And a time when conspiracy theories were not used to explain away facts and reality.

Faux News (Fox) stock just took a pounding, as apparently Trump is planning to start his own "news" network. His true believers are enraged that the network is not aiding and abetting his gambit to steal the election. They now consider Fox News to be a left wing fake news outlet.

"President Donald Trump went on a Twitter tirade against Fox News on Thursday morning, escalating recent attacks against his long preferred cable network."

Therefore, they are going to start a new network. We can probably guess the name. The top contenders will be INN: Idiocracy News Network. Or NJN: Nutjob News. Regardless of what it's called, it will be non-stop bullshit and conspiracy theories catering to the dumbest people on this planet.

Corporations caused this problem, they wanted a dumb and facile populace that they could exploit for maximum profit. From there, the GOP cultivated a base of useful idiots. Now, their frankenmonster is off its leash. Rupert Murdoch's evil empire is only the last casualty. Since McDonald Trump hijacked their party, traditional conservatives have had a choice, leave the party and have no representation whatsoever, or join the league of nutjobs.

Conservatives have lost track of right and wrong. An outcome predicted by The Lonely Crowd over 60 years ago, in which society would get hijacked by sociopathic extroverts. The gullible would come to prefer opinion over facts and data, until they could no longer tell the difference. As their living conditions deteriorated, they would seek out a new lower common denominator in facile buffoonery:

The Lonely Crowd also argues that society dominated by the other-directed faces profound deficiencies in leadership, individual self-knowledge, and human potential"

The Founding Fathers would not recognize McDonald Trump and his cabal of liars. Because they are the antithesis of what the Founders sought to create in their new republic. We live in a society of Disney people not willing to reveal too much of themselves to others lest it reveal the Oz-like production taking place behind the curtain. The ability to work a room with small talk is valued, however, revealing the truth is frowned upon. People who are too honest about themselves are deemed antisocial or perhaps even "on the spectrum". The slick carnival barker is preferred over the genuine individual. Where do the sociopaths learn these skills? College of course. America's black hole of wasted time and money. An industrial factory for pumping out commodified widgets for corporate use. And along with these superficial relationships has come a profound sense of loneliness and disconnection from the rest of society. No one knows who they can trust anymore.

The next thing you know a con man is trying to tear down democracy with the assent of nearly half the country.

We have entered a black hole of leadership between now and the inauguration late January. During this time, Trump will be solely preoccupied with his own future, at the expense of the country. Planning a new talk show network reveals that he is already thinking about his next move. In the meantime, there will be no stimulus, no COVID strategy, and no leadership. This period will reveal the full extent of his incompetence and negligence of duty. To even the most ardent of supporters. And they will come to know fear.

In the biblical tradition.

Wednesday, November 11, 2020

COVID Is 2008 Subprime Deja Vu

Picture no economy, no stimulus, no vaccine, and a petulant fraud barricaded in the White House while thousands are dying. Because that is what's coming. When they finally remove him, he will make Herbert Hoover seem popular by comparison...

Deja vu of subprime circa 2008, COVID is a massive wrecking ball that is being assiduously ignored by the GOP, the White House and Disney markets.

Denial is their entire way of life.

Way back in late February, the COVID pandemic had been spreading globally for an entire month since late January. COVID cases were beginning to appear in the U.S. and the experts were warning it was about to get far worse. However, the denialists in the GOP, the White House, and in Disney markets ignored the warning signs.

When the lockdowns arrived "unexpectedly", the market exploded.

Good times.

Right now, the COVID pandemic has been raging for ten months, and is entering "the winter from hell" according to President Biden's COVID expert. However, the pandemic experts in the GOP, the White House and Disney markets are in signature denial.

Good times.

For months, the alt-right and other make-believe pandemic "experts" have been saying that this is a "casedemic" meaning, much ado about nothing. And thanks to all of that denial which reached its apex last week at the election, COVID hospitalizations are now skyrocketing to new record highs.

I watched a young guy on TV recently, he had believed that COVID was a Democrat hoax, until he got his grandmother killed "by accident". Shit happens man. Some people run red lights, some presidents cheat on their wives and taxes, and some people get their relatives killed because they're lifelong idiots.

THE BIG SHORT 2020:

Back in late February, hedge fund billionaire Bill Ackman made a $27 million bet in the credit default swap market - the same private market used to bet against subprime in 2008. That bet turned into $2.6 billion within a few weeks, for a 1,000% return. Now being called the greatest trade of all time.

Now Ackman is putting on the exact same bet, albeit on a smaller scale, because he sees the same risks and complacency:

"What’s fascinating is the same bet we put on eight months ago is available on the same terms as if there had never been a fire and on the probability that the world is going to be fine.”

When Ackman took his profits on March 23, there were just over 10,000 new cases of COVID-19 nationwide. On Tuesday, new cases were just shy of 140,000, a dizzying number that has stoked fears of a second lockdown."

What Ackman calls "fascinating" is the same ridiculous greed and complacency that exploded markets in 2008. Clearly some dumbfuck investment bank is willing to take the other side of a failed trade a second time in a row and on the exact same terms. It would be like an insurance company selling fire insurance in a wildfire at discount rates.

What we notice vis-a-vis the cyclical sectors such as airlines, is that all year up until now, they rallied into a falloff in hospitalizations.

Except, this time they've rallied into a spike in hospitalizations:

Adding to the insanity is the manic reach for risk amid record risk. Also deja vu of February:

Step back for a moment and consider this past week of market madness. Last week, markets ramped higher into the election. Then on election eve when the blue wave failed to materialize, the deflation and reflation trades went in polar opposite directions. The deflation trade ripped higher into the end of the week, and reflation trades got monkey hammered. Then this week, the exact opposite took place Monday and Tuesday, the reflation trade ripped and Tech traders got monkey hammered.

In other words, algos were merely causing the most pain to the most people. Which is what I said would happen post-election. Run the stops in both directions. Now, Wall Street is loaded up on reflation trades, which is why today those trades started to roll over again, and Tech caught a bounce apparently thanks to Millennials buying the dip.

Bear in mind the bond market was closed today for Veterans Day, so we didn't get a good look at bond yields.

Here we see banks stalled at the same level as June, despite record call option speculation all year long:

“Until our political leaders force bars and restaurants to close, I don’t see how we can get this thing under control,” Cramer said. Investors have rotated out of stocks associated with the stay-at-home theme on Covid-19 vaccine optimism, but experts are warning that the winter months could be brutal as cases continue rising."

Uncertainty surrounding pending stimulus talks is also on the host’s mind...[Trump & Co.] denying the legitimacy of the election and trying to fight it any way they can, they’re certainly destabilizing the situation,” he said. “From the stock market’s perspective, that’s a problem.”

The Invisible Hand Of Implosion

"Chief Justice John Roberts twice saved Obamacare, and he appears ready to uphold it again. But Roberts is growing weary of it all"

Tuesday, November 10, 2020

Goldilocks And No Bears

We have no economy, no stimulus, no vaccine, and no president. So instead we get bedtime stories with happy endings, in the Wall Street tradition...

The great rotation to value continued for the second day today. How many times just in the past year alone have we heard this story? Recall not even a month ago, the entire "blue wave" fantasy was going to bring endless reflation. Then, that crashed ahead of the election, as the odds of a contested election increased. Last week, we got the Goldilocks fairytale via Zerohedge:

Friday, Nov. 6th

"So what about the reflation rotation - is that dead? Well, according to BofA, yes"

That prediction had a shelf life of hours. Not to be outdone, Barron's had an article over the weekend saying that Tech stocks are the new safe havens. That trade has been getting monkey hammered this week.

Now, of course all of the dumbfucks have raced BACK to the other side of the boat. Embracing the vaccine reflation trade and dumping Tech deflation trades en masse.

Fast Money started out with a segment tonight on where bond yields are headed. The unanimous consensus was higher. Meaning buy banks, industrials, hotels, airlines etc. Every time Tech pulls back, the value rotation hypothesis comes back in fashion. Go figure.

CNBC: Prepare for Bond Yield Breakout

Anyone who trusts people who can invert their entire bedtime story in a matter of hours deserves their fate.

So, what's the answer, deflation trades or reflation trades? The answer is NEITHER. Cash is king.

First, I will revisit the reflation trade which I touched upon yesterday. Here we see the thirty year yield with Treasury bond shorts (lower pane). As we noted last week this is the most crowded trade in human history. The net speculative as of the most recent CFTC data is from one week ago. However, anecdotally one could make the case that this is still a crowded trade.

All it would take is one state-wide lockdown and this trade will explode, meaning bond yields will fall.

Backing up this hypothesis is the fact that the equity option call/put ratio is back at the all time high from June, which is when the entire reflation trade spiked and then exploded:

Of course, when the reflation trade exploded back in June, there was a MASSIVE rotation back to Tech stocks. Because those are safe havens, remember? Why can't that happen this time around?

After June, Tech continued climbing and then had a blowoff top back in September. Since that time, the sector has been trending down. Each rotation to "reflation", has led to a lower high in Tech.

We learned today that Millennials are now doubling down on work from home stocks as they take profit in cyclicals.

Which explains why there has been no panic. Yet.

All of which leaves Utilities holding up the Casino:

Gamble at your own risk.

Monday, November 9, 2020

Winter 2008 Deja Vu

After more than a decade of monetary Japanification topped off with four years of Circus Donny, one thing we've learned with certainty is that an aging society can no longer accept the truth...

The World's handling of this pandemic has been all wrong from the start. Trump's handling of it was the worst in the world. I seldom agree with Bill Gates, but he has said from the start that testing was key to keeping the economy open. He was spot on. However, Trump in his infinite denialism put all of his eggs in the vaccine basket. And many people believed it would be a silver bullet panacea. Even now, with Pfizer's most recent 90% efficacy indication, it won't prevent the winter from hell. What it will do however, is allow people to let their guard down and assume the pandemic is ending. Which will increase the spread further.

As Gates has said, if we had focused our efforts on instant testing, most of the economy would be back open by now. However, denialists don't like testing because it "causes" the case load to skyrocket. Which looks bad for Trump. Denialism strikes again.

Which gets us to the casino and the 2008 paradigm.

People forget that there were many false dawns in that fateful Autumn leading into winter. The largest rallies are always in bear markets, which caused a lot of people to assume the worst was over.

The last false dawn was a fake reflation rally that put a massive bid under cyclicals and in particular small cap value stocks which had been beaten down the most. Nevertheless, like all things Wall Street, it was an ephemeral end of cycle blow-off top. Bought and believed by the majority, solely due to the misallocation of capital and short-covering.

Last week starting on election eve, Wall Street put on a massive Tech trade and shorted the Russell 2000 under the auspice of the Goldilocks gridlock trade.

Now all we are seeing is that trade get monkey hammered due to one vaccine headline. In Disney markets consensus trades are lethal.

Zooming in to this year's view, Regional banks are leading this last rally amid a familiar spike in bond yields. June was the mid-point of the rally and this is the end:

Due to mass delusion, most people today are of the brainwashed belief that this economy is stronger than the one in 2008:

"Joe Biden is returning to the White House to lead the United States in the midst of an economic crisis after beating President Donald Trump in Tuesday’s election, a turn of events likely to conjure an eerie sense of deja vu for the Democratic former vice president."

Unlike in 2008, when the country elected Democrat Barack Obama and his running mate Biden as the global economy teetered from the sub-prime mortgage crisis and collapse of the Lehman Brothers investment bank, the worst of the current economic downturn may have passed already, economists and analysts say."

Got that? The worst is over.

There is literally no basis to compare today's imploded economy to the one in 2008. Today, there are millions more unemployed than at the peak in 2009. Today, combined fiscal and monetary stimulus is DOUBLE what it was in 2008.

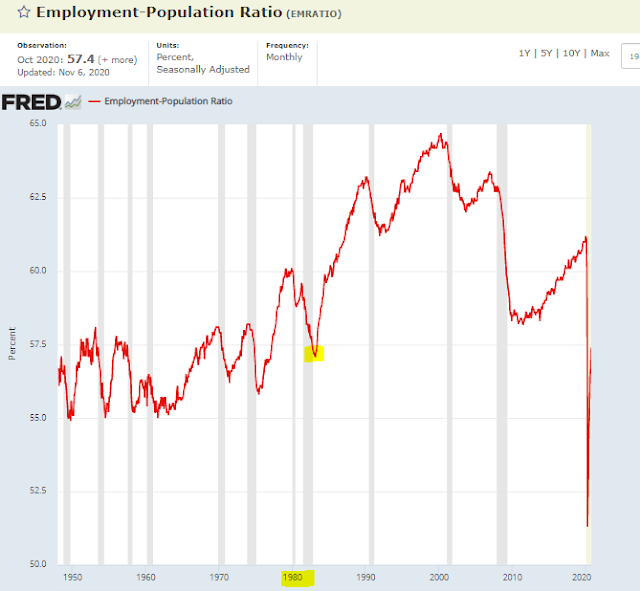

Here we see the employment/population ratio is at the lowest level in four decades. Large companies are crushing small business, and society is ignoring the consequences.

Oil demand is a good proxy for economic activity. This economy just lost three decades of oil demand.

Emerging Markets peaked almost three years ago near the beginning of the MAGA fantasy. Now they are soaring back on the belief that the worst is over.

When in reality, the worst hasn't even started yet.

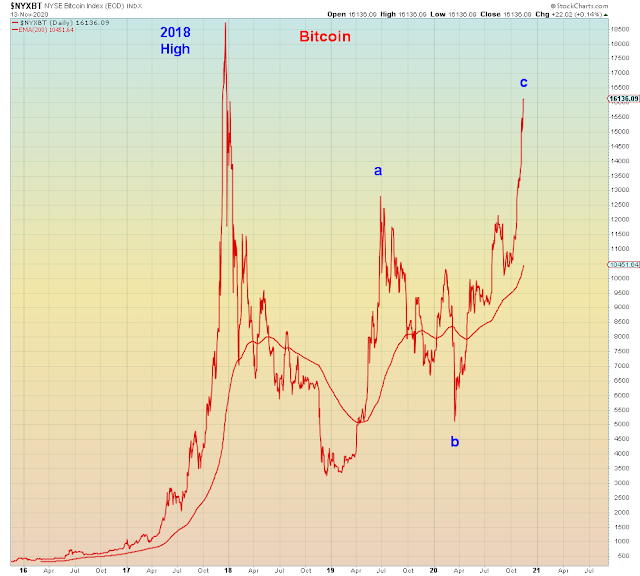

EMs are a good proxy for global social mood, which is three wave corrective:

In summary, we have a v-shaped recovery in delusion. Wall Street is like every other American Dream factory - Disneyland, Hollywood, Faux News - it's 100% fraudulent. And yet people accept the lies over and over again.

Right now, we are watching the final capitulation to fantasy. A movie some of us remember, and most want to forget.