Just one day after saying they would not revise monetary policy until their scheduled meeting in November, the BOE panic intervened in the UK Treasury market to restore order. The 10 year UK Bond had catapulted from under 1% to 4.5% in less than a year.

That's all it took for global gamblers to rush back into risk markets. Bailout Watch is back. Leave aside the fact that it was only a few weeks ago that Fed Powell monkey hammered global markets with the message that pivot was not on the table. The stock market has been straight down since that time and is now camped perilously at the June lows.

Zerohedge was all over this new central bank "pivot", because it checked their box for imminent hyperinflation, dollar demise, and commodity super cycle. The latter of which has been a failed trade ever since the war in Ukraine began. More than a few pundits took the opportunity to assuage the concerns of trapped gamblers.

Yet again, in order to believe in this latest central bank fantasy one must believe that the middle class will continue to go under the bus due to inflation and higher interest rates, while financial markets receive another bailout. It's the same theme of the past 14 years, however this time running up against 10% inflation.

What the Bank of England is attempting now, is known as "impossible". They are attempting to monetize a new tax cut, raise interest rates to cool rampant inflation, and stabilize the currency. No one told them these objectives are mutually incompatible, so they will learn the hard way. This new easing policy is highly likely to undermine the currency which has already collapsed.

All of which makes this the Boris Johnson of financial bailouts - it's here for a good time not a long time. The more central banks outside the U.S. capitulate, the more it will drive the dollar rally.

It's the Fed that must capitulate, but there is not even the slightest sign of that taking place. Don't take my word for it, even perma-bull Jim Cramer understands the Boris Johnson bailout won't last:

The market is short-term oversold so this nascent bounce could last a few more hours or days. Or it could already be over. This is a good article to understand the potential short-term path of this rally and ramifications for trapped gamblers:

The article asserts that "everyone" is bearish. Which is moronic, because the target audience for the article is trapped bulls. However, the real punch line further down in the article after setting the stage that sentiment is negative:

"During bear markets (2008), negative sentiment provided very small opportunities to reduce risk before further declines"

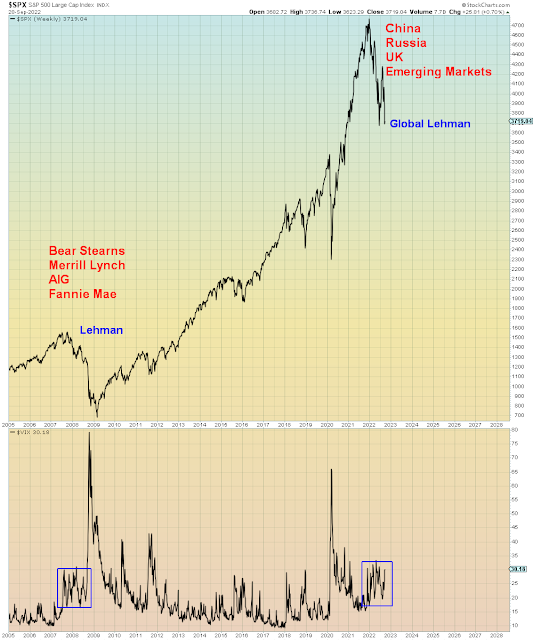

I agree, and I'm not even that bullish. However long it lasts, this could very well be the last bounce before the market accelerates lower. Anyone can see below, there is no sign of real panic the likes of which we saw in 2008 and 2020. This isn't even as extreme as 2011, 2015, and 2018. In all of those times the VIX hit 50.

Consider also that those blue squares represent ACTUAL Fed bailouts. Not imaginary bailouts, like this current one. It's shocking to realize that investors are the MOST complacent at a time when bailout is LEAST likely. Today's financial managers don't understand moral hazard. All they understand is bailouts.

And 2022 is the year when bailout investing will fail catastrophically.

Below I put together this illustrative chart to show what I believe to be the next sequence of events. My original chart was somewhat optimistic, so I made this revised one to take into account the full scope of impending dislocation. This of course is a best "guess", so take it with a grain of salt. I will adjust accordingly as circumstances evolve.

Once this oversold rally ends and the June support level is broken, it will take serious U.S. dislocation before the Fed turns neutral. In the meantime, all hell can and will break loose. It will be a non-binary event meaning having dislocations that are very hard to predict in advance aside from brick shitting panic. Market liquidity will collapse. Ultimately, the Fed will be forced to turn neutral and attempt to calm the market. I predict that will further spook investors which is what happened in March 2020 - The first rate cuts were met with more selling. Ultimately bulls will capitulate and that will set-up a trading rally. After that, the market will continue lower amid widespread rumours of mass defaults in a new global credit crisis. Once the Fed panic capitulates and goes ALL IN on QE then likely a multi-month headfake rally could begin.

In summary, of course the Fed is going to pivot eventually.

The question isn't "if", it's "when". And the answer could mean the difference between being financially intact and financially buried.