Risks have reached a point at which a bull market would be an outlier event...

The Fed is now the furthest away from a bailout bias as they've been in forty years.

This week features a central bank gauntlet coming at a time when the largest central banks are the least coordinated in history. I am of course referring to the U.S. and Europe both on the tightening warpath vs. China and Japan easing.

Yesterday the WSJ had an excellent article explaining the background behind Powell's Quixotic Volcker gambit:

"Mr. Powell cited the example of former Fed chairman Paul Volcker, who drove the economy into a deep hole in the early 1980s with punishing rate increases to break the back of double-digit price gains"

“Until inflation comes down a lot, the Fed is really a single mandate central bank”

Mr. Powell has stopped talking about a so-called soft landing"

It's clear that the Fed is not only willing to risk a recession, they are willing to risk a market crash. Perhaps even welcoming one as a means for accelerating the decline in inflation.

The article goes on to discuss the accumulated moral hazard from the standpoint that this new approach is the binary opposite of the approach they've had since 2008. One which has conditioned investors to expect monetary bailouts:

"Markets have been slow to come around to the Fed’s new posture, largely because it is at odds with how the Fed has acted for years"

But then comes the punchline regarding the stock market vis-a-vis this summer rally that Powell imploded at Jackson Hole:

"The rally was making the Fed's job harder"

In other words, the Fed used to have a put (option) below the market, now they have a call option above the market. They don't want another bull market and they are intent on ensuring it doesn't happen.

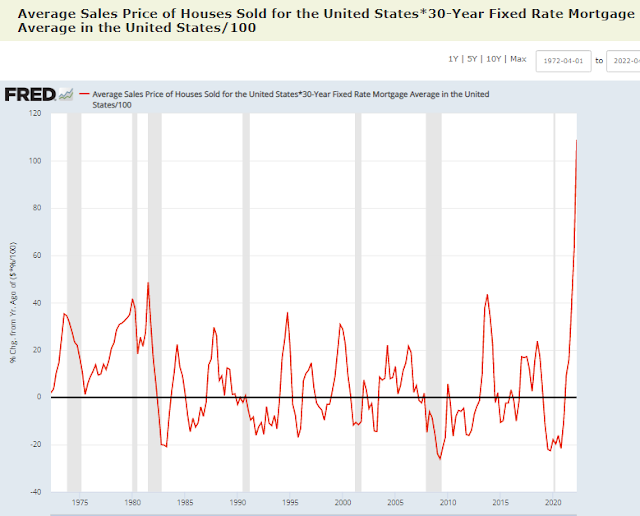

This week, Fed futures are expecting the third .75% rate hike in a row. However, that's only half the story because bond markets have been front-running the Fed higher all year. Taking into account the record rise in home prices caused by Fed QE during the pandemic, and compounding that by the record rise in mortgage rates this year, indicates the most brutal tightening of housing financial conditions in U.S. history going back to at least 1975. Likely all time periods:

A 100% increase in carrying costs for newly purchased homes (New and used):

Of course the Wall Street Journal fails to mention the greatest risk which is that Paul Volcker had a 19% Fed rate vs. Powell who has a 3% Fed rate. Volcker had ample downside cushion in case the economy imploded. Powell has ZERO downside cushion.

The Fed is only part of the story this week.

The BOJ releases their decision Wednesday evening after the FOMC. Thursday in Japan. The BOJ has already signaled what is called a "rate check" which is a precursor to currency intervention. However, currency speculators are FAT AND HAPPY gorging on the Yen carry trade, so they don't think it will actually happen:

"Last week, the Bank of Japan reportedly conducted a foreign exchange “check,” according to Japanese newspaper Nikkei – a move largely seen as preparing for formal intervention."

“Our economists expect the BOJ to firmly maintain its commitment to YCC zero interest rate policy at this week’s meeting against a backdrop of five other G10 central banks that are all likely to deliver large rate hikes,”

When you read the article you realize that Wall Street is unanimous in believing that the BOJ won't reverse their monetary easing stance. Even though the Yen is now at the same level as it was in 1998 which was the last time they monkey hammered global markets. And considering that Japan's inflation rate is the highest in 31 years. If you can't access the article, it says that inflation is at a 31 year high, but economists all agree the BOJ won't change policy.

What could go wrong?

"While the Bank of England is expected to raise rates by at least 50 basis points (bps) this week, the prospect of further tightening has failed to shore up the pound"