Gamblers are convinced it's different this time.

They're right, it's far worse...

Let's see, newbie gamblers piling into a bear market lured by Reddit-ordered pump and dump schemes. Peak Boomer retirement. Central banks correcting their massive over-easing error by massively over-tightening. Europe's Lehman Moment. China's Lehman Moment. Japan-U.S. largest monetary divergence since 1998. Tech bubble imploding, housing bubble imploding. Record low liquidity.

What's next? System test.

This coming week is all about Europe because Russia finally cut off natural gas supply and stated that it won't be coming back online. The nuclear option.

Back in June, many pundits warned this would catalyze Europe's Lehman Moment:

June 23rd, 2022.

As we see in the bottom pane, in August German economic confidence was already the lowest since 2008, even before this latest gas cutoff. Now consider this chart in the context of an ECB STILL planning to raise interest rates on Thursday.

It's totally ludicrous.

This past weekend, in a very rare warning El-Erian told investors to get the hell out of these "distorted" markets.

"Stock and bond markets appear "distorted," meaning it's high time for investors to tweak their portfolios, according to Mohamed El-Erian... El-Erian's embrace of cash is somewhat contrarian, as historically high inflation is eroding the value of currencies"

Contrarian indeed.

El-Erian's warning is far too little, too late.

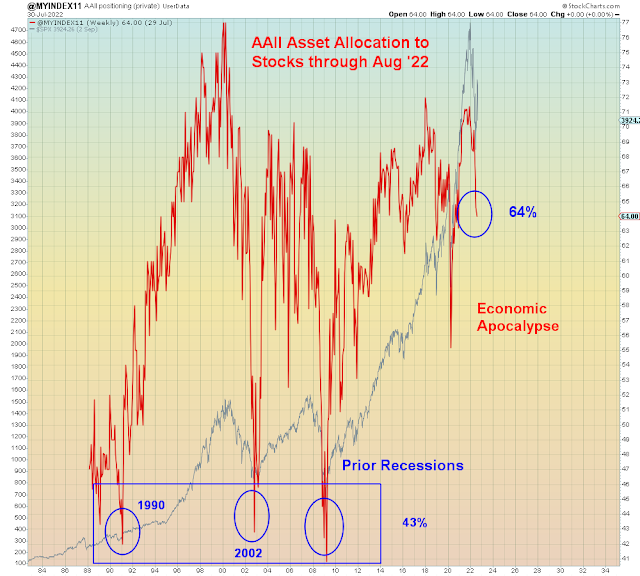

As we see above, the August AAII positioning report indicates that investors are far too over-loaded on stocks going into recession. This is because they believe the inflation hysteria and are convinced "Cash is trash". Which means the impending losses will be exorbitant.

As I showed on Twitter, investors are now in a bind between a Fed intentionally forcing recession and a Fed rate that is currently nowhere near high enough to offset recession. In both 2000 and 2008, the Fed had to cut rates by 5% to forestall depression. However with the CPI far higher today, the Fed has no choice but to keep pushing rates higher. All of which means that the 2000/2008 -50% stock decline is now the best case scenario. It also happens to be the least likely scenario.

The most likely scenario is markets meltdown and a lack of stimulus at the zero bound.

Bailout failure means system failure. First and foremost because it portends extreme volatility and market dislocation. Secondly because it means that people will lose faith in the "system". They have poured their life savings into a dead end Ponzi scheme. As John Hussman constantly points out, at these levels of over-valuation, future returns are deeply negative years into the future. However, that's not how it happens in the real world. What really happens is that losses are "front loaded", after which forward returns become positive again. Once the masses panic out of the casino at the bottom.

"Prepare for an epic finale," Grantham said. "If history repeats, the play will once again be a Tragedy."

Zerohedge: In Order To Hit New Lows Markets Would Have to Do Something They've Never Done Before:

"The S&P has never set a lower low in any of the 13 post-World War II bear markets after recovering 50% of its peak-to-trough decline"

Pre-War World II. The most famous crash in history.

Finally, investors will ask themselves the question ALL pundits should be asking right now - Why are WE different than Japan and China, who are already stuck at the zero bound? And the answer is because we're not.