This is a society with a lethal case of hubristic dementia. What we are witnessing is a centrally managed collapse in broad daylight. The Sheeple are eagerly following their trusted psychopaths deja vu of 2008...

This society has survivor bias on steroids. No matter how many people go under the bus, the mainstream message remains rinse and repeat. The ultra-wealthy beneficiaries of fraud continue to push the standard narrative at the expense of the silenced majority.

U.S. policy-makers are trapped in a past that no longer exists. In a stimulus dependent economy, conventional economic models no longer work. The U.S. is now at record economic policy divergence vis-a-vis Japan and China. Those two countries have already learned to respect deflation, and they are both currently in easing mode. Whereas U.S. policy-makers are operating on the basis of extreme hubris in a torrent of disinformation at the end of the cycle.

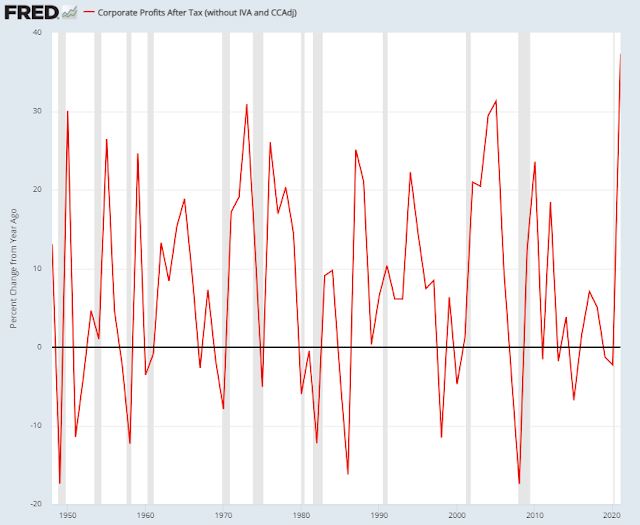

In the meantime, today's CEO salesmen are delighted to push the stagflationary hypothesis to record profit. Stagflation is a call to buy everything - durable goods, cars, homes, stocks, cryptos, gold. Which is why after tax corporate profits just grew the most on record, going back to 1948. It's called profiteering from inflation hysteria, also known as "Shock Doctrine". Never let a good crisis go to waste.

"When taxes are factored in, last year’s corporate profit increases were even more of an outlier. They soared 37% year over year, more than any other time since the Fed began tracking profits in 1948"

Of course to believe today's business pundits, the only "bad" inflation is wage inflation. They are more than happy to turn a blind eye to rampant profiteering. And therein lies their blindspot. They fail to see a consumer on the verge of collapse as prices of EVERYTHING skyrocket at the same time.

Wages are up 8% versus profits up 37%.

Meaning that none of this end of cycle consumption orgy is the least bit sustainable. Somehow it never occurs to these people that THEY bid up all of these prices.

It gets far worse on the market side, because this stagflationary hypothesis which was also extant in 2008 has caused an EPIC misallocation of capital. And ironically it's this misallocation of capital that has emboldened the Fed to embark on the fastest and most brutal tightening in history.

In Q1 global bonds experienced their worst selloff in history. Meanwhile, the Fed stress indicator which includes metrics such as credit spreads, credit conditions, and other risk premia, just this week collapsed to the lowest level on RECORD. The divergence versus 2020 and 2008 is asinine:

Here we see gamblers crowding into commodities and Google searches for "stagflation" are the highest since 2008.

Bubble denial is rampant

"It’s highly anomalous for housing prices to rise over 32% in a span of two years, and so the trend is causing some economists to start worrying about a possible bubble"

The growth rates we are now seeing exceed those immediately preceding the Great Financial Crisis"

The article goes on to rationalize away bubble risk by saying that in this era there are no "shady lending practices taking place" unlike last time. What happened after 2008, is that large banks were forbidden from making "risky" loans to marginal borrowers. So a new industry of shadow banking hedge funds sprung up to be the intermediaries between the banks and the low quality borrowers. These intermediary lenders have "pristine" balance sheets because they were created AFTER the 2008 financial crisis. However, they are borrowing bank money as a pass through to subprime borrowers. I know all this because for two years out of business school our middle son worked for one of these companies, which will remain nameless. He said that just before the pandemic, many of his portfolio companies were running out of cash and were about to get cut off from funding. The pandemic saved them by allowing them to borrow MORE money. In other words, in this cycle credit risk is "hidden" behind a layer of obfuscation, but it's still there and banks are still very much exposed.

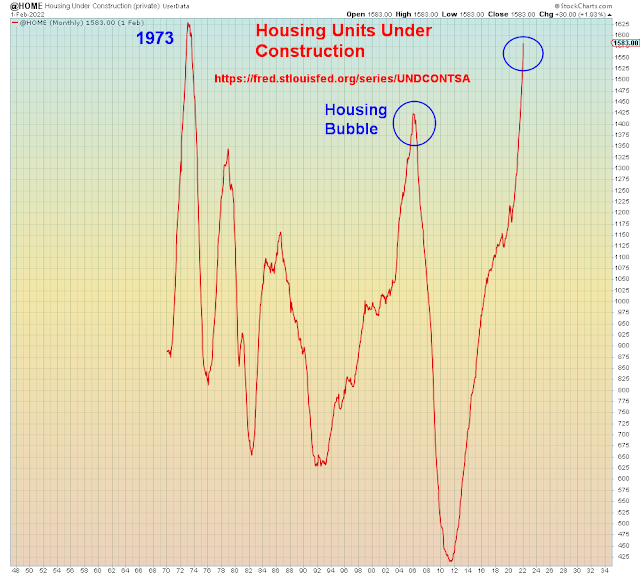

Another thing the article asserts is that this entire melt-up price move is due to the "mismatch" between supply and demand. We heard the exact same argument during the last bubble. When demand reaches a hyperactive state because everyone assumes prices can only go up, that is not sustainable. In addition, in-process supply is at decade highs:

Today's pundits are sanguine because despite yield curve inversion which is now widely discussed - meaning long-term yields are lower than short-term yields - pundits believe that recession is at least 12 months away. For that conclusion they are data mining prior recessions.

However, what they are ALL ignoring is the asset crash risk which will pull that timeframe forward by 12 months.

The impending asset crash will bring recession forward to NOW.

In summary, stonks just ended the worst quarter since March 2020, despite the fact that all risks got bought with both hands:

I call it the "We love rate hikes rally". Which will be followed by the "bidless market collapse".