The Fed is on the verge of the biggest policy error in human history, aided and abetted by a cabal of salesmen who will NEVER admit it's the end of the cycle even when it's over. History will say that a global pandemic caused massive supply chain disruptions, punctuated by an end of cycle Energy shock that sent commodity prices sky-rocketing. Deja vu of 2008. Then the Fed raised rates because their "models" said they have no choice. And they triggered the global Minsky Moment. Fans of "low prices" are going to love it...

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values"

First off, make no mistake this is a global asset meltdown in progress. Today was the biggest rally in almost two years (June 2020) due to short-covering ahead of tomorrow's ECB meeting and the major U.S. CPI report. One pundit today recycled the theory that if you try to time the market you miss all of the best days. The only problem is that the biggest rallies are ALWAYs in bear markets. The biggest days in the past 14 years came in the Fall of 2008 when the market STILL had -40% to go to the bottom. The sheeple are now DOOMED by this type of Idiocratic logic.

Today was a bear market rally in an early stage bear market.

Regarding the ongoing war in Ukraine, the super spike in commodities has served the purpose of boxing the Fed into only one course of action. Which means that barring meltdown between now and then, they are going to raise rates into the weakest market in 50 years. Something they've never tried before.

Here we see NYSE new lows as of yesterday's close compared to prior rate hike cycles. In December 2015 at the beginning of the last rate hiking cycle, after one rate hike global markets exploded.

As of today's close there is STILL a 99.8% probability of rate hike next week, despite the threat of global nuclear war, demolition of Russia and Ukraine economies, and sky-rocketing gas prices in Europe.

For the record, Americans have the LOWEST gasoline prices in the developed world and yet still there is existential angst over these prices. Here are a handful of countries to compare against:

All of which means that we have reached peak inflation hysteria.

This was today's headline in U.S.A. Today:

TOTAL disinformation

Nominal gas prices are higher than 2008. REAL gas prices are nowhere near 2008 levels:

Despite the millions of variables today's pundits like to throw at people, this has all become a very simple equation: Escalation of the war in Ukraine can now only serve to accelerate this meltdown. If the war ended tomorrow, oil would collapse and the rest of global risk assets would rally as they did today.

That is until next week when the Fed pulls the trigger.

Oil has now become the Armageddon trade, which is why I'm not that bullish long-term.

Today was the LAST day for Quantitative Easing. The pandemic emergency inflation of asset bubbles is now officially OVER.

Just in time for new meltdown.

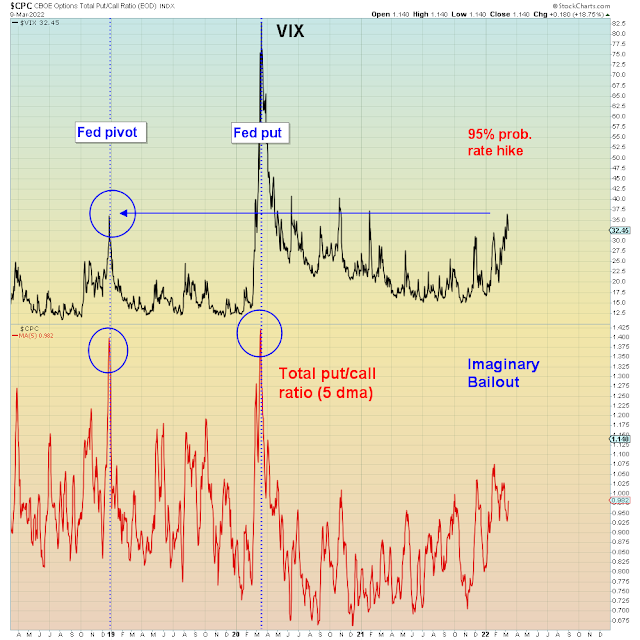

There are of course two major differences between now and two years ago. First off, the Fed has ZERO room to go down on interest rates. Secondly of course, they are on a tightening path which means they are several "meetings" away from contemplating market bailout.

Nevertheless, mass complacency reigns supreme. Whereas during the past two market implosions the Fed was conducive to bailout, gamblers nevertheless hedged risk. This time, with no bailout on the horizon, they are taking no precautions. When everyone reaches for the sell button at the same time, there will be no one on the other side of the trade. We are headed for a ZERO liquidity global asset meltdown.

You see, the passive money bubble doesn't believe in risk management. These people have been brainwashed into ignoring all risk. And therein lies the problem - without risk management, panic at lower levels is all but assured.

And there is no way central banks can bailout everyone at the same time.

In summary, forget about oil and inflation.

This is now the largest RATE SHOCK in U.S. history when measured on a relative basis. What took six years post-Lehman took six months post-pandemic:

The global Minsky Moment has arrived.