Today's policy-makers are racing full speed towards the Minsky meltdown:

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate"

The pandemic and its *special* bailout programs allowed companies that were essentially insolvent to rollover their debts.

One, more, time.

The Fed missed their window to raise rates, and now they are tightening into a deleveraging phase:

Amnesia or dementia? Of course it will make no difference in the end. Except with respect to the treatment for the impending mass mental health breakdown.

This society specializes in doubling down on failure. Not only are the Dotcom Tech bubble and 2008 Housing bubbles long forgotten, but every policy mistake in between as well. To believe in this fraud one must forget the 2018 Fed implosion. The 2015 China meltdown. The 2014 oil collapse. And the 1998 Russian default.

This monster is the SUM TOTAL of all of that, now accelerated by a Fed hellbent on implosion. This tsunami of risk is so large that its gargantuan magnitude is imperceptible in open water and will only be visible when it breaks on shore and obliterates everything in its path.

The Fed is flooring their rate hike plans while keeping their eyes firmly locked on the rear view mirror of stale and irrelevant data. They are in Thelma & Louise end of cycle policy disaster mode. What hubris they had keeping QE and rates at full throttle for FAR too long, they are now repeating by cutting liquidity FAR too fast.

Unfortunately, today's pundits squandered their credibility telling everyone for months that the Fed is behind the curve. So now they are trapped by their own consensus of idiots.

For their part, the sheeple are just massively confused. They are being constantly told to ignore all mounting risk. Which is why social mood is collapsing. Never before have we seen such a large collapse in consumer sentiment BEFORE an asset crash and before Fed rate hikes. One can only imagine what depth of despair awaits this crime scene when asset collapse stirs the profoundly stoned masses from their narcoleptic coma.

"Home prices soared 18.8% through 2021, marking the largest annual gain since at least 1988

Still, for all the wild price gains in the housing market, the landscape doesn't share the risks that emerged during the late-2000s bubble, the Fed governor added"

Below we see the University of Michigan current economic conditions. This is the mid-month (interim) reading, which is the lowest since 2008. In the bottom pane I show the 30 week % change in the 30 year mortgage. Combined we see these are the worst correlated readings since Paul Volcker pulled the plug on inflation in 1980.

Thelma and Louise are about to go through the windshield:

Even before the Russian war in Ukraine, global risks were mounting inexorably. In the meantime, China Evergrande and its derivative dominoes have been spreading throughout the Chinese economy. This week, China is experiencing its biggest COVID lockdown in TWO YEARs. For those who still think they invented this virus, you have mistaken idiocy for a conspiracy.

Russian default is coming around again in early April:

"The last payment was a small investment in credibility, but when Russia has to start writing billion dollar checks it’s a different calculation”

The Fed's implosion of the global bond market is a Black Swan event in broad daylight. It's not only Russia and China that are caught up in this meltdown.

This is the worst quarter for EM dollar bonds since the Russian debt default in 1998:

What does this all have to do with the Casino?

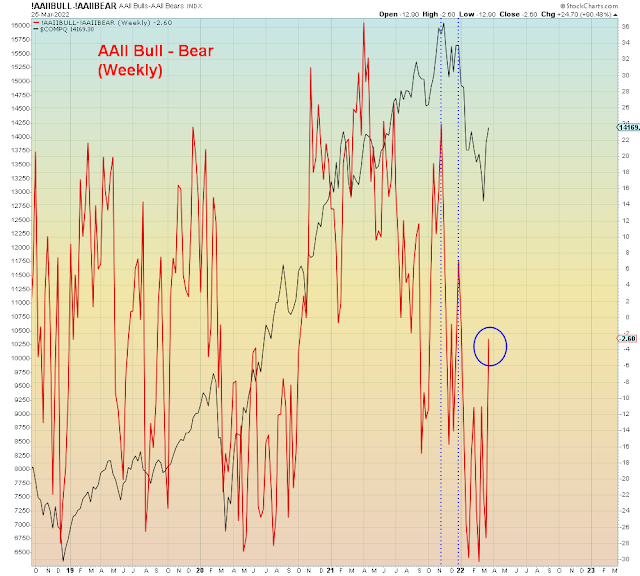

Right now bulls believe there is too much bearish sentiment for stocks to go down. Unfortunately, as we see via the AAII survey, bearish sentiment does not prevent the market from sliding down the slope of hope:

Anyways, sentiment is just opinion polls. Only positioning matters, and positioning of course is FAR too bullish to mark any sort of tradable bottom yet.

The equity call/put ratio remains near pre-pandemic highs:

In summary, the full force of Wall Street criminality is arrayed against the public right now. They are intentionally being kept in the dark and fed bullshit. As far as the masses are concerned, they wouldn't have it any other way.

No one wants inconvenient facts and data to get in the way of their cherished opinions, or to interfere with their daily subscription bullshit enema.