"There is no means of avoiding the final collapse of a boom brought about by credit expansion" - Ludwig Von Mises

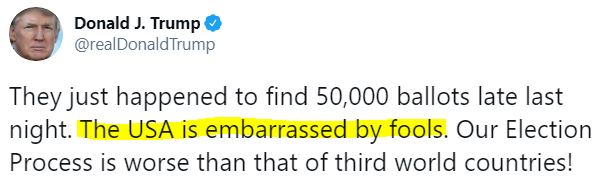

One other thing he got right.

I have said for some time now that credit crisis is the next stop in this debacle. That yes, dollar destruction is inevitable - and just became more of a certainty, but before that happens, we will see human history's largest dollar margin call. When that happens short dollar trades will get monkey hammered, including gold and Bitcoins. The blue wave will be the spark that ignites the Trump bubble. As I write, early on Wednesday, the reflation trades are going late stage parabolic led by Financials. However, as I expected, the Tech trade is getting monkey hammered. I will go out on a limb and say that the Tech bubble is over, with the exception of a few pockets of speculation specifically in green energy.

Large scale institutions are now rotating massively to cyclicals at what I deem to be the end of the cycle. It's a risky gambit to be sure. The bond markets are already getting monkey hammered as bond yields explode higher.

This is all very similar to when Trump got elected and promised his big tax cut, except this time it's a blue wave, meaning additional fiscal stimulus is coming much sooner this time around. Some have said that in 2021 the economy will perform better than the stock market. This event makes that outcome far more plausible. Although the bubble explosion will no question affect the economy.

A back up in yields right now is not really an option, as there has been no deleveraging in this cycle. 2020 saw the largest corporate debt issuance in history.

This is corporate debt as a percentage of GDP:

Gamblers right now believe this is a good time to rotate to Financials and other cyclicals, because they've been told it's the beginning of a new cycle. According to today's Ponzi advisors, this will be the first cycle in U.S. history to begin amid record debt. Sure, whatever.

AND, in addition, the cycle will kick off with an unprecedented fiscal stimulus and a massive spike in bond yields. It's called "Goldilocks" on crack cocaine. You have to be stoned to believe it. Remember, we were told just two days ago that a blue wave is not priced in and hence would lead to selloff. And yet, this morning the S&P opened down and ripped higher.

No story is too fantastical to believe anymore. Wall Street will never conjure up a narrative in which the future is worse than today, because then they would have to produce price targets with a minus sign.

One would have to be somewhat of an optimist to believe this will continue, when Wall Street soon gets re-regulated now that Democrats are in full control:

The short dollar trade - already the second most crowded trade of 2020, just became overwhelming consensus for 2021. When that reverses, global risk will explode with only the longest cycle in history of warning.

The Nasdaq is now 100% leveraged to Tesla and the green energy super bubble which kicked off a year ago in January with the ESG/fossil fuel divestment movement.