According to today's economic "experts", the cure for wealth inequality is greater wealth inequality. The only way this "system" gets fixed is when all of these "experts" and their dumbfuck ideas explode with extreme dislocation...

What could go wrong?

"Nine months. That's how long it took the world's top 1,000 billionaires to recoup their fortunes after the coronavirus pandemic hit.

All of this chicanery so that Boomers could pretend their retirement is still intact. They can ride out a global depression in the most over-valued stock market in history to achieve the linear-extrapolated goals set forth by their investment advisors. Today's advisors and central banks are hardcore acolytes of the Bernie Madoff school of investing: Set a goal and then work backwards to whatever asset misallocation will achieve it.

We now see that even the "blue wave" has still not changed the predominant deflation paradigm, which by sheer coincidence happens to be very billionaire friendly. It's at this time of year that Oxfam reminds us that global wealth inequality increases every year. This past year however has been one for the record books:

"Nine months. That's how long it took the world's top 1,000 billionaires to recoup their fortunes after the coronavirus pandemic hit.

More than a decade is how long it could take the world's poorest to recover, according to Oxfam International's annual inequality report."

Let's get this straight:

Since 2008, global wealth inequality has been getting worse, and now that abject lack of progress just got set back by another decade? I'm no logic expert, but I'm pretty sure that means there will be no "recovery" for the world's poorest. We were making NO progress before, and now we're another full decade behind in making no progress. Rule #1 of navigation, you can't reach a destination by going in the wrong direction.

So how to fix a global economic depression in a system that generates mass wealth inequality? According to today's "experts", you put an asset bubble on steroids. Cure a system terminally corrupted by greed by subsidizing epic amounts of leveraged speculation.

Only one thing can fix this problem wherein Elon Musk sees his wealth grow by 600% in one year compliments of socialism for the rich. Asset explosion.

And despite all of the talk of "reflation", the locus of risk remains the Tech sector.

The reflation trade:

Bueller?

EMs about to get crushed deja vu of 2020:

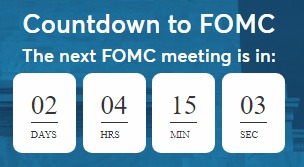

Yes, it's FOMC time again

Fear Of Missing Crash: