Five years ago this week, Hugh Hendry's imagined realities 2015 came crashing down. It all started out so well - 25 year low GDP in China, a massive melt-up liquidity bubble, global RISK ON party. But then it all exploded "without warning".

2014 End of Year Shareholder Message:

"China is set to record its weakest growth in GDP in 25 years. Yet it seems to have entered a bull market and may be where we deploy much more of our risk capital next year. That's because the recent exuberant run up in onshore Chinese equities seems to me to amply demonstrate the power of imagined realities."

The Chinese state is the largest shareholder in the Chinese financial system. That surely makes its ability to stave off a liquidity crisis pretty much limitless"

Come to find out by August 2015, it wasn't limitless after all.

Good times:

The main difference between then and now is that risks are 10x greater now, as is the Tech driven liquidity bubble. We learned yesterday that this is now officially the longest Nasdaq melt-up in history. The prior longest melt-up in history was the rally that exploded spectacularly in February of this year:

"The Nasdaq-100 just set a new record: Its 20-day simple moving average (SMA) has been rising for 89 consecutive days.

The prior record ended at 88 days on Feb. 21. We remember well because stocks went into free-fall thereafter."

In other words, the two longest melt-ups in Tech history, in the same year. The chance of that happening outside of Fed balance explosion, is the limit approaching never happened before.

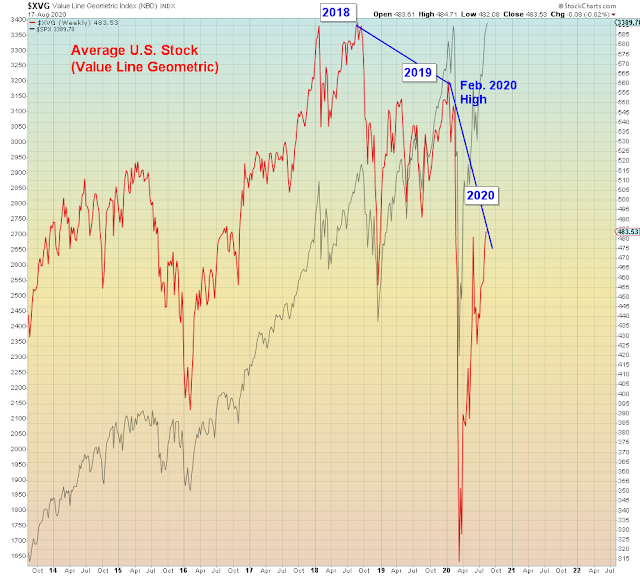

Looking back in retrospect, market pundits will realize that the COVID crisis sparked the final cycle rotation out of value stocks into a fifth wave stay-at-home Tech stock blow-off top.

Looking back in retrospect, market pundits will realize that the COVID crisis sparked the final cycle rotation out of value stocks into a fifth wave stay-at-home Tech stock blow-off top.

MACD lower pane, shows the streak above the 20 dma as the net difference between one day and 20 dma > 0:

For the past week the S&P 500 has been staging an epic battle with its February all time high - Amid chasmic divergences, the likes of which we have never seen in history. Which is why I am not calling for a crash, I am calling for a binary explosion of risk.

Here we see that the algos have crushed volatility down to the same level that attended the February top.

Today, the S&P 500 finally closed above the February high. Unconfirmed by the Dow, the Russell 2000 small cap, banks, transports, mall retail, defensive stocks, and global stocks.

"Safe havens" are ready to roll.

Over.

Over.

I don't know if gold will make another new high, before it implodes again. Or not.

Banks are at the key uptrend line. Notice the double fractal - the rally into June is the larger fractal, and the rally since June is a smaller version of the same rally. Indicative of economic cyclicals in general.

As it was in February at the S&P top, the PBOC has been juicing global markets. Which is why gamblers are well lubricated for what comes next:

"PBOC adds most money to markets since early February"

Those who evince ultimate confidence in central banks to create bubbles and keep them permanently inflated, are about to learn their final lesson.

The one they didn't learn in 2015 and in February 2020:

$USDJPY already going RISK OFF

Even within the Tech sector, the majority of Tech stocks are already rolling over.

What is still driving the Nasdaq is a rotating handful of parabolic stocks, led by Tesla. Yesterday, Tesla traded more dollar volume than ALL of the MAGA stocks and the QQQ combined. Yes, you read that right. A function of its stratospheric price x above average volume.And Robinhood gamblers going full retard.

Yesterday's most actives:

Yesterday's most actives:

Overstock.com gained another 25% yesterday.

And fittingly, Dave Portnoy lead gambler, is getting richer by the day in Trump Casino. Because that's how ALL pump and dumps work. A handful of con men followed by multitudes of dumbfuck acolytes.

In summary, this is a final Tech blow-off top in stay-at-home stocks while the economy implodes in broad daylight. The rally since the March low amply demonstrates the power of imagined realities and conflict of interest:

"While Wall Street has gotten more excited about the economy since March, U.S. household sentiment remains depressed"

"While Wall Street has gotten more excited about the economy since March, U.S. household sentiment remains depressed"