July 13th, 2022:

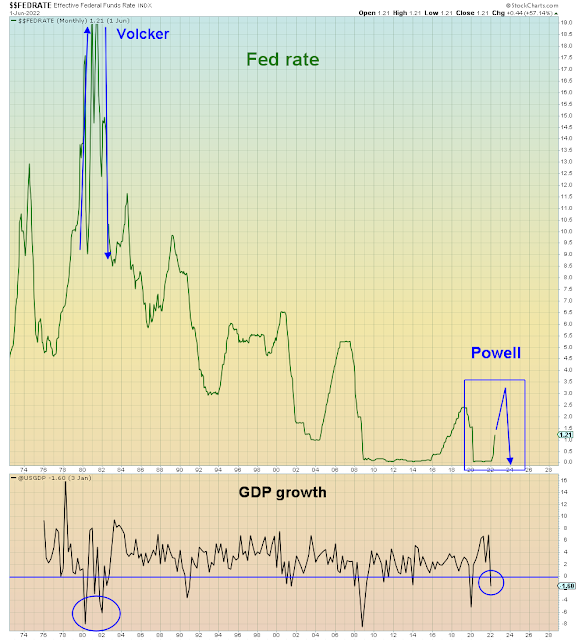

This post was written concurrent with the latest CPI reading which is yet another hotter reading than last time. So far there is no sign of Fed reversal on the horizon. Markets are at a critical juncture. Unfortunately, today's investors have forgotten the NUMBER ONE rule on Wall Street. Don't fight the Fed...

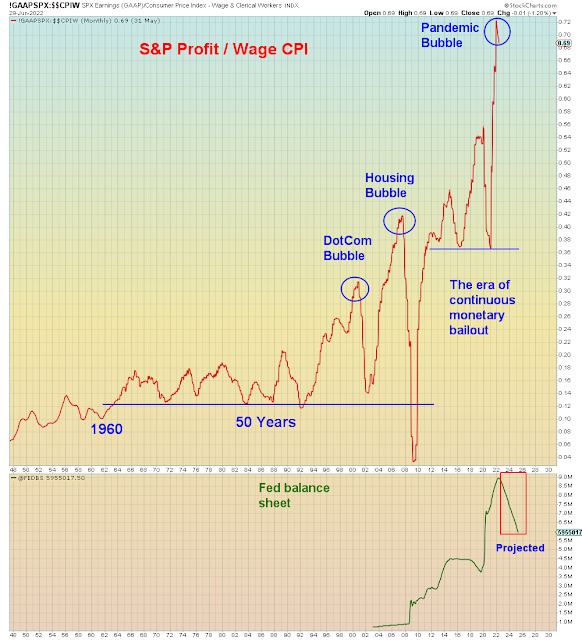

There has been far too much fixation on the job market as the source of inflation. Wages as a share of the economy have been trending down for forty years straight and only ticked higher during the pandemic. However, corporate profits and total wealth have sky-rocketed relative to GDP.

What's interesting is that no pundits were worried about asset inflation when Elon Musk's wealth increased 600% in one year. It wasn't until the CPI started creeping up last Fall that the business media became hysterical over inflation. They blamed the tight job market.

Of course the job market IS tight. Twenty million people were laid off in March 2020 which is a DECADE worth of jobs. Three million Baby Boomers retired early and untold undocumented immigrants went home and never came back.

Nevertheless, to believe that job CREATION is causing inflation is purely asinine. Most of these new jobs are low paying McJobs in the service sector. The number of jobs alone is in no way driving inflation. Coming out of the pandemic, many pundits predicted that the pandemic unemployment programs would lead to inflation. The problem with that hypothesis is that those programs ended almost one year ago. There is only ONE WAY to account for all of this lingering inflation - which is the central bank wealth effect.

Step back and recall that the "genius" behind Quantitative Easing was that it wasn't supposed to create inflation. The money is injected into the bond market where it ripples out from that market into various risk assets until next thing you know one totally worthless Bitcoin costs $60,000. However, the middle class sees NONE of this money. You see QE didn't create DIRECT inflation, it created indirect inflation via the fake wealth effect. Contrary to ubiquitous belief, this is NOT middle class inflation. This is "Ponzi inflation".

Fortunately, there is a cure for that problem and it's not interest rate hikes, it's balance sheet reduction which is now on AUTO-PILOT for the foreseeable future.

So far, so bad:

Crypto bubble toast

Growth stocks/IPOs toast

Emerging Markets Imploded

Global Bonds collapsed

Commodities collapsing

Which leaves the housing bubble AND the passive indexing bubble.

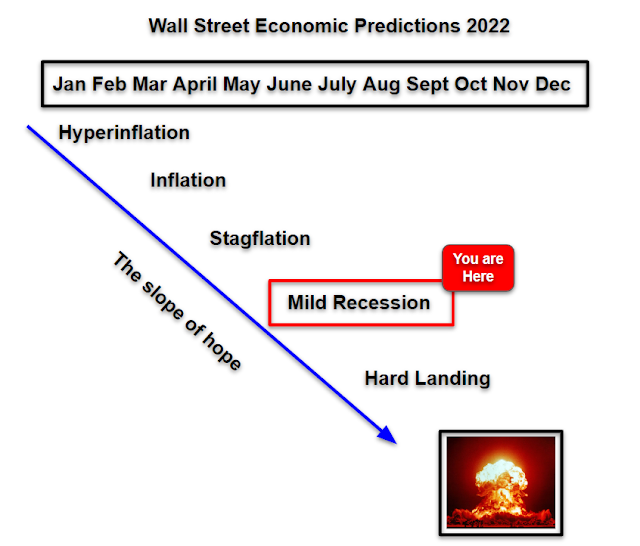

My last blog post was called "No One Saw It Coming" because the majority of today's pundits are far too obsessed with rate hikes and the job market to realize the magnitude of financial collapse that is now INEVITABLE.

Ironically, the one pundit who has CONSISTENTLY warned about these two final mega bubbles (housing/stock indexing) is Michael Burry. The exact same guy who warned about the bubble in 2007. This prescient warning was from one year ago, but there have been many more since that time:

June 2021:

"Michael Burry, the famed investor who predicted the collapse of the housing market bubble in the US in 2008 and had a movie made about his legendary short position, is now ringing the church bells for another disaster"

“People always ask me what is going on in the markets. It is simple. Greatest speculative bubble of all time in all things. By two orders of magnitude”

That is where the happy comparisons to 2008 largely end. Because instead of banks falling like dominoes, this time it will be sovereign nations falling like dominoes.

July 7th, 2022

"A quarter-trillion dollar pile of distressed debt is threatening to drag the developing world into a historic cascade of defaults."

“With the low-income countries, debt risks and debt crises are not hypothetical,” Reinhart said on Bloomberg Television. “We’re pretty much already there.”

And is the solution to this problem RECORD monetary divergence between the U.S. and China?

No.

"The net outflows from EM fixed income funds are the most severe in at least 17 years, far worse than were recorded during a bout of acute concern about China’s economy in 2015"

“The probability of a soft landing—is only about 10 percent. Conversely, the chances of a hard landing—are about 80 percent”

Correction. The chance of a soft landing is actually ZERO percent. Position accordingly.