Everything taking place right now makes perfect sense in the context of a collapsing Global empire, called Globalization...

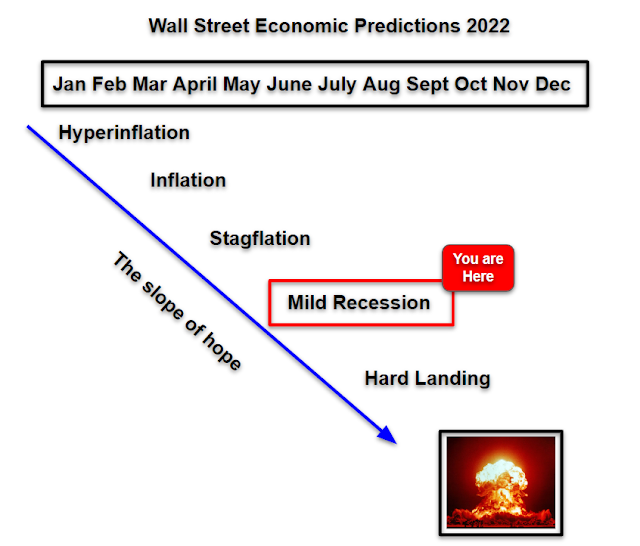

The consistent theme of 2022 is that as the collapse accelerates, the sugar coated media fall further behind the curve on explaining where this is all heading.

Every step of the way, bagholders have been tempted into the casino as the noose gets tighter and tighter.

More fake inflation, more rate hikes, more recession, more lies.

The one common theme taking place across all media and political platforms right now is denial of reality. Why? Because both sides are making a land grab for how many fools will believe their own one-sided version of the truth. In the process they are accelerating the overall collapse of mental health. Is there anyone at higher levels of power who will tell the unvarnished truth anymore? No. There's no audience for it. Sugar coated pablum is the order of the day.

The one consistent theme of 2022 is that bad news gets worse AND the media continually fall further behind the reality curve. We've reached a point now where Wall Street has stopped updating their price and profit forecasts. Out of laziness or deception who knows?

"Commendable courage or a refusal to face reality, a receding stock market tide has left Wall Street analysts sitting with price predictions that will take more than a little luck to come true"

The brutal six-month repricing in markets has been met with a significantly less hurried reappraisal of analyst forecasts"

[The inertia around] estimates today is a carbon copy of situations in past bear markets...adjustments have been slow, not just on price targets but also on forecasts on corporate earnings. At $249 a share, their expected 2023 profits for S&P 500 firms have increased by roughly $7 this year, an improvement that’s at odds with growing recession warnings"

The next major gauntlet that today's investors will face is earnings season. The fact that companies and analysts have NOT been warning ahead of time means a lot more land mines are waiting for the market in July.

Back in May the Fed started DOUBLE tightening interest rates and they also announced they would be double tightening their balance sheet by the end of the summer. At that point ALL of Wall Street's predictions for 2022 were TOTALLY null and void. Analysts started this year with a narrative of a strong consumer and a moderate Fed. Halfway through the year and we've seen a collapsing consumer and RECORD rate hikes ALREADY. With more to come. The largest policy error in history is only getting started.

But who will tell the sheeple? No one.

The evolution of rate hike predictions by Goldman Sachs:

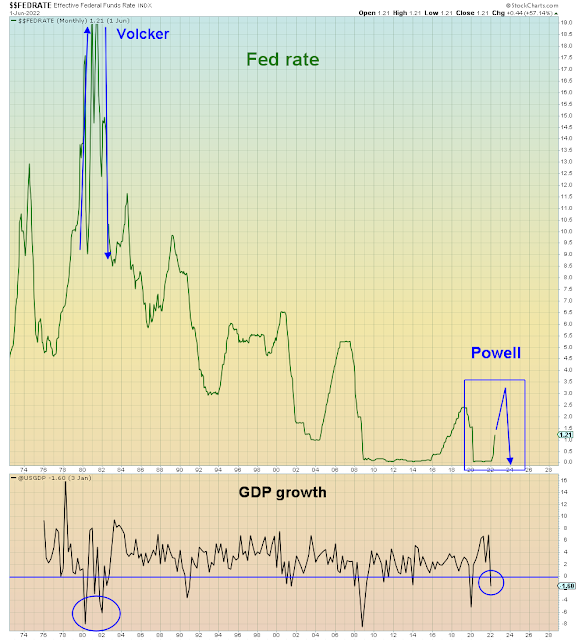

The Fed is attempting to repeat what Fed Chair Paul Volcker did back in 1980 - to rapidly raise interest rates, crash the economy, exorcise inflation, and then begin easing to prevent depression. However, this Fed is attempting the same aerial acrobatics at ground level, at the zero bound. In other words, what they are attempting is not improbable, it's impossible. They will be highly successful right up until they crash the economy. After that, they will be dick in hand amid mass panic at 0%.

Still, so many of today's pundits are bought into the 1980 paradigm that there isn't anyone to warn the Fed that this is Volcker madness.

Worse yet, all of this "inflation" is hiding weakness in the underlying economy. In the absence of a strong consumer, price increases are offsetting quantity declines. Meaning demand IS falling across both durable and non-durable goods.

The Fed's obsession with % price increases has put them on the path for total disaster:

On a nominal basis, commodities as a whole are lower than 2008. Adjusted for wage inflation, there is not even ONE commodity that is higher than 2008. During the pandemic, commodity prices collapsed and now the recovery has been conflated as "inflation". The Fed is therefore mistaking a one time price recovery for secular inflation.

One must ask the obvious question in an election year - how much of this inflation hysteria is purely political? Because if it is, I suggest that those who are propagating this hysteria and otherwise claiming the Fed is behind the curve, are complicit in the largest policy disaster in modern history.

If this all sounds like a lot of infantile idiocy, it's because it is. Denial of reality has become a societal addiction. It's clear that people would rather sacrifice their mental health on the altar of consumption addiction than to accept the inconvenient truth.

I call that consumer choice.