Globalization has been steadily disintegrating since 2008. Environmental meltdown, mental health breakdown, global pandemic, trade wars, World War III, economic collapse. What can you say, no fool saw it coming. A staggering two thirds of the deadliest mass shootings in U.S. history occurred since 2007. The fact that Biden and Trump are deemed the two most viable candidates should be a wake up call for everyone that the magnitude of this crisis is beyond the scope of politics. Political acrimony is not the solution, it's now the problem, spreading hate and anger virulently. Accelerating mental breakdown. People need to start taking PERSONAL responsibility to accept the inconvenient truth: The consumption oriented lifestyle is over, and the exorbitant cost of denial is about to be revealed...

The common theme of 2022 year to date, is that bad news keeps getting worse. Nevertheless, compliments of monetary euthanasia, the general populace is TOTALLY unprepared for what's coming. Over the past 14 years, the downside risks of economic collapse grew larger, so the lies by definition grew larger as well. Now, we live in a society that is addicted to sugar coated bullshit. Those who have not accepted the truth are NOT mentally prepared for what comes next.

I am not saying this is the end of the world, I'm saying it's the end of a way of life.

What this society has to learn the hard way is that protecting people from adversity creates what Black Swan author Nassim Taleb calls fragility. We now have latent fragility in every direction, but most imminently in financial markets.

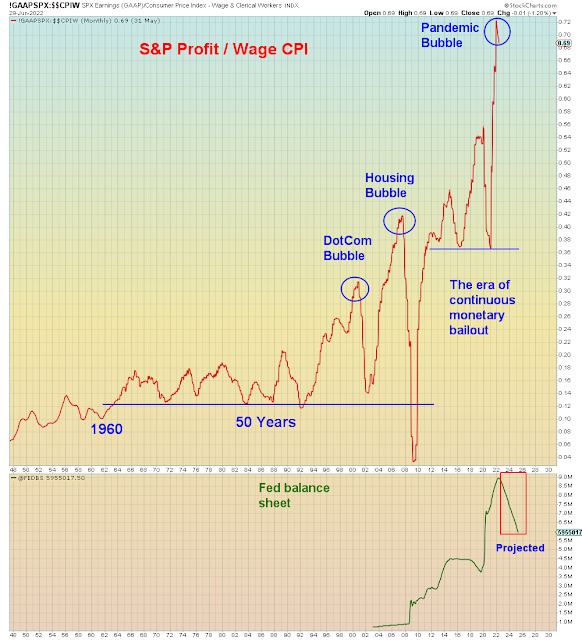

Throughout the economic expansion the Fed conditioned investors to expect bailouts. Now, going into recession, the Fed has pulled the safety net.

It's beyond idiotic. Today we got confirmation that FINAL Q1 GDP is -1.6% while the Fed is pushing even LARGER rate hikes:

"U.S. stock index futures dipped on Wednesday after several Federal Reserve policymakers made the case for faster interest rate hikes to bring down high inflation"

What Powell said from Europe today was even more troubling. He basically acknowledged that recession is likely and even necessary to bring down inflation:

"Federal Reserve Chairman Jerome Powell said he was more concerned about the risk of failing to stamp out high inflation than about the possibility of raising interest rates too high and pushing the economy into a recession"

It's abundantly clear that Powell on behalf of his corporate overlords views wage inflation to be the biggest threat to corporate profits. And therefore he is willing to implode the economy:

There it is plain as day. The first employee-friendly job market in 40 years must be exploded at all cost.

We have clear imbalances in negotiations:

Ironically and fittingly, crushing the job market means that the Fed is NOT going to be bailing out investors this time. In the process of crushing the middle class, the Fed will inadvertently crush the bailout class as well.

Unfortunately, investors are now ADDICTED to bailouts. Several years ago, former hedge fund manager Hugh Hendry predicted that monetary euthanasia would eventually lead investors to embrace risk even while the economy collapsed. He called QE the virtual simulation of prosperity and he predicted that the worse the reality of the economy became, the more investors would eagerly front-run large and dramatic monetary bailout. He was right, because now instead of fearing risk, investors have what I call fear of missing bailout.

Investor complacency is rampant as indicated by low volumes, low VIX, low skew, and low put/call ratio. I predict that complacency will remain extreme until the explosion, at which point it will be too late to panic. Liquidity will collapse.

What we are seeing is the extreme version of what happened back in 2008. Recall that in the book/movie "Big Short", Michael Burry was buying Credit Default Swaps (insurance) as a bet that subprime would explode. However, initially the value of those contracts DECLINED, because there were so many large investors writing those contracts to collect the fat default premiums. He lost a lot of premium money before he was ultimately proved right. Well, the same thing is happening now, only on a ludicrous scale. For the first time in U.S. history, financial stress is now INVERSELY correlated to the economy.

If MASSIVE lies are what the people want, then they came to the right place, because there are no shortage of charlatans today telling the sheeple what they want to hear. File that risk under "confirmation bias" - a groupthink circle jerk taking comfort in the strength of numbers. What NO financial pundit ever tells the people is that the Fed CAN'T bailout the economy this time, because they have the least amount of interest rate buffer in U.S. history, ahead of recession. Which means that investors are complacently sky-diving into pavement:

Incipient recession

Record Fed tightening

Record low consumer sentiment

Imploding housing bubble 2.0

Collapsing Tech bubble 2.0

EM currency crisis 2.0

Record global bond collapse

There is nothing these people won't believe, except the TRUTH

"What worries everybody is that all the risks are stacked on the downside"

In summary, when this society's thin veneer of fantasy gets ripped away, we are going to see the unvarnished reality. Those who have mistaken their fantasy life for the real one, will have their true selves revealed for the first time. And it won't be pretty. A facade of strength on the outside is no substitute for strength on the INSIDE that only acceptance of reality can bring.