The nature of meltdowns is that you only get out BEFORE the meltdown or AFTER. Never during...

Picture this scenario: Rabid Fed rate hikes implode Emerging Markets, setting off a domino collapse of global risk assets. Everything from commodities, to housing, to cryptos, and of course stocks simultaneously implodes. Liquidity is non-existent, so gamblers are trapped in bad trades. Getting margined out between limit down and circuit breaker halts. Finally, the Fed reverses and takes their puny Fed rate down 1.5%. What happens next? Nothing.

Then the REAL panic sets in.

When the smoke clears and global markets have cratered, who gets bailed out this time? No one.

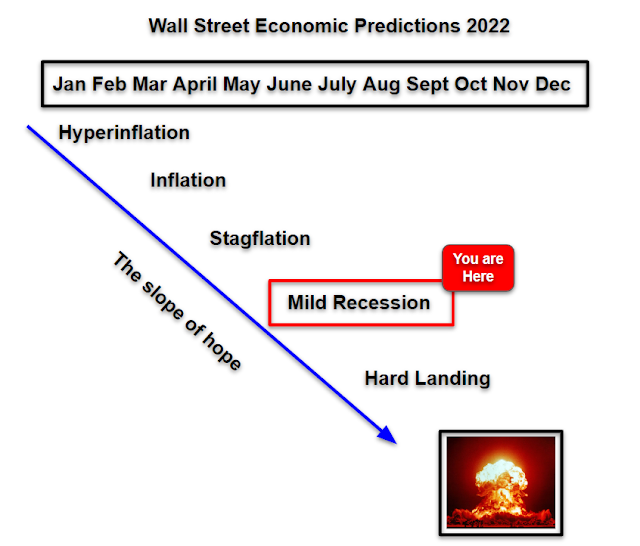

The Fed is pushing the entire world to a global depression and the chance it doesn't happen just became the LEAST likely and most widely expected scenario.

Any questions?

"Federal Reserve officials in June emphasized the need to fight inflation even if it meant slowing an economy that already appears on the brink of a recession"

Wow.

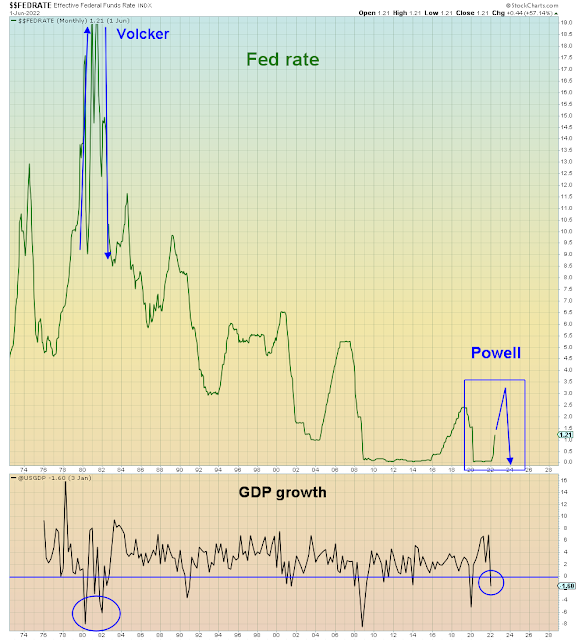

Let me get this straight, the Fed is slowing an economy they acknowledge is on the brink of recession, knowing full well that monetary policy has a six month lag. So by the time they've figured out it's a policy error, it's WAY too late.

No surprise, they have recent experience making this exact same mistake. Recall that the BIG mistake the Fed made last year was using lagged CPI data to set policy while ignoring the bond market which was warning of inflation. So now this year, they are making the SAME mistake but in the opposite direction. Using lagged CPI data to confirm that inflation is coming down while ignoring the bond market.

Because everyone knows that two wrongs make a right.

"While the market has become fearful, many Wall Street economists do not expect a recession this year"

Economists ALWAYS think they are smarter than the bond market, whereas history confirms their conceit is unrequited.

For now, most of the dislocation from Fed policy has been in non-U.S. markets. The dollar has been sky-rocketing which has been sucking capital out of the rest of the world, which is now collapsing like a cheap tent. We learned today that Emerging Markets have seen four straight months of outflows - the most since 2015. We know the Fed is totally ignoring global markets because EM stocks and EM currencies are now at levels that initiated Fed reversals in 2015, 2018 and 2020:

Meanwhile, as I warned recently, Tech stocks are starting to outperform Cyclicals again on a relative basis, because investors are abandoning the reflation trade. The commodity complex is going bidless at the fastest rate since 2020 and before that 2008.

It was just another Ponzi trade - slowly sucking in capital on the way up and then collapsing on the way down.

Four months of gains gone in four weeks:

Another reason Tech stocks are outperforming is because they've been heavily shorted and hedge funds are now taking their entire exposure DOWN on the long side and short side.

The Nasdaq is clinging to the LAST line of support. The line at which the Fed bailed out investors every time since 2008 during economic expansion. Only to be abandoned by the Fed during recession.

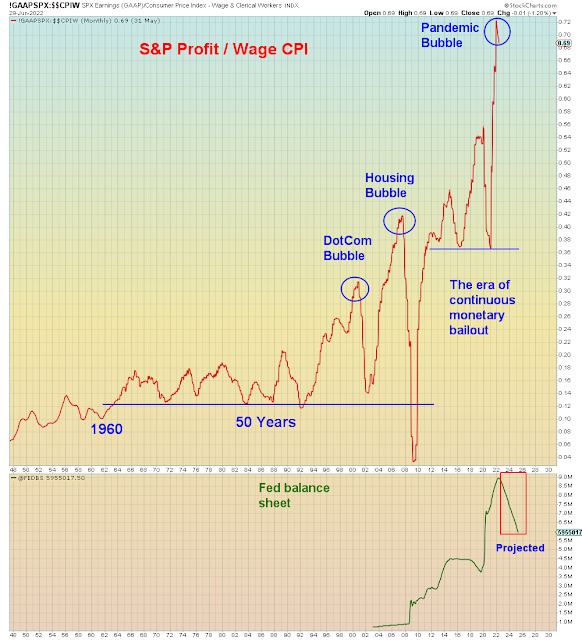

Investors have had AMPLE warning, but they have continued to stick to their hypothesis that the Fed can bail them out of EVERY situation, even a global depression at the zero bound.

2022 has been the year of the Black Swan event:

Largest Crypto crash EVER

Largest Tech crash in two decades

Largest commodity spike since 2008

Fastest interest rates increases in three decades

Fastest Quantitative Tightening ever attempted, has started now in July

Largest dollar rally in two decades

Largest global bond collapse on record

And officially the largest two year housing price increase in history:

Still, when their bailout fails, gamblers will say no one saw it coming. Not the crash, just the failed bailout.

We are witnessing the end of the Efficient Bailout Hypothesis and the requisite belief that printed money is the secret to effortless wealth.