Monday, March 14, 2022

CRASH INTO DEFLATION

Saturday, March 12, 2022

Globalized Collapse In Real-Time

Wednesday, March 9, 2022

FOMC: Fear Of Missing Crash

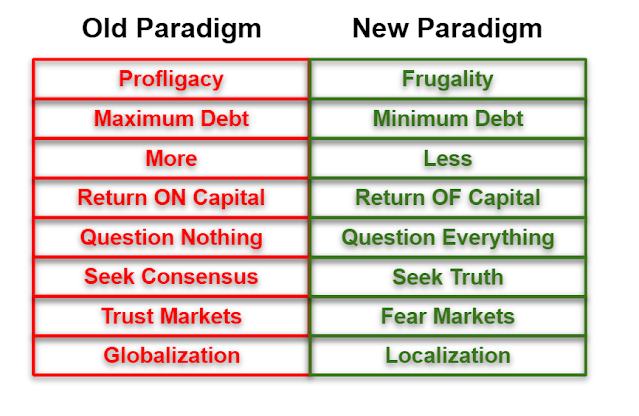

The Fed is on the verge of the biggest policy error in human history, aided and abetted by a cabal of salesmen who will NEVER admit it's the end of the cycle even when it's over. History will say that a global pandemic caused massive supply chain disruptions, punctuated by an end of cycle Energy shock that sent commodity prices sky-rocketing. Deja vu of 2008. Then the Fed raised rates because their "models" said they have no choice. And they triggered the global Minsky Moment. Fans of "low prices" are going to love it...

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values"

First off, make no mistake this is a global asset meltdown in progress. Today was the biggest rally in almost two years (June 2020) due to short-covering ahead of tomorrow's ECB meeting and the major U.S. CPI report. One pundit today recycled the theory that if you try to time the market you miss all of the best days. The only problem is that the biggest rallies are ALWAYs in bear markets. The biggest days in the past 14 years came in the Fall of 2008 when the market STILL had -40% to go to the bottom. The sheeple are now DOOMED by this type of Idiocratic logic.

Today was a bear market rally in an early stage bear market.

Regarding the ongoing war in Ukraine, the super spike in commodities has served the purpose of boxing the Fed into only one course of action. Which means that barring meltdown between now and then, they are going to raise rates into the weakest market in 50 years. Something they've never tried before.

Here we see NYSE new lows as of yesterday's close compared to prior rate hike cycles. In December 2015 at the beginning of the last rate hiking cycle, after one rate hike global markets exploded.

As of today's close there is STILL a 99.8% probability of rate hike next week, despite the threat of global nuclear war, demolition of Russia and Ukraine economies, and sky-rocketing gas prices in Europe.

For the record, Americans have the LOWEST gasoline prices in the developed world and yet still there is existential angst over these prices. Here are a handful of countries to compare against:

All of which means that we have reached peak inflation hysteria.

This was today's headline in U.S.A. Today:

TOTAL disinformation

Nominal gas prices are higher than 2008. REAL gas prices are nowhere near 2008 levels:

Despite the millions of variables today's pundits like to throw at people, this has all become a very simple equation: Escalation of the war in Ukraine can now only serve to accelerate this meltdown. If the war ended tomorrow, oil would collapse and the rest of global risk assets would rally as they did today.

That is until next week when the Fed pulls the trigger.

Oil has now become the Armageddon trade, which is why I'm not that bullish long-term.

Today was the LAST day for Quantitative Easing. The pandemic emergency inflation of asset bubbles is now officially OVER.

Just in time for new meltdown.

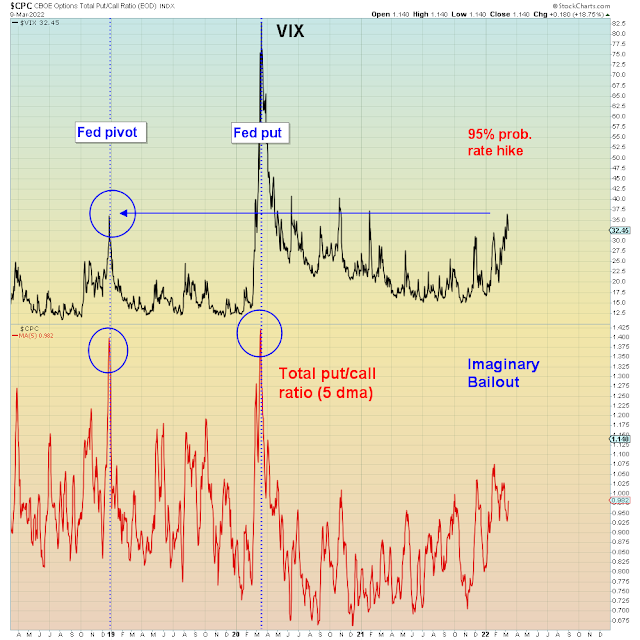

There are of course two major differences between now and two years ago. First off, the Fed has ZERO room to go down on interest rates. Secondly of course, they are on a tightening path which means they are several "meetings" away from contemplating market bailout.

Nevertheless, mass complacency reigns supreme. Whereas during the past two market implosions the Fed was conducive to bailout, gamblers nevertheless hedged risk. This time, with no bailout on the horizon, they are taking no precautions. When everyone reaches for the sell button at the same time, there will be no one on the other side of the trade. We are headed for a ZERO liquidity global asset meltdown.

You see, the passive money bubble doesn't believe in risk management. These people have been brainwashed into ignoring all risk. And therein lies the problem - without risk management, panic at lower levels is all but assured.

And there is no way central banks can bailout everyone at the same time.

In summary, forget about oil and inflation.

This is now the largest RATE SHOCK in U.S. history when measured on a relative basis. What took six years post-Lehman took six months post-pandemic:

The global Minsky Moment has arrived.

Tuesday, March 8, 2022

THE BREAKING POINT

A Black Swan nuclear event. What's not to like? Gamblers can finally say "No one saw it coming". And Wall Street now has their excuse to bury clueless gamblers deep in end of cycle trades...

We are late in the crack up BOOM AND BUST. The only thing that can stop Fed-precipitated meltdown, is meltdown. Bulls are optimistic...

On the topic of the war between Russia and Ukraine, the only thing that's clear is that both countries are turning into failed states. Russia has become the new North Korea. We can pray that it doesn't turn nuclear but Putin is desperate and he may deploy a tactical nuke to keep NATO at bay.

In the meantime, the nuclear economic option has now been deployed - a ban on Russian oil and gas. Today the White House announced the U.S. ban and Europe announced they will seek to ban a majority of Russia natural gas over the course of 2022.

In retaliation, Russia is threatening to cut-off ALL oil and gas to the West.

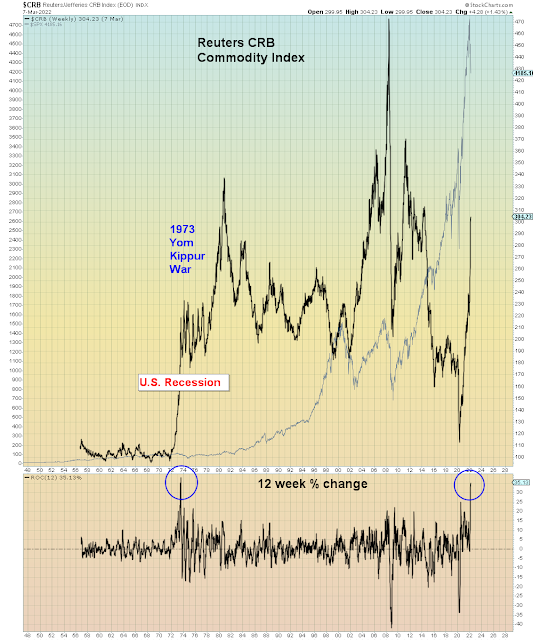

This is now officially the largest global Energy shock since 1973 when OPEC embargoed oil shipments to the West due to U.S. support for Israel during the Yom Kippur war. That event led to U.S. and global recession and the 1974 bear market.

Going into this fiasco, the global economy was already facing tremendous end of cycle risk. So it's highly likely this event has pushed the global economy over the cliff.

Talk of recession is now circulating Wall Street desks, but so far that scenario has remained well out of the purview of Main Street investors who are now trapped in end of cycle trades. Wall Street is now free to say whatever they want to clients, because they can blame this "Black Swan" event for what comes next.

Which is where this all gets interesting.

For the moment, oil is the wrecking ball creating "demand destruction" across the entire economy. However, this event has teed up the U.S. to become the only safe haven on the planet.

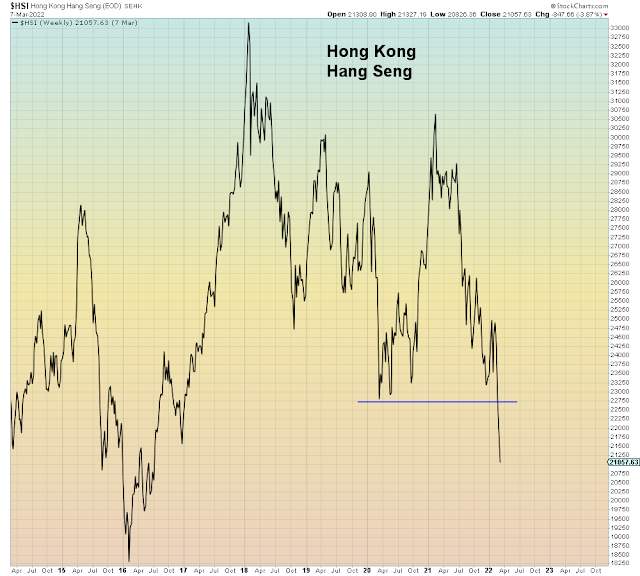

Before this war started, China was already imploding due to their real estate meltdown and COVID zero tolerance policy. The PBOC has been in easing mode for several months.

Hong Kong stocks are now well below the COVID lows and totally bidless as one China policy has destroyed their status as a global financial center.

The European Central Bank which meets Thursday this week will likely return to a neutral stance as their Energy markets are massively exposed to this Russian oil embargo. European recession is now getting priced into markets as European stocks go bidless:

EM currencies, EM bonds, and EM stocks are all imploding due to the various meltdown factors and the rising $USD which I will discuss in a moment:

Next comes Japan. Normally, in a crisis scenario the Yen catches a massive bid due to the global carry trade unwind. However, this time the Yen remains weak due to the commodity shock and the record trade deficit. Which is why there is now a massive policy divergence between the U.S. and Japan.

Shock Commodities Spike Threatens to Push Yen to Six-Year Low - Bloomberg

"No chance monetary easing will be reduced"

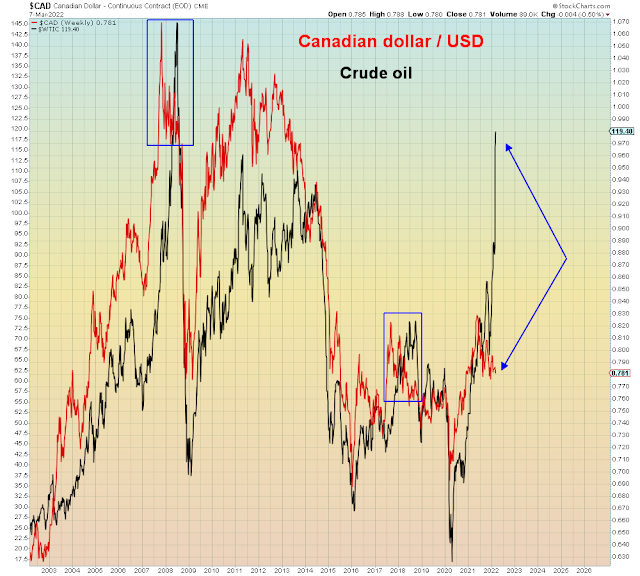

Normally in a commodity super cycle Canada and Australia would be massively outperforming. So far their stock markets are holding up better than most. However, currency wise we now see a massive disconnect between the C$ and oil. This is further indication that oil is totally disconnected from global economic growth. This is the largest divergence we've seen since 2008 and we see how that worked out for oil:

All of which means that the U.S. is the ONLY safe haven left in the world. Which is why the dollar is rising in lockstep with this parabolic ascent in oil.

Whereas oil is currently the global wrecking ball, soon the $USD will become the REAL global wrecking ball. Oil has boxed the Fed into tightening. So either something breaks THIS week due to oil. Or something is going to break NEXT week due to the Fed. The only thing that will stop meltdown is meltdown.

Dollar funding stress is already showing up in global markets this week:

Funding Stress Indicator Surges to Widest Levels Since May 2020 - Bloomberg

"The fear that the impact of the war will create a dollar shortage is rippling through the system"

What would a dollar super spike do to all of the above markets?

In particular it will implode oil, gold, and Emerging Markets post haste. Followed by massive global deflation.

This Thursday we get another CPI report which is expected to run hot.

At least bulls can honestly claim no one saw it coming.

Again.