The chart of the month for February is this one showing the Ark ETF making a two year round-trip to nowhere having pumped and dumped legions of gullible speculators along the way. The Ark "Innovation" ETF is the largest single holder of recent Wall Street IPOs. It's a conduit of dumb money straight to the Cayman Islands.

It's a stark reminder that there is no human tragedy this society won't exploit for maximum profit.

The main difference between me and other financial commentators is that I don't feel the need to explain away every daily close with a correlated headline. My predictions are not marked to market in the Jim Cramer style. Which is why I don't dilute my commentary with a daily dose of contradictory bullshit. No crash happens in a straight line. At least at the beginning. The end is another matter. This market has been stair stepping into the abyss for months now, always pulled back from the brink by the weekly opex-driven algo rally. Ironically bears buying weekly put options are the major reason this market always catches a Friday bid. When those options are sold or expired, the market makers buy stock to offset their short hedge. And then Monday comes along and the market implodes again.

Be that as it may, Goldman put out a note this past weekend saying that the U.S. is now the sole beneficiary of global inflows, however U.S. stock market liquidity is at a 15 year low.

"Money is still flowing into U.S. stocks at a prolific pace, but it’s arriving into a market where liquidity is evaporating"

"Equity liquidity -- as measured by orders from market makers ready to transact on American exchanges -- has slumped to levels seen only three times in the last 15 years"

In each episode, the S&P 500 dropped more than 20%"

Now, picture what happens when inflows to the U.S. suddenly stop and investors want to sell.

Hotel Californication.

But for now, we are to presume that the U.S. is a safe haven from global dislocation. The entire rest of the world can implode, but not the U.S. Where have we heard this fairy tale before? It was back in 1998 when the Russian Financial Crisis caused a single massively leveraged hedge fund (LTCM) to implode. Which almost brought down global markets. In the event Greenspan cut rats .5% and organized a bailout. This time, a rate cut of that size is not even possible.

In addition, given the weakness of global markets and the magnitude of sanctions levied against Russia it's not hard to believe the collateral damage could be far greater.

However, today's bulls have total confidence in the just-in-time bailout hypothesis.

Unfortunately, the just-in-time bailout hypothesis is about to get system tested in real-time. What I call J. Powell juggling ten pies while falling down stairs.

The reflation trade has made Powell's task quite impossible, because any sign that the Fed is backing off on rate hikes will implode the massively crowded reflation trade. As a first order of business.

We are already starting to see hints of that implosion taking place as these past few days Tech and T-bonds have been bid while reflation trades have been imploding. A clear sign that hedge funds are unwinding their consensus trade: long cyclicals short Tech. Don't assume this Tech bid is anything other than short covering.

Meanwhile, just as Russia is being intentionally imploded by the "Great powers", China is going into late stage meltdown.

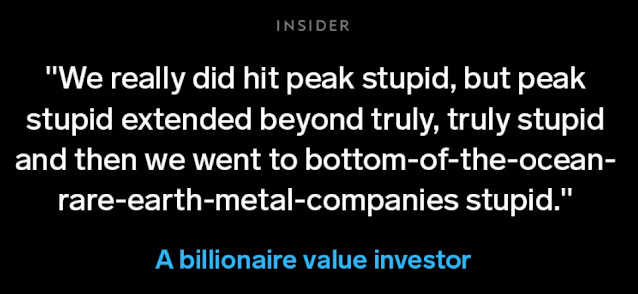

One commentator on Twitter blamed negative commentary for bringing down markets. It seems that everyone wants to make their contribution to peak stupid.

In summary, this Disney "market" has now become human history's largest liability. It has achieved a level of overvaluation at the end of the cycle that no longer fits the categorization of an "asset". It's now a thermonuclear weapon of financial mass destruction. Lethal to those who own it.

Those camped right now in the S&P 500 are of the belief that only Ark ETFs are overvalued.

Why? Because there is no human tragedy they won't exploit for personal gain, AND there is no risk they won't ignore.