"About 3 million people retired earlier than they likely had planned as a result of the Covid environment, according to a report by a senior economist at the Federal Reserve Bank of St. Louis"

Monday, October 25, 2021

The Crack Up Boom And Bust

"About 3 million people retired earlier than they likely had planned as a result of the Covid environment, according to a report by a senior economist at the Federal Reserve Bank of St. Louis"

Thursday, October 21, 2021

Global Synchronized Delusion

Monday, October 18, 2021

The Golden Age Of Fraud

Friday, October 15, 2021

The Hardest Landing

One could not invent a dire set of circumstances that would be more cataclysmic than this banquet of overdue consequences. The Casino Class is about to experience what the middle class experienced in 2008 - forced de-leveraging in a bidless market. What happens when you are looking down the tracks expecting inflation and get steamrolled from the other direction by deflation. Hard to believe, but bidding up everything to record valuations ahead of a global crash is a bad idea...

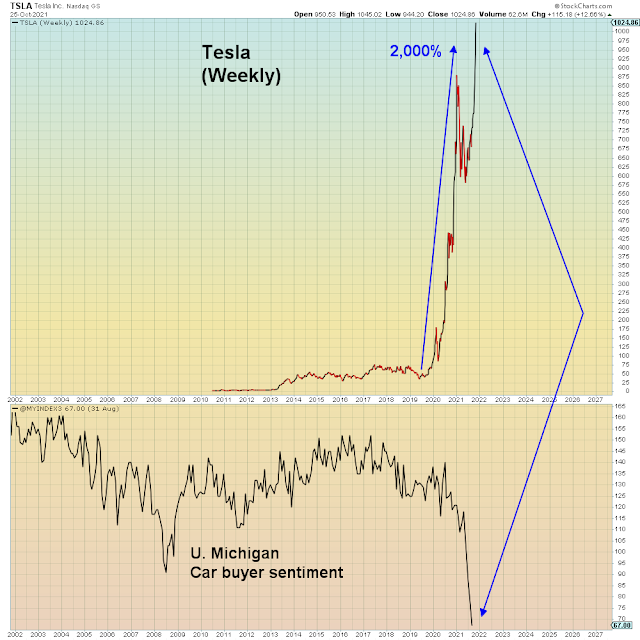

Here we see consumer sentiment is very similar to the 2007 market top except even lower. Q4 2007 was also the onset of the Great Recession, however it took until the markets exploded a year later for the Fed to realize it had started. Up until that time they were primarily concerned about inflation. Sound familiar?

The other low in consumer sentiment we notice was from August 2011 just after the debt ceiling debacle. Which is a reminder of what is coming up in a handful of weeks (December 3rd). And then of course we learned this week via the FOMC minutes that the taper is coming in as soon as a few weeks (mid-November). Suffice to say, the Fed's current policy stance is 100% wrong. I predict they will soon be forced to a neutral stance on their way to an easing stance. But unfortunately they are 100% out of easing ammo.

At the top in 2007 they had a 6% interest rate buffer, now they have 0%. But really, what could go wrong?

Even at this latent juncture, gamblers, pundits, and advisors remain sanguine. Deja vu of the Fed circa September 2008, the Chinese government just announced today that they will not be bailing out Evergrande, because it's a "unique" situation. They see no risk of contagion and therefore they have conveniently ignored what is now officially the largest property asset bubble in human history. According to this recent article, China's super real estate bubble is even larger than the one in Japan from 1990 that put them in deflation for the past 30 years:

"According to Rushi Advanced Institute of Finance, condominium prices in the southern city of Shenzhen are now 57 times the average annual income, and 55 times that of income in Beijing. Even at the height of Japan's bubble economy in 1990, Tokyo condos were 18 times the average annual income"

Picture a middle class family in the U.S. with household income of $80k per year. At 55x they would be buying a home worth $4.5 million on leverage. You get the idea.

The other crazy statistic is the fact that real estate/property development is 25% of China's GDP. In the U.S., it's 6% of GDP. So imagine the magnitude of dislocation if the Politburo is wrong in not attempting to stop Evergrande from imploding. Quite high. Regardless, in 2009 China's massive property-driven fiscal stimulus exported reflation via commodity demand to the rest of the world, whereas from this point forward they will be exporting deflation as the air comes out of their bubble at a "controlled" rate. Needless to say that China's satellite cities of Hong Kong, Sydney, Vancouver, Seattle, London and San Francisco will feel the full effect of real estate de-leveraging.

The chart of the week is this one showing EM currencies at critical support and in the lower pane Chinese junk bonds which have collapsed BELOW COVID levels. If EM currencies break that key level, the entire World switches from an inflationary impulse to a deflationary impulse OVERNIGHT.

Nevertheless, today's gamblers are making an ALL IN bet that it can't happen.

For the purpose of the discussion below when I say "cash" I mean money market funds and t-bills. There is no such thing as pure cash deposits in today's fractional reserve world. Everything is a loan of some sort.

Today's negative real yields are the root cause of moral hazard in today's Casino. By taking rates down to 0% the Fed made cash extremely unattractive. By leaving them down at 0% they have generated just enough inflation to force real yields negative forcing institutions, robo-money, (and many others) out of cash entirely. "Cash is trash" is the mantra of the day. Bond "guru" Bill Gross said so himself at the end of August which still stands as the S&P all time high by the way. This article I posted on Twitter explains that today's money managers are "super cash efficient", which means they don't have any at all. What they have instead is something they believe is highly liquid aka. long duration Treasuries which they assume can always be turned into cash easily. That assumption will be tested and fail catastrophically. What I predict is that first deflation will explode with a vengeance via some sequence of EM currency collapse, commodity/oil crash, global margin call etc. THEN, I see so-called Risk Parity funds being forced to puke Treasuries (and other long duration proxies i.e. Tech) back into the market due to forced unwind/de-leveraging. When they do so, they will further accelerate the rise in real yields which will further monkey hammer reflation trades, forcing more de-leveraging so on and so forth. I call it the de-leveraging death spiral. I do not predict that T-bonds will be permanently imploded - I predict they will be imploded long enough to wipe out every other risk asset, particularly non-yielding assets - Bitcoins and all that other worthless crap that had perceived value so long as yields remained negative forever. Long duration Treasuries imploded back in March 2020 for a day or two, but this time I see it lasting substantially longer. The Fed will eventually panic and take over the Treasury market Japan-style. But suffice to say, policy-wise they are right now heading in the other direction. Sadly, the FOMC isn't quite as quick as algos and margin clerks.

What we notice from the chart below in the lower pane is that gamblers have less and less respect for owning cash. They are 100% positioned wrong for what's coming and therefore they will exacerbate the overall liquidity collapse that will be global.

Which is why I said above, they will be forced de-leveraging in a bidless market.

Wednesday, October 13, 2021

The New Permanent Plateau Of Bullshit

"There is no means of avoiding the final collapse of a boom brought about by credit expansion" - Ludwig Von Mises

The ideological consequences of this super asset bubble collapsing will be of such a magnitude that most of today's pundits are incapable of acknowledging them. This market has done nothing "wrong" other than to remain artificially pinned at all time highs while the sheeple threw their life savings into it. Bulls can afford to be fat and happy, because they are sitting atop the largest uncorrected rally since 1933 and that fact is not the slightest concern to them. Unfortunately, contrary to popular belief, there is no pot of gold at the end of this rainbow. On the other side of super asset bubble meltdown, gamblers will come to realize that all they bought was the biggest empty load of hot air in human history...

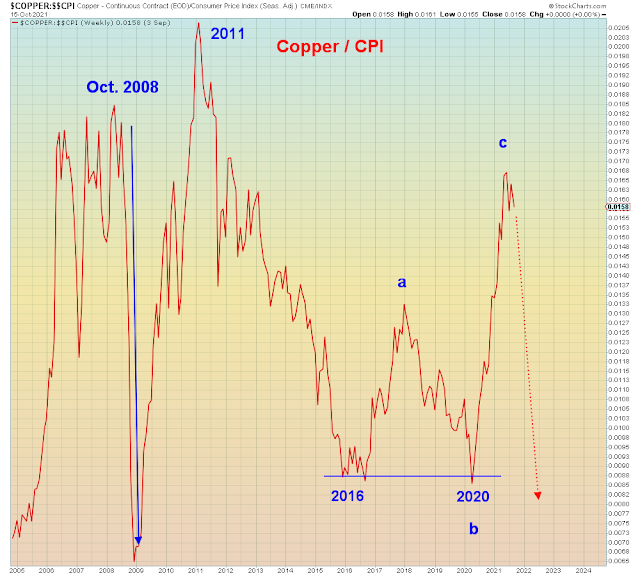

The greatest fear I've heard over and over again is that we are headed for "stagflation", and of course there is a trade for that - commodities, Bitcoins, alt-currencies, real estate etc. Never mind that those asset classes are part of the super asset bubble. This argument of stagflation is of course wishful thinking for those who are whistling past the graveyard of the greatest debt bubble in human history. It conveniently fits with the right leaning desire that Biden's economic recovery is doomed to fail, but not catastrophically. It will fail in a late 1970s peak middle class kind of way that proves Supply Side economics was the right choice all along. It WON'T fail to the extent that it reveals four decades of Reaganomics to be an abject human catastrophe. Because that would be bad and ideologically terminal.

Wishful thinking.

It never once occurs to any of these people that they are watching a credit crisis unfold in real-time. Not A credit crisis - THE CREDIT CRISIS.

Here we see gasoline adjusted for inflation is either at a three year high OR at the same level as 2005, depending upon who you believe.

This chart of global (wealthy nation) real estate is a good proxy for the overall relative magnitude of each serial asset bubble. What it shows is that each bubble has exploded with greater and greater dislocation, followed by a bailout and an even larger bubble. Many people seem to forget that there was a financial crisis that preceded the financial crisis. It was the Savings and Loan Crisis:

"The roots of the S&L crisis lay in excessive lending, speculation, and risk-taking driven by the moral hazard created by deregulation and taxpayer bailout guarantees"

In other words, the roots of the Global Financial Crisis of 2008 are the EXACT same as the roots of the S&L crisis, only of much larger magnitude. AND the roots of this impending crisis are the exact same as the roots of those two prior crises only once again of much greater magnitude. Fraud and criminality encouraged via continuous monetary bailout since 2008.

Of course, societal moral collapse has been front-running this latent disaster all along. Which is why even now so few people question it. Most people in positions of wealth and authority today are the prime beneficiaries of this mega fraud and hence they have no incentive to warn against it. Why would they want to see a paradigm shift that could have them at the bottom instead of the top?

All of which preamble gets us to the Casino...

As the saying goes, tops are a "process" not an event. I say, tops are a process followed by an event. In this case, a super cycle top which is even a longer process than usual. Here we see the Dow has been topping since last May which is now five months and who's counting?

The 2018 Q4 deflationary collapse is the analog of choice. It featured the following similarities:

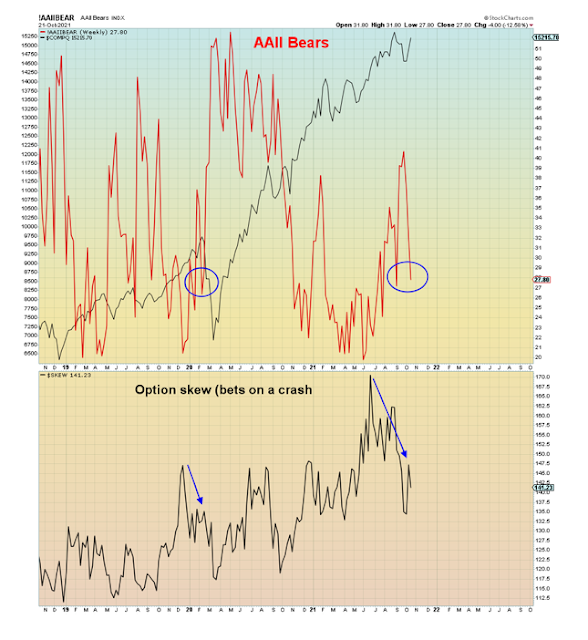

Fiscal stimulus withdrawal, monetary stimulus withdrawal, a peak in oil, a massive spike in natural gas, peak Treasury reflation expectations, heavy distribution (negative money flow), Chinese stock meltdown, dollar rally, massive breadth divergence, a double breakout in Nasdaq new lows, record option skew, and a second growth stock blow-off top in the same year. The first one being February. The main difference we see below however is that investor positioning (IMX) increased since February whereas in 2018 it decreased.

Note the current position (main pane) and the circle from October 2018:

Here we see Brent Crude is literally identical to 2018:

Sunday, October 10, 2021

The Wall Of Shame

"Numerous experts have predicted not to expect a housing crash like in 2008, given that the current market is so different"