Tuesday, April 13, 2021

Party Like It's 1929

Monday, April 12, 2021

No Respect For Risk

One year ago in late February, central banks were easing heavily, gamblers were partying hard, risks were growing exponentially, and then the bottom fell out with "no warning"...

What has changed in the interim? Last year gamblers were ignoring the pandemic, this year they are ignoring the pandemic's aftermath. The only other thing that has changed is that leverage has increased astronomically. In the spirit of Fooled By Randomness, central banks have created a cabal of over-leveraged morons who believe they are gambling geniuses.

Which is why the revelation that they are not, will be a "Black Swan" event. A large cataclysmic event unforeseen by those who have their heads up their own asses.

The headlines from January and February 2020 are interchangeable with the ones we are seeing right now:

Jan. 28, 2020

2020 Is Shaping Up To Be a Strong Year For IPOs

2020 was indeed the strongest year ever, but first the market crashed and margined gamblers were wiped out. Minor detail.

In 2021, the market for IPOs is far frothier. As of the end of March, 2021 has already surpassed the entire year 2000 in total IPOs:

4/1/2021:

Options speculation hit records early last year, but this year's surge makes last year's look miniscule by comparison:

Feb. 13th, 2020

As the month of February 2020 wore on and the pandemic grew worse, there was this warning:

Feb. 19th, 2020

Mania Has Taken Over The Market, There Is No Respect For Risk

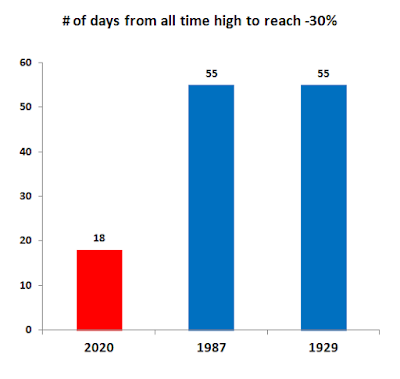

And then "out of nowhere". Kaboom. The worst high to low crash in market history.

Fast forward one year and Bill Hwang's story is straight out of Nassim Taleb's Fooled By Randomness. An arrogant cocky trader finds early success in the markets, so he keeps doubling down and parlaying his gains into ever larger bets, until he explodes spectacularly.

He lost his entire net worth of $20 billion in two days.

There are now untold numbers of Bill Hwang's in these markets. Newbies who now think they are investing geniuses. They've been bailed out by central banks so many times, they believe they are invincible.

However the other deja vu story that keeps getting ignored is the fact that corporate debt markets were already on the ropes last year. And ironically, the COVID pandemic saved the Ponzi market, by making it far bigger.

Jan. 22, 2020

Today 50 percent of the investment-grade market is rated BBB, and in 2007 it was 35 percent"

Got that? The end of cycle zombies were on the ropes, but they got refinanced one more time thanks to a pandemic. Now the Fed no longer has magical abilities to buy corporate bonds in the secondary market, and the LQD bond ETF just experienced record outflows. What the central banks did was kicked the debt can one more time.

However we are to believe that the pandemic "fixed" the corporate debt problem by making it far larger. Only zombies would believe such a thing:

In summary, the glue fumes from this latest central bank asset recovery are wearing off, so they need a new excuse to intervene in markets.

In the meantime, the margin clerks will be showing today's newbies how to sell stonks. Because they apparently didn't learn that lesson last year.

When they get wiped out, central banks will come back in to buy the dip again.

The machines are about to get Bill Hwang'd x 100 and Skynet will be offline by the end of it all.

Position accordingly.

Sunday, April 11, 2021

All Time High Fraud

Central banks are sponsoring mass stupidity and rampant fraud. The masses are now convinced it will continue forever. They are apparently unaware of the cardinal rule of pump and dump schemes - one must get out BEFORE they end, lest they become the greater fool of record...

One thing all of today's rotating pump and dump schemes have in common is that they are driven by fraudulent narratives. From Gamestop to SPACS, to Crypto Ponzi Schemes to Ark Funds, to economic cyclicals, they are all predicated upon a zero sum view of markets. One person's gain is another person's loss, and the losses are piling up silently in the background. Somehow this society's moral collapse has always remained one step ahead of the latent economic collapse, now papered over with 20% of borrowed "GDP".

We can blame central banks all we want, but no one forced these people to believe these fraudulent narratives. For example no one forced them to believe that the post-COVID economy will be better than the pre-COVID economy, and yet based upon valuations and investor positioning, that is the assumption.

Notice that the IMX positioning indicator is higher today than it was pre-COVID. Based on the ubiquitous view that only liquidity matters:

I read two bearish articles this weekend and now I understand why people are so one-sidedly bullish. Both articles cited various risk factors but then they concluded in a very ambivalent way that central bank liquidity can keep this party going indefinitely. In other words, today's "bears" share the consensus view that central banks are invincible:

MW: The Stock Market Has A 'Binary' Feel To It

"With all of that said, I could be wrong. This bubble-blowing bull market might rage on for three more years without looking back"

RIA: Market Surgest To Overbought As Investors Go ALL IN

"This does not mean “sell everything” and go to cash. We remain in the seasonally strong period of the year, psychology remains extremely bullish, and liquidity is still flooding markets"

"Over the next few weeks, there is little reason to be “bearish.”

If this is the bearish viewpoint, imagine the bullish views at this juncture. First off, given the murkiness of the economic outlook, today's forward P/E valuations are rife with fraud and deception. As far as technical overbought metrics, those haven't mattered since the election. And today's lopsided sentiment tells us that a lot of people will be wiped out by reversal, but it doesn't pinpoint the date.

Ironically, it's this implicit view that central banks are omnipotent that is by far the greatest risk to markets. This consensus view is encouraging people to do very stupid things with money right now under the belief they will get away with it forever.

In the corporate credit markets all manner of Ponzi borrowers are currently being funded. How bullish is it that central banks are now funding record junk bond issuance?

“It’s really hard to keep up with the issuance...Now the pendulum is shifting a little bit toward more aggressive behaviors”

In 2020, annual sales zoomed past the previous record by over $100 billion"

Emerging markets borrowed record amounts of money in 2020 and now they are facing rate hikes and currency declines, putting pressure on their ability to service their record debt load. All resulting from bullish "free money":

The SPAC market I've said many times is this era's stock market version of subprime, riddled with fraud. 2020 was a record year for issuance and 2021 has already surpassed 2020 on IPO issuance and doubled 2020 on impending listings.

The housing market is now back in bubble territory.

In other words, Gamestop and Bitcoin are chump change next to what is going on in large scale financial markets.

But the biggest fraud of all is this fantasy global recovery that consists of stock market prices front-running a fictional economy.

Deja vu of last time:

"On the morning after Lehman Brothers filed for bankruptcy in 2008, most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis"

"The transcript for that meeting contains 129 mentions of “inflation” and five of “recession.”

What the Fed didn't know in September 2008 is that the economy had already been in recession for NINE months. Why didn't they know that? Because their own crisis-driven policies were bidding up risk asset markets and commodities, creating a feedback loop of market-driven "inflation" having nothing to do with the real economy.

They fooled themselves.

Friday, April 9, 2021

Meltdown Is A Crowded Trade

Here we see the current state of large cap Momentum stocks. The largest holdings are: Tesla, Microsoft, Apple, Nvidia, Amazon, Paypal, Adobe, and Google. The Full Monty.

My advice to bulls is to enjoy the ride. Because it's a one way trip.

Thursday, April 8, 2021

SUPER CYCLE MELTDOWN PREVIEW

Wednesday, April 7, 2021

Conditioned To Implode

Can the U.S. borrow insane amounts of money from the rest of the world, explode global interest rates and global currencies AND pull the world out of recession? Surprisingly not.