The lesson that apparently very few of us learned in 2008 is that you can't trust proven criminals. For president or any other trusted occupation...

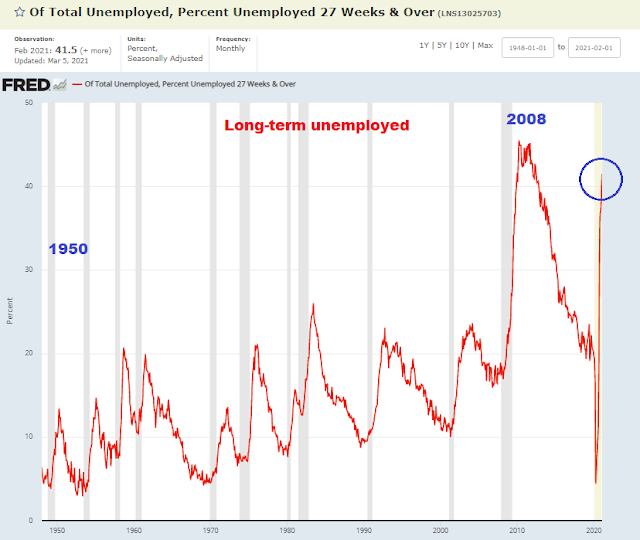

After the 2008 meltdown, economists declared the recession was over by June 2009. However, for many households, the economic pain went on for many years afterward. Then as now, the 2008 recession created massive numbers of long-term unemployed workers, on a scale never before seen in U.S. history. For Wall Street, the recovery was almost instantaneous, as it was this past year.

"The Labor Department’s technical definition of “long-term unemployment” applies to someone who’s been jobless for 27 weeks or longer — a bit more than six months."

In the January jobs report, that was 40% of unemployed folks. That’s not even taking into consideration the people who’ve just given up and left the labor force altogether."

Here we are all over again. Wall Street is busily declaring that the "recovery" is well underway. And for the middle class, the same long-term hangover effect is now in place. Of course this time around we have massive and dramatic stimulus for as far as the eye can see. However, the current unemployment stipend of $300/week works out to roughly $7 an hour. So, for a minimum wage worker that amount gets them back to the poverty line. For high wage workers, that amount plus their normal state unemployment is a pay cut. There is no reflation in either of those scenarios.

This ongoing deflationary morass is corporate paradise. It's deflation combined with jobless consumers. Cheap capital, cheap labor, and pain-free layoffs at public expense.

Notice that today's ebullient claims of recovery assume interest rates will remain at emergency levels indefinitely, as will QE, and the Federal debt will continue to explode. What in previous times would have been called a total fucking disaster, is now called "recovery". With each iteration, the bodies get stacked up like cord wood.

As Japan has proved, this can go on for a very long time. Japan has the largest debt as % of GDP in the world, and yet which currency is considered the ultimate safe haven? The Yen. When markets go into meltdown mode, the Yen is the asset class of choice. And the second safe haven is the Ponzi dollar, third the negative yielding Euro.

I am not a conspiracy theorist, because I don't consider greed to be a conspiracy. However, we should be aware that the beneficiaries of this 9-11/Lehman/COVID permanent economic Shock Doctrine don't EVER want it to change. So we need not assume that the economic "reforms" I listed recently, are pending. One should ask themselves, how can an economy that is systematically oriented towards making the richest people consistently richer ever create "reflation" for the middle class? Obviously it can't. For the ultra-wealthy, the marginal propensity to spend is extremely low. Most of their wealth gets saved. Which is a major reason why government stimulus is no longer stimulative. The money goes from the Federal Reserve to the U.S. government to the stimulus recipient, to the corporation, to the bottom line, and out to the Cayman Islands. It doesn't get re-invested back into the economy. Almost half of it goes to stonks to front-run imminent reflation.

Which is also why the velocity of money has collapsed. Banks are happy to sit on excess reserves and earn interest from the Fed. At peak household debt, the stimulus money is not circulating back into the economy.

The consistent theme that has accelerated over the past decades is for monetary policy to be hyper-tuned to financial markets at the expense of the economy. As interest rates have plummeted during this period, the general consensus for what is a "hot economy" has declined inexorably, and along with it capacity utilization and full time employment. As I've said, this hyper-sensitivity to "inflation" is due to the massive amounts of debt. It has effectively lowered the speed limit on the economy to the zero bound.

Currently we are told that bond yields are too high, and the economy is over-heating. What they mean is that the financial markets don't like to see big wage gains, so we need to shut down the reflation party before it becomes too inclusive.

Stepping back for a wider perspective, decades ago futurists predicted that the society of the future would work less and spend more time on recreational pursuits. For decades they were wrong, but after the stagflationary 1970s, the inexorable decline in inflation, full time jobs, and interest rates brought their prediction to fruition. COVID and the virtual stay-at-home economy merely accelerated the trend that was already in place.

The future has arrived:

"Automation, in tandem with the Covid-19 recession, is creating a 'double disruption' scenario for workers," said the report published Wednesday in Switzerland by the World Economic Forum, which warns that inequality is likely to increase unless displaced workers can be retrained to enter new professions."

For the first time in recent years, job creation is starting to lag behind job destruction"

Got that? For the first time ever, technology is now destroying more jobs than it creates. The secular trend of increasing employment that has been in place since the industrial revolution began, is now reversing.

Now, before everyone jumps off a bridge, I don't personally view this as entirely bad news. I think that the next generation needs to devote their time and training to professions that are less likely to be automated. I think for many older people who are pre-retirement this implies part time work in conjunction with time spent on other interests. I am also optimistic that with Trump we achieved peak Assholism with respect to the policy of robbing the middle class to pay the rich. No one can say we didn't try hard enough.

What about universal basic income? I think it will be basic but it will not be universal, it will be means tested. And hence it will not be inflationary. Again, corporate paradise. Part time workers subsidized by an unlimited balance sheet. Think $10 minimum wage and $5 basic income. Something along that lines.

From an investment standpoint, all of this means that we are entering the long sideways. Meaning buy the dips and sell the rips. As far as imminent dollar destruction is concerned, Japan is 31 years and counting with the world's most printed safe haven currency.

What does this have to do with explosion?

Nothing. It's still well on track, the masses are still going to shit a brick as expected. And then like the Japanese, NO ONE will trust the stock market.

That will be the time to buy. The rule in all pump and dump schemes is that you can rent delusion, you just can't own it.

Of course there will be re-regulation of Wall Street, but it will come far too late to save the usual bagholders. Those who STILL trust Wall Street and their bullshit recoveries, deserve their certain fate.

We are very late in the pump and dump cycle: