The amount of rot and fraud under the hood of this Fed sponsored pump and dump is unprecedented in U.S. history. When it all explodes "without warning", the Idiocracy will be shocked at how much criminality they enjoyed while it was working in their favor...

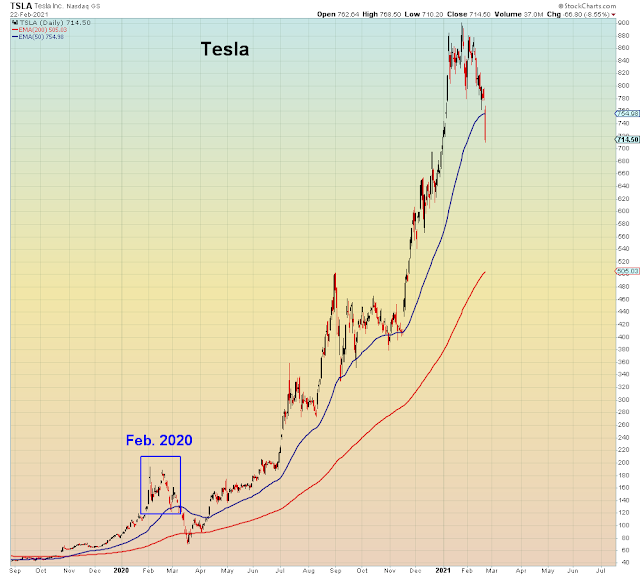

On the anniversary of Meltdown 1.0, ALL of the COVID bubbles are imploding at the exact same time: Bitcoin, EV/Tesla, SPACs, MAGA cap Tech, Work from home, pot stocks, biotechs, and EM Tech...

Sadly, the usual bagholders have no possible way of knowing that the party is already over. One of the downsides of being addicted to bullshit.

Last year during the first week of meltdown, I noted that the BTFD impulse had conditioned gamblers to calmly self-implode. The slow motion implosion was a surreal moment, as it is right now. The perma-bullish financial media will take a few days or weeks to catch on to the fact that the party is over, because their audience is in no mood to believe it. By the time they figure it out, it will be far too late. Over the past week there have been four overnight selloffs that led to morning crashes in the U.S. - each one of a larger magnitude, and yet each one got bought.

Then as now, post-opex the Nasdaq 100 crashed into its 50 day moving average and backtested it from the underside. By Friday of that first week, the 200 dma was the first level of support. Which is another 10% lower from current levels.

The World's most popular ETF traded 600% of average volume today.

The largest holding of the Ark Funds is of course Tesla, which has now entered a bear market along with BitCasino. Two Ponzi schemes tied together to see if they'll float:

"Tesla shares have fallen into a bear market, down over 20% from the recent high, and some analysts suggest the company's ties to bitcoin are to blame as the currency takes a beating"

Ark Web's two largest holdings are Bitcoins and Tesla

I read a message board comment recently saying that Cathie Wood is the only Boomer who trades like a Millennial.

100% pump and dump and proud of it.

Speaking of which, Nasdaq selling pressure is at March 2020 levels of distribution. The smart money is hitting the dumb money bid.

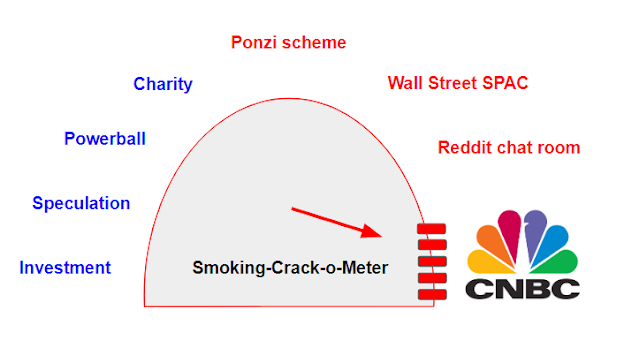

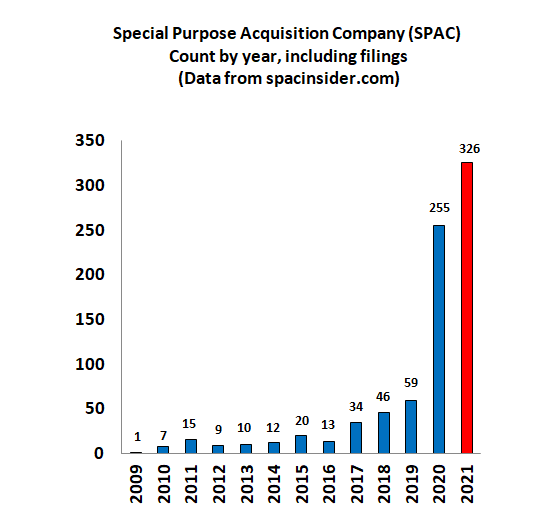

Today, one of the most high profile SPAC deals revealed itself to be another pump and dump at home gamer expense. Shocking as that may sound. These unregulated private equity vehicles are a con man's paradise.

"Amateur investors have crowded into Klein’s SPAC in the hope of backing the next Tesla Inc. They did so before knowing the terms of the proposed transaction or the state of Lucid’s finances. Gambling doesn’t always pay.

The big winner here is Lucid’s principal shareholder, the Public Investment Fund of Saudi Arabia"

Despite the widening overnight gaps, so far, the algos are keeping options volatility compressed. However, as we see below, last year volatility shorts were reducing their positions into the event, whereas this year they have been pressing their bets.

The potential for volatility explosion is far greater this time around:

Of course we never saw this much delusion a year ago:

There is an algo driven pattern to these Disney markets that is intended to monetize as many people as possible in both directions. Which means that when the bubble final explodes, most home gamers will be wiped out.

And then there will be nothing left to show for the virtual simulation of prosperity, and its acolyte QE, except for an enraged populace. Bilked by the usual psychopaths.

Again.