What a week in Disney markets. Following a manic year for stock market speculation in 2020, in the first week of 2021 global reach for risk went parabolic led by crypto Ponzi schemes and the Tesla clean energy super bubble...

One can argue that the easy money has been made.

This week started with a major selloff as Wall Street informed us a "blue wave" is not priced in to markets. They were right, but only in the exact opposite way they expected, because when the blue wave arrived on Tuesday markets went vertical up, instead of down.

My expectation of a Tech explosion almost came to pass on Monday and Wednesday, but then the MAGA caps were bid into weekly opex on Friday. What really happened this week is that all of the volatility collars that were put on around the seminal election in Georgia got monetized creating two way volatility and short covering. Throw in a disastrous jobs report and the recipe for a massive stock market rally was complete.

Per Hendry's Iron Law of Disney markets, the one reliable constant for the past decade+ of non-stop monetary bailouts has been stocks rallying on an imploding economy, in anticipation of further dramatic monetary euthanasia. According to Hendry's Law, when everyone finally loses their job, the stock market will reach infinity. We'll all be rich and we will have all of our money in Bitcoins. You have to be an idiot to believe all of this, which is why it's the consensus view.

Now that we have a de facto "blue wave", I have been ruminating over the consequences for the economy in 2021. No surprise, Wall Street's expectation for this year is STILL the best of all worlds - fiscal stimulus for the economy, monetary stimulus for stocks, and zero inflation.

Sure. Whatever.

Despite this blue wave, my expectation of what happens to the economy in 2021 is now entirely dependent upon what happens to the Financial WMD. When that explodes, I expect far more unemployment accompanied by far more fiscal and monetary stimulus eight ball. However, when people making $200k per year are now living on unemployment benefits one quarter that amount, I highly doubt there will be inflation. In addition, I predict these stimulus gimmicks will create ZERO permanent jobs. Does anyone remember "shovel-ready infrastructure projects" in 2009? Big waste of money. The "good news" is that we are getting desensitized to a high death count, so once the vulnerable population is vaccinated, I expect the economy will re-open by Springtime. Nevertheless, by that time, unemployment will be epic, and the economic depression will take center stage. COVID will continue to reduce the herd in the background, at a high rate all year, thus reducing the Social Security and Medicare deficit. As always, I'm an optimist at heart.

What does all this have to do with Disney markets? Glad you asked.

This week, the uptrend in global risk assets that accelerated throughout 2020, went vertical.

For example, the Korean Kospi was up 10% this week. The solar ETF (TAN) was up 25% this week. Tesla, up 25%. Pot stocks up 30%. Ethereum crypto currency was up 75% this week. The big story of course was Bitcoin up from $29,000 to $42,000 or 45% in one week.

Nevertheless, alt-coins - crypto minus Bitcoin - continue to give us a good indication of social mood at this juncture. Alt-coins are BELOW their 2018 high while Bitcoin is far above its 2018 high ($20k), which means that Bitcoin dominance is increasing at the expense of the rest of crypto.

Bitcoin is also increasing at the expense of gold. In other words, parabolic Bitcoin is the new "safe haven" from socialism. And yet it wasn't Joe Biden making news on the economy this week, it was one single moderate Democrat Senator who threw a monkey wrench into the reflation fantasy. Under the current shaky paradigm, it only takes only one dissenter to block stimulus now:

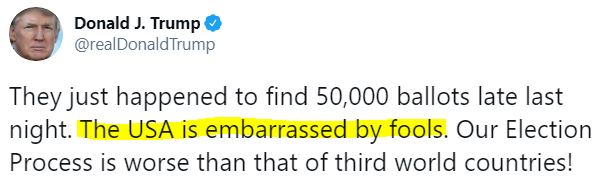

Meanwhile, aside from U.S. Ponzi risk, Asia is starting to look like another pillar of salt and sand. First off, Trump is doing everything possible to monkey hammer the Chinese stock market. Including delisting major U.S.-listed Chinese companies, now threatening the largest, Alibaba and Tencent.

"There are elements to worry about: Retail buying of stocks has ballooned in South Korea. In the past week, individual investors have regularly transacted the equivalent of more than $30 billion a day in the equity market. In 2019, they didn’t crack $10 billion on any day."

What changed this week from an economic standpoint, is that NOW in 2021, the U.S. will likely have the World's strongest economy, on a relative basis - back to being the tallest midget in the circus, deja vu of 2018. What that means is that the U.S. will have higher interest rates and a stronger currency. Which will lead to inevitable dollar margin call on EM carry trades.

Which sets up the likelihood of an impending currency crisis in a pandemic depression Tech bubble explosion.

Good times.

Now, for what everyone has been patiently waiting for...chart porn:

"Happy New Year"

Bueller?

Bueller?