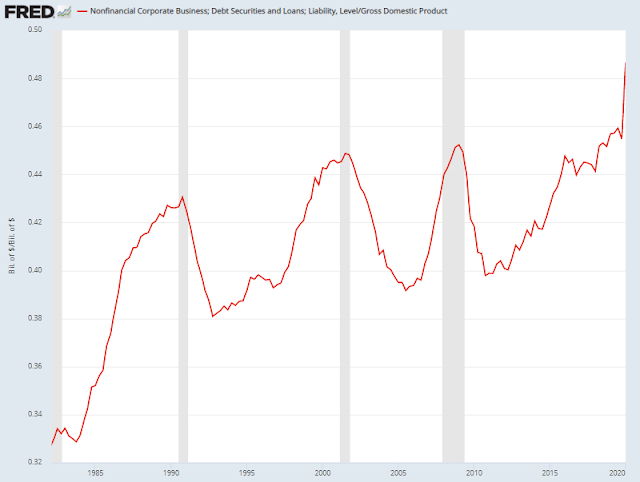

It's the end of the cycle, which means a 2008-style credit crisis is imminent. Unfortunately, today's criminalized financial pundits can't admit that fact, because that would doom the MAGA Kingdom, and the greatness that derives from following lying circus clowns...

This period of mid-September to mid-October ahead of the 2008 presidential election, was the third wave. Down...

Any questions?

There are only two kinds of people in this world right now, realists and denialists. MAGA fiends of course are not the only denialists, merely the most dedicated. At present, denialists outnumber realists by 100 to 1. Of course things were actually going far better in late September 2008 than they are right now. Never before has so much stimulus been used to hide a depression as right now. A 15% of GDP deficit to achieve -5% GDP growth. Because we have to be in a recovery, otherwise the MAGA Kingdom is doomed. This is our "future", using ludicrous levels of stimulus to pretend that recessions no longer exist.

The Fed was just as clueless back in September 2008, however they still had ample fire power, which is not the case now.

NY Times

How the Fed misread the 2008 Crisis

"On the morning after Lehman Brothers filed for bankruptcy in 2008 [Sept. 15th, 2008], most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis...the Fed’s policy-making committee voted unanimously against bolstering the economy by cutting interest rates"

Then the wheels came off the bus, and the rest is history.

Historians will never understand the level of complacency taking place right now. Of the many differences between then and now, one key difference is this massive speculative bubble which is unraveling in real-time. Another key difference is the number of weekly jobless claims which has exceeded the maximum 2008/2009 levels EVERY week since March.

It's insanity. As usual.

Which gets us back to Trump Casino:

Monday early morning (~3am Eastern), the futures had been idling along fairly flat, and then all of a sudden they imploded just prior to the European open. Global banks got pole axed by allegations of widespread money laundering taking place over the past two decades.

Monday's U.S. session gapped down at the open which was followed by the obligatory all day BTFD rally. However, the buying was confined entirely to the Tech sector, as the other 10 out of 11 sectors were all down. Ex-Tech, it was a 90% down day. Desperate speculators are now throwing caution to the wind and piling into the last vestiges of the Tech stay-at-home rally.

I listened to a Tech stock analyst on Bloomberg yesterday who sounded like she was not around in Y2K. From what I could tell, she was in kindergarten. She was recycling the same false platitudes that were deployed in that era to keep the bubble going. Tech is the future, there is no future without Tech, valuations don't matter etc. For those of us around in that era, it was all a massive lie to accompany a massive pump and dump of junk IPOs. Similar to what is taking place right now.

Among the leading stocks yesterday, as usual was Tesla, the continuing leader by far in Nasdaq active dollar volume. However, today is the Tesla shareholder meeting aka. "Battery day". After the close last night Elon Musk tweeted that most of the new innovations are two years away from being monetized. Which is why the stock is selling off pre-market. As we know, Tuesday's are the best day of the week in Trump Casino. So anything can happen.

That said, WHEN not IF Tesla rolls over hard, it will final implode the Nasdaq:

But here is the big difference between now and Y2K:

In this era, the so-called safe haven stocks are the weakest stocks in the casino. Which means there are no safe havens outside of cash aka. money markets/t-bills. T-bills being the safest on a relative basis.

Here we see on the S&P 500, using February as a guideline, a gap down Monday and then the 200 day was taken out by the end of that week.

This is not a prediction, merely an observation that the casino is heading in the same direction, at the same rate. This time, I doubt the 200 day will hold for as long as last time. We will soon find out.

For those who are wondering how close we are to a bottom so they can play the Ponzi Casino from the long side, I suggest not yet.