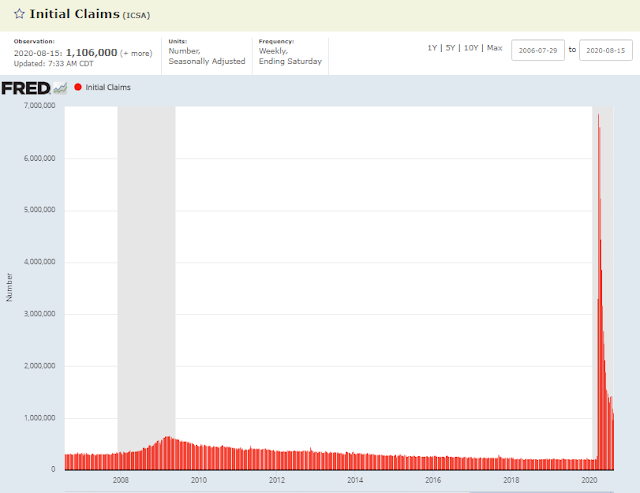

Mad Man infotainer Jim Cramer is of course well renowned for his circus antics and his unique ability to contradict himself from one day to the next, as required by bipolar Disney markets. What can be viewed as good news one day - rising unemployment/more Fed dopium can be just as easily construed as bad news the next, depending upon which way the algos are flowing. Today's rally was sponsored by the first monthly rise in weekly claims since March. Bearing in mind, that at 1.1 million, today's level of jobless claims is STILL higher than in EVERY week of 2008/2009.

So how can it be that EVERY week the NEW (initial) unemployment claims exceed the maximum reached in 2008/2009 amid a stock market rally? For that we turn to the Mad Man himself, who once in a while stumbles upon the inconvenient truth and lays it out in a way that few of today's pundits would dare to suggest. Here in this diatribe, Jim Cramer sets forth the reason this is the most dangerous delusion of our lifetimes.

“We’ve had a magnificent V-shaped recovery in the stock market, but the stock market’s not a great reflection of the broader economy anymore”

“Just look the stocks that have brought us to these levels — they’re not the recovery plays. In fact, they are the opposite."

“The winners in this market are the companies that are most divorced from the underlying economy. The actual economy is in precarious shape, especially now that the government’s stimulus package has run out and Congress went home for the summer rather than trying to come up with a replacement”

Take a step further and realize that the new technology companies leading this rally are gaining market share at the expense of the real economy. As small businesses fail by the millions, the largest public companies are now taking market share from the collapsing businesses.

This entire rally is a celebration of collapse, the likes of which we have never seen before.

So we clearly see that things are "different" than they used to be, in more ways than one. However, another major difference has been in the corporate reaction to the COVID collapse versus what was seen in other recessions. During ALL prior U.S. recessions, corporations were actively deleveraging their balance sheets and preparing for economic downturn. However, in this worst recession since 1930, they are adding new debt at the fastest rate in history.

Why? Because they are convinced this is NOT the end of the cycle.

You see, most independent bloggers on the economy and markets now hold this view that the world is controlled by "the elites" and the "Deep State" - Jeffrey Epstein (who is dead by the way), Bill Clinton, and George Soros etc.

Unfortunately, the people who believe all of that crap are total fucking idiots. Super dunces who confirm today's Idiocracy. Roughly speaking, there are now only two classes of people from an economic standpoint - those who garner their wealth from their jobs aka. the working class, and those who garner their bulk of wealth from Fed policy aka. the Casino Class. The Casino Class are in the upper echelons of everything - business, academia, finance, media, government etc. These are the people who have come to believe that stocks are more important than jobs, as they watch their Monetary-inflated unrealized gains increase day in and day out, compliments of ever-worsening economic news, in the Hendryite tradition:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks."

However, what these people don't know is that they are taking part in the largest economic blunder in world history.

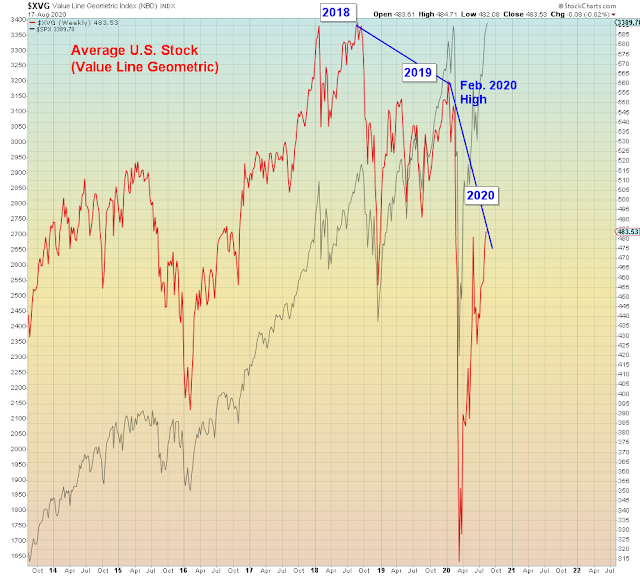

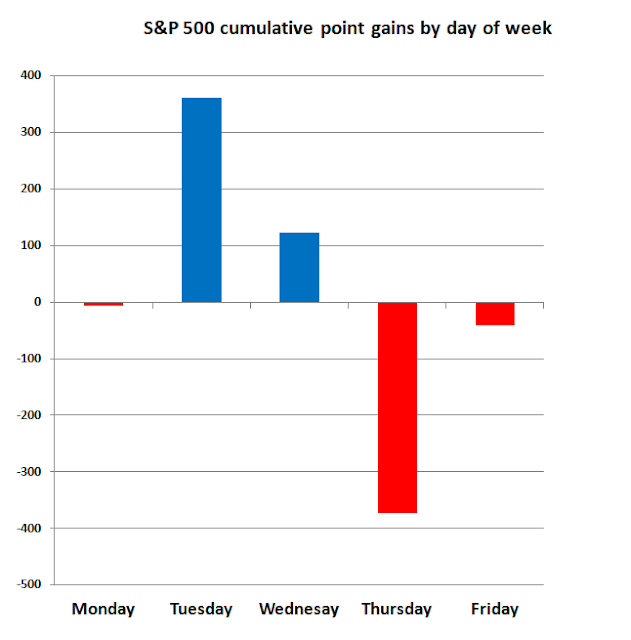

Where this gets interesting, is that as of this week the S&P 500 has now charted a double top with a slight overthrow. Overly aggressive bears who believe that stocks follow the economy, have been summarily monkey hammered. And newfound bulls are convinced this is a new bull market.

Which sets up maximum pain all around, in the tradition of Disney markets.

The last time we saw such a rapid (albeit on a smaller scale) short-covering retracement rally, was at the top in 2007. The market peaked in July, crashed, and then final peaked in October led by Tech stocks. Bears got rinsed and bulls went ALL IN at the all time high.

Similar to right now:

Sound familiar?

Zooming back to the one year view, here we see that S&P breadth rolled over ahead of the market in February of this year, and bottomed ahead of the market in March. The pattern is repeating now:

A third wave down means that this decline will make February's record-setting clusterfuck seem like a picnic by comparison.

Some people like to learn the hard way. Rest assured, this is the hard way.

What this society has yet to figure out is that there was not just one Bernie Madoff, there is an financial entire industry full of Bernie Madoffs. Who have been emboldened by Trump's deregulation of their industry, to now be lying their asses off, in the Wall Street tradition.

Circa July 2007:

Citigroup's CEO Chuck Prince Wants To Keep Dancing While the Music Is Playing. Can You Blame Him?

"The Citigroup chief executive told the Financial Times that the party would end at some point but there was so much liquidity it would not be disrupted by the turmoil in the US subprime mortgage market."

In summary, these massively leveraged "stocks" people now own without any regard to over-valuation, are all just call options on the end of the cycle.

Which contrary to popular belief, is now.

We are about to see a seismic financial dislocation on a biblical scale. One that finally resolves today's chasmic wealth inequality.

Just not in the way that is expected.