I think we all see where I'm going with this:

Looks like Trump got what he demanded after all. For trapped bulls this is their last chance to get out. Rest assured Wall Street is selling with both hands as the very last of the dumb money pours in on the news. A red close will be fatal for the bulls.

And Donny.

Any questions?

Financials are going bidless on the rate cut news

The dollar carry trade just got monkey hammered by the rate cut. Another source of liquidity gone from U.S. markets:

Where was I...

On the run up to the Y2K top, the mass euphoria sucked in all of us newbie traders. Valuations were ludicrous, but we were told that valuations no longer matter. This was a new paradigm. The bubble had been fed by easy Fed policy in the prior year due to the LTCM collapse. The Fed called it a "mid-cycle" adjustment even though it was coming at the end of the longest expansion in U.S. history. No one questioned it. The same way they didn't question 2019's "mid-cycle" adjustment coming at the end of the longest expansion in U.S. history. Wall Street was taking full advantage of the euphoria to dump massive amounts of IPO junk into the casino which would serve to accelerate the collapse on the way down. Similar to how they dumped record profitless unicorns into the market last year which are now imploding.

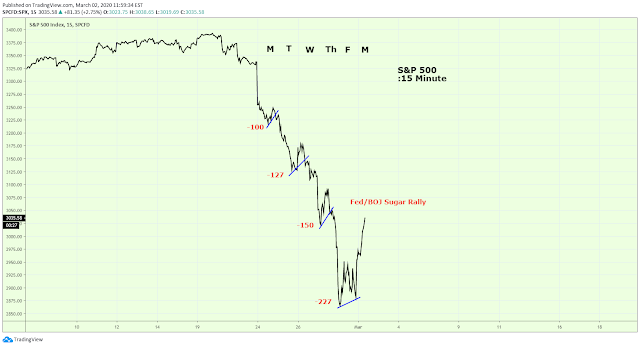

The initial leg down took everyone by surprise, it was violent and brutal. Extremely shocking to those of us who had never lived through a bear market before. But then the next week the market staged a massive rally which made everyone believe that the worst was over. So we all doubled down. Unfortunately, the worst hadn't even started yet.

Back then there were four mega cap Tech stocks leading the rally. They were known as the four horsemen of Tech: Microsoft, Intel, Cisco, and Dell. As the smaller Dotcoms imploded spectacularly, massive amounts of money flowed to the four mega caps believing they were safe havens. The market became more and more skewed to a handful of overvalued mega caps. The same way it's skewed to MAGA: Microsoft, Apple, Amazon, and Google right now. When the four horsemen imploded that second week, they took the entire market down with them.

What is taking place right now is almost identically the same. Monetary lubed melt-up rally. Insane valuations. Thunderous crack lower last week. Trapped bulls doubling down. Rotation to a final handful of mega caps.

Of course, the major difference is that this isn't 2000. Back then the Fed had a 7% interest rate buffer. GDP was running at a 7% clip and the U.S. was running a thirty year high surplus.

It was the best economy in modern U.S. history, making today's economy an absolute joke by comparison.

And to think, I haven't even mentioned the Coronavirus, 1930s trade war, collapse of China, global record low interest rates, mass money printing, political dysfunction, and Donald Trump as president. All unthinkable twenty years ago. No one would have believed any of today's insanity back then.

In this era, gamblers have been lethally conditioned to believe that bad news is good news, worse news is better. This is how they ended up going ALL IN at the end of the longest cycle in U.S. history, with NO stimulus safety net. Sheer madness.

Now it gets interesting.

Bernie Sanders rising.

Crushing Big Pharma

Big Oil

And Big Money

“If Bernie becomes the candidate and you assume Wall Street wants Trump to win again — and I think they do — then this is nothing but good news.”

It’s a perspective similar to the stance many held on Wall Street about Trump’s prospects in 2016"

Many surveys show the Vermont senator leading the president by as many as eight points. Wall Street pros generally blow off these numbers, suggesting once Trump is actually one-on-one with Sanders he’d be able to portray his opponent as an existential threat to the stock market, the economy and the traditional American way of life."

"More bailout please"