In this cycle, there have been more market distortions than any other cycle in U.S. history, from algo-driven momentum to central bank money printing, record low interest rates, record stock buybacks, to record fiscal stimulus. So it can come as no surprise that today's gambling class no longer believes that actual human beings play any role in markets. And I would say that most of the time they don't, they are merely along for the centrally managed roller coaster ride in Disney markets. Except, at the extremes - the tops and bottoms, when volumes increase and greed and fear take over, such as now.

Even at this late stage, the vast majority of investors still somehow believe that the economy drives the stock market, despite the fact that central banks have lethally inverted the relationship between global GDP and stocks. A critical fact that has escaped the attention of dopium stoned zombies. All a testament to the power of brainwashing. We have what I call the Suze Ormanization of markets. She comes on TV and makes everyone feel like an idiot for not plowing as much hard earned savings as possible into "stocks". Somehow conflating responsible investing with throwing away money at the record overvalued Trump Casino while insiders cash out in record size using debt-fueled stock buybacks. Orman merely being the ambassador for an entire financial services industry preoccupied with growing assets under management.

She has plenty of assistance in this regard. Warren Buffett is sitting on record cash and admits that valuations are astronomical, he can't find anything to buy, yet for everyone else he still recommends (indexed) stocks over bonds, much less cash. Basically telling people to buy a Tech bubble at peak valuation:

Buffett was born in 1930, at the onset of the Great Depression, which is apparently why he never learned the lessons from that era, having ridden the longest secular bull market in world history, from one end to the other. Those who bought stocks at the peak in 1929 took 25 years to breakeven. At the lows in 1932 they were down -90%, that's how much "return" was pulled forward into the Roaring '20s. Bubbles don't correct sideways. They first find true valuation, and then they dig out of the hole from there. Assuming the economy is still intact.

By distorting the term "responsible investing", these people such as Orman and Buffett have given their official stamp of approval to rampant criminality. The bilking of the old age home in the age of Trump. The wholesale abandonment of fiduciary duty. History will not be kind to the purveyors of this chicanery at peak Boomer retirement.

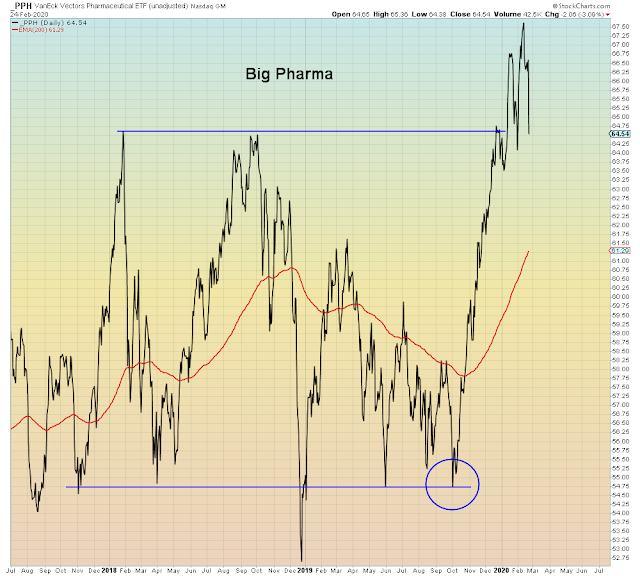

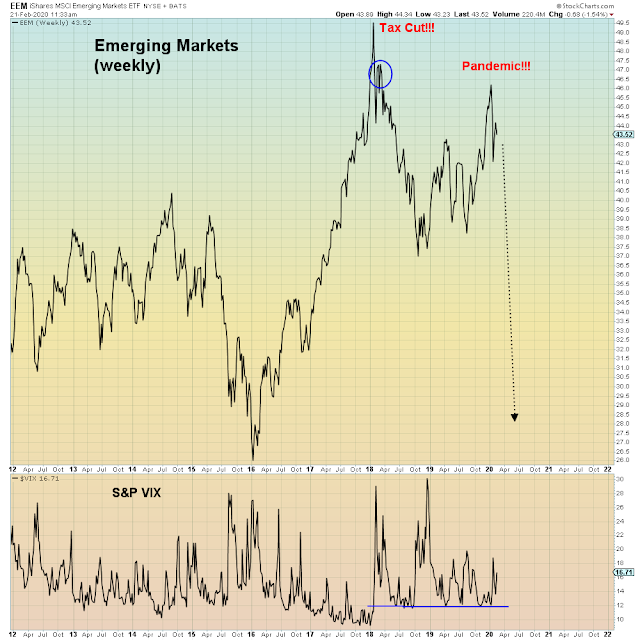

The reason why no one sees this coming is due to all of these various distortions. Elliott Wave patterns have been rendered obsolete, particularly on the major U.S. averages. For the true pattern of greed and fear we must look below the surface to the various sectors.

And what we find, portends unforeseen panic on a massive scale. A third wave down in a two year stealth bear market. The moment at which today's bulls come to realize that the bears were not wrong, we were merely ignored. Unable to compete with rampant bullshit.

Here we see Nasdaq relative strength (weekly, top pane). Overlaid with the world ex-U.S. Meaning that U.S. speculative appetite peaked in January two years ago and again in January this year.

Wave 'a' was May 2019:

Within U.S. markets, a three wave pattern is recognizable within Oil. Although it's a weak retracement in which wave "c" is lower than wave "a".

Wave 'a' peaked in May 2019, whereas wave 'c' peaked at the end of December 2019 ahead of global stocks.

Nasdaq breadth, same idea.

U.S. social mood is aligned with global implosion:

NextGen internet, peaked in May 2019, and is peaking again now. A three wave retracement in social mood but one that was turbo-charged to new highs:

Here we see U.S. deflation with the average U.S. stock. It doesn't matter where you look, you see the same bullshit market.

Bought and believed by RECORD fools.

Fittingly, social media stocks exhibit the clearest social mood wave pattern within U.S. Tech stocks: