Since Trump's own den of thieves won't remove him from office, it falls on his MMT Financial Weapon of Mass Destruction to do the heavy lifting. Detonation sequence has been initiated. There is now a ubiquitous belief within the Republican Party that non-stop lying has no cost associated with it. We are about to test that hypothesis:

The stakes have never been higher, as Trump has cleaved this country like never before. You either believe this guy is the saviour or the Anti-Christ, there is no middle ground. The fact that this Super Clown is a showcase for ALL that is wrong with America, shows how far down the Road to Perdition the GOP has sprinted behind their beloved pussy grabber.

"The fact that the 10 most polarized years have all occurred in the past 16 years -- affecting both Democratic and Republican presidents -- underscores how politically polarized the nation has become"

89% of Republicans approve of this criminal.

Who can they blame when this all explodes, but the dunce looking back at them in the mirror. What GW Bush couldn't Mission Accomplish, this known fraud will finish.

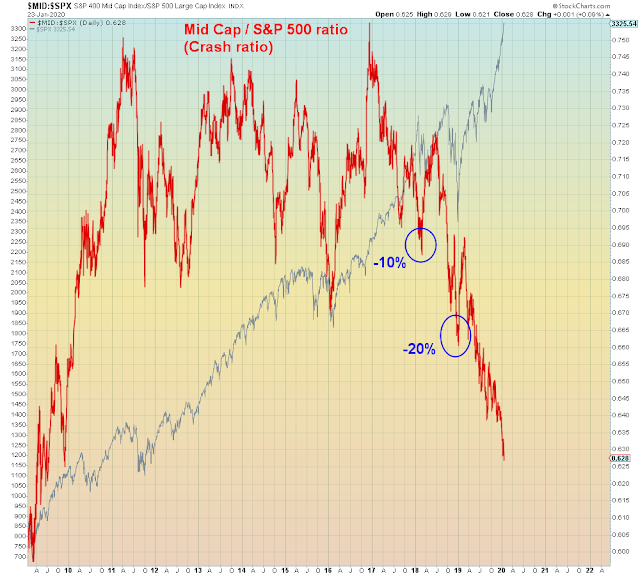

In other words, my prediction for 2020 is on track. Panic and rioting the next stop.

Trump's impeachment circus was only half the usual spectacle this week. Ponzified billionaires in Davos were tripping over themselves extolling the Trump super bubble and the last chance to get in before meltdown. Hedge fund titan Ray Dalio who famously derided cash two years ago at Davos right before VixPlosion 1.0, said the exact same thing all over again this week, "cash is trash".

Of course, the "Black swan" event of the week was the burgeoning Coronavirus in China. Now spreading worldwide. Emerging Markets and in particular Chinese stocks led the way down. All of which comes at a bad time for markets, as the Chinese Lunar New Year begins this week. The worst performing stocks cross-listed in U.S. markets, will now be bidless.

Over in the UK, Boris Johnson signed the articles of Brexit and declared a fantastic moment for disintegration. Judging by his dishevelment it couldn't have come a minute too soon.

Getting back to Trump Casino, gamblers were finally reminded this week that one-way markets go down sometimes. The headline on Friday morning indicated the longest overbought stretch in almost FIVE DECADES:

"FOREX.com looked at how many times the S&P 500 has closed below its 10-day moving average over the past 70 days, a time frame used because it entails the time since the Federal Reserve started expanding the bond holdings on its balance sheet.

The result is that the index has had just five such closings over the period, the lowest going back to 1972, or some 48 years"

Which is where this gets interesting, because the Fed balance sheet had a major drawdown this week. Picture record extreme positioning, 48-year overbought condition, Fed balance sheet withdrawal, and stock buyback blackout all at the same time. Because that's what we are seeing now. Speculators are piled into a casino with no exit:

All of which means that the level of risk right now is ludicrous, however because the party of fraud must propagate non-stop delusion, the masses remain wholly ignorant.

Banks got pounded this week, as the reflation trade rolled over hard.

Bond yields imploded...

Big Pharma rolling over

Global Dow has gone nowhere since the last VixPlosion:

A moonshot in Intel saved Tech from implosion, however semiconductors rolled over this week:

My supposition is that the epic short-covering that attends the end of the cycle, is now over. The great "value rotation" won't survive lower bond yields and recession.

The fact that Utilities led this week should not be taken as a positive sign. It's the final rotation.

The Fed sponsored two risk on rallies in the past year. First via their interest rate "pivot" in early 2019, which ran out of steam in the second quarter, and the second rally began with their Trump repo bailout. We can clearly see the two rallies via banks. The bond market never believed any of it.

Something about tax cuts for the rich is not reflationary, which we learned the hard way in late 2018. Something about monetized tax cuts for the rich that is also not reflationary.

A lesson that will be learned right now.

"Alarm bells are sounding in volatility markets amid a set-up that traders warn has some resemblance to the period preceding the February 2018 risk rout"

“This January VIX settlement is looking similar to January 2018 in that the new front month VIX spread between February and March is going to dramatically shrink the level of contango"

Bueller?