The Banana Republican playbook is a total disaster: geopolitical, economic, financial, environmental, healthcare - just greed all around. The lesson NOT learned from 2008. The party of greed, hate, war, and circus clowns has one more lesson to learn: GAME OVER, MAN...

I am 100% convinced Trump is the Anti-Christ. Although aside from his sordid personal life, ongoing tax evasion, serial bankruptcy, hate mongering, incessant lying, and abuse of power, I have no actual proof. Nevertheless, every time the casino hits a new all time high he comes out with some Black Swan announcement that tanks the market. This time it was war with Iran. The one country in the Middle East the U.S. hasn't tried invading. It would be highly ironic and yet fitting if this is the event that begins meltdown. After all, most of the Faux News audience couldn't find Iran on a map if their life depended on it. They just know that we are the good guys and they are the bad guys...

Prepare for Keynesian bombing of foreigners

aka. Republican Second Term Election Strategy 101:

This is the end of the oil rally

As of mid-day Friday WWIII is getting bought with both hands in the U.S., but the overnight is where the damage will be done...

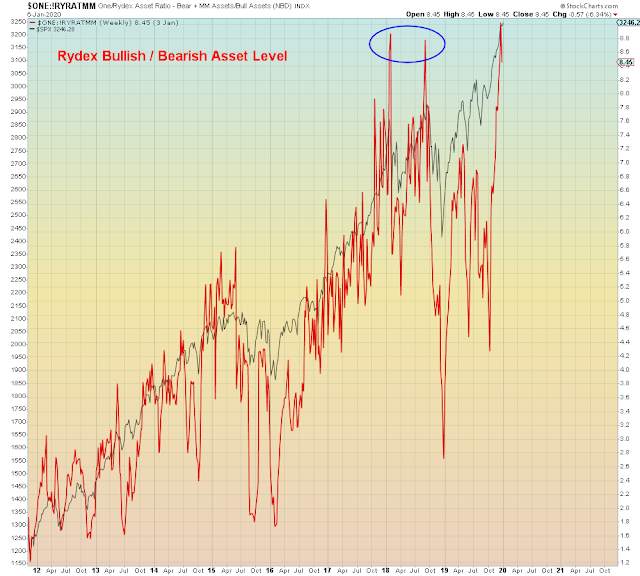

It took several months but Zerohedge finally admitted that the Fed is monetizing Trump's deficit. This has been obvious from the first day's of the repo crisis, and something the Fed themselves have admitted. There is something about being a Trump supporter, a gold hoarder, and an ad-sponsored conspiracy propagator that prevents the truth from seeing the light of day. I can't put my finger on it.

Nevertheless, contrary to Zerohedge assertion, this is not true "helicopter money", since none of it has been made available to the masses. This same type of monetization of the deficit took place back in 2009 during the darkest days of the recession, however, it has never been attempted at record over-valuations and in a Tech mega bubble.

A fool's errand of the highest order.

We are still very much in a deflationary environment, which is about to be made 10x worse when the mega bubble explodes. At that point, I expect it will take some time before the Republicans decide to bail out the middle class, if ever.

Time, and rioting.

In the meantime, the death of the Treasury bull market has been greatly exaggerated. I expect a new plunge in long-term bond yields to all time lows approaching the zero bound.

Full disclosure, I am not long Treasuries at this juncture. And as we see from 2009, I would consider such a position a rental.

This is my opinion, not advice.

I also expect the very crowded gold trade to get duly monkey hammered. These speculators have been front running central banks all year, under the premise of imminent "reflation".

We've seen this movie before and it doesn't end well for gold.

More importantly from an economic standpoint, after the crash and the rioting, I expect a sea change in political mindset. Eventually.

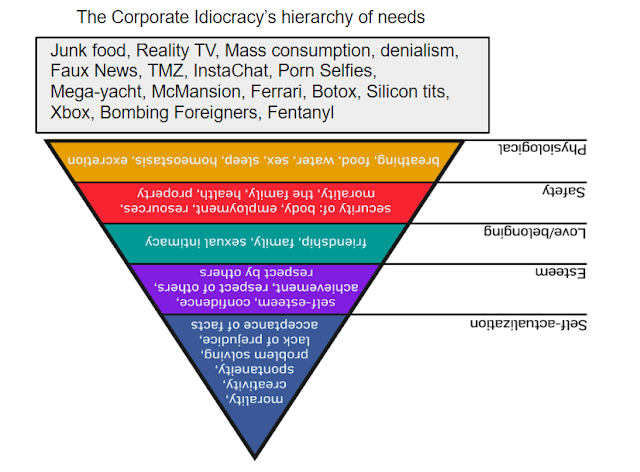

When today's mega bubble in arrogance explodes, today's exceptional Idiocracy will realize they are not too good for "socialism" after all. Quite the other way around. How could they know anything about "socialism", when they think that capitalism is a decade of monetary bailouts for the rich. What I mean in any case is merely a rebalancing of the economy back to where it was in the two hundred years before Supply Side criminality became the order of the day.

When they finally admit that they don't know anything about anything, that is when I expect real helicopter money to arrive. Around the same time that Sean Hannity is no longer the most popular vacuous blowhard on television, and Big Donny is wearing an orange jumpsuit. Handed to him by his own party of delinquents.

In the meantime, one of these bailouts is not like the others: