Thursday, November 10, 2022

DOUBLED DOWN ON COLLAPSE

Monday, November 7, 2022

THE END OF THE INFLATION TRADE

Friday, November 4, 2022

THE EFFICIENT MELTDOWN HYPOTHESIS

It's bulls versus the Fed. Get some popcorn and stand back...

On first glance this past week's FOMC statement appeared dovish, leading to a manic melt-up algo rally. However, at the press conference Powell threw cold water on the rally when he said there is more work to be done on rate hikes. That's all it took to implode the most recent "Pivot" rally. The remainder of the week was highly volatile due to options unwind and the jobs report which was hotter than expected but not as bad as feared.

It's clear these pivot rallies have been making the Fed's job of bringing down inflation, that much harder. As a result, these rallies keep pushing out rate hikes, so it's Powell's job to come in every FOMC meeting and pound markets back down. The Fed has finally realized that inflated asset prices are driving economic inflation. While it's true that options algos have been pounding volatility down, at the same time the Fed keeps pounding stocks down. Which means they are on a collision course, and I suggest the Fed will win.

The Fed is not going to stop raising rates when they can see that their Financial stress index keeps going down with every pivot rally:

In addition, we learned this quarter that Tech earnings are imploding. Which means that the entire growth/deflation trade is now going bidless, which happens to also be the pivot trade. Therefore if/when the Fed does pivot, there will be no leadership in the market. Putting it all together and the Fed will tighten until they break markets, and then everyone will be shocked at how quickly this house of cards explodes.

We are seeing very unusual action in the Nasdaq VIX market lately. There have been seven flash crashes in the Nasdaq VIX in the past twenty days. And only 18 total flash crashes in the past 27 years.

In summary, the Fed is going to break some shit, and bulls have conflated that meltdown moment with their long awaited bailout.

The inevitable consequence of being told for 14 years straight that bad news is good news.

Tuesday, November 1, 2022

MELT-UP TO MELTDOWN

Global central banks will tighten more in this fourth quarter than they've tightened in any fourth quarter in the past forty years. Nevertheless, gamblers see a headlight at the end of the tunnel...

At some point, we all know that an oversold bounce will morph into a long-term rally. That's how it happens at every important low. It begins with short-covering and then transitions to REAL buying. The only thing bulls and bears now disagree upon is when that will happen. Bulls are very eager to pull forward that event as soon as possible. In the process they are happily ignoring the various risks that have been growing steadily throughout 2022. Therefore it's now obligatory to believe that the Fed is the ONLY risk to markets. Once they're done tightening, everything will be tea and crumpets for "stocks". I assert that the Fed has already over-tightened but the "front-loading" of Volcker magnitude rate hikes has yet to make themselves known.

First off, the inflation trade is STILL on in full force. This means that late cycle Energy stocks are leading, growth stocks are imploding, and Treasury bonds are getting hammered. The stock/bond ratio has never been more overbought than it is now. One can make the case that stocks are MORE overvalued now than they were at the top a year ago. Why? Because of the dual effect of reduced earnings and higher interest rates. Wall Street has been very slow to bring down earnings forecasts, and companies have been even slower to guide down for 2023. So now next year sits there like a big black hole of earnings visibility.

Perfect for those who don't want to believe that recession is inevitable.

The rate of tightening combined with the rate of home price increase has left the housing market effectively bidless:

"Homebuilders say 2023 is going to bring an even sharper downturn in the market, as high interest rates scare away buyers"

“There’s this cliff that’s happening in January...”

Single-family housing starts fell a stunning 80% from January 2006 to March 2009, but Myers notes that it was a slower turn compared with what is happening now"

The bull case is that the Fed will soon stop rate hikes and hold them at this level until inflation comes down. Unfortunately only recession and asset crash will bring down inflation. And it will bring down record corporate profit at the same time.

Investors are no way positioned for recession even though they need one in order to effect their next bailout. The moronic irony can't be overlooked. A consequence of the Fed balance sheet-induced wealth effect being in lockstep with the CPI. So in the meantime - while inflation is NOT coming down - the real economy implodes.

But what does this have to do with end of year melt-up?

First off, this latest oversold bounce began two weeks ago, so it is nearing the point where it must transition to the next phase of real buying. Or else it will suffer the same fate as the last three failed "pivot" rallies. The Dow is record overbought and just had its best month since 1976. The S&P is the most overbought since the Fed's actual pivot in late 2018.

The critical difference vis-a-vis 2018, is that the Fed/ECB/BOE et al. STILL have many more rate hikes in store for these next two months. Whereas back in 2018 when the oscillator reached this level, the Fed had already pivoted and no other central bank was raising rates.

I don't know what Powell will do tomorrow. As we see above he's been hawkish for two months straight - each time pounding markets lower.

What we need to understand is that bulls have now decided that even a .75% rate hike this week followed by a .5% rate hike in December would be BULLISH. What would have been considered unthinkably bearish a year ago, is now the bull case for the end of the year. Fed futures have a 95% probability of AT LEAST 4.25% Fed rate by the end of the year:

So why bother being bearish when the bulls are just going to co-opt all of our concerns and conflate them as being bailout friendly?

Let's say Powell hints at a "step down" in rate hikes tomorrow. Sure markets could explode higher for a few hours or days. But ultimately this is still only a technical rally. So everyone must decide for themselves if they are a short-term trader or a long-term investor.

Because now the bull case and the bear case are essentially the same, the only difference is what happens AFTER the glue fumes wear off.

Position accordingly.

Wednesday, October 26, 2022

FOMC: FEAR OF MISSING CRASH

It's that time again when bulls play Russian Roulette with their life savings. What could go wrong?

First off, the Fed is now hiking at TWICE the pace as in 2003-2006. The Fed rate is currently at 3%. If the Fed hikes two more times this year as markets expect, the number of 1/4 pt rate hikes will equal 17, the same as between 2003-2006.

In 9 months vs. 18 months.

Two massive policy errors, two years in a row.

Hedge funds have a severe case of end of year bonus FOMO, so they are continually front-running the pivot. On Tuesday, the S&P became as overbought as in January 2019 which was AFTER the Fed pivot. This time they are front-running an event that is at least two months into the future.

This is the third oversold pivot rally in 2022 and any blind man can see it's the weakest. It's clearly three wave corrective, which I will discuss further below.

On Thursday this week, the ECB is widely expected to raise rates by .75% for the second meeting in a row, to quell inflation. Even though the economy is entering recession. Then next week, the Fed is expected to also raise rates by .75%.

World markets are at the precipice.

China has been in meltdown mode ever since the Chinese Congress meeting wrapped up last week. The general message from the Chinese government to investors is don't expect any more bailouts.

Ironically, for the first time in 2022 bulls and bears agree that the Fed will soon be forced to pivot. The only thing they disagree upon is at WHAT LEVEL the Fed will pivot AND what happens after that. Bulls are of the belief that this will be another 2018 type of pivot soft landing.

Unfortunately, they have zero margin of error because the 200 week moving avg. was just tested two weeks ago. Which was where the Fed pivoted in 2018.

Doh!

Monday, October 24, 2022

THE HANGOVER

For those who were not around during Y2K, I will now explain what happened during that era and how this current fiasco is very similar...

I have several relatives in-law who are former hedge fund managers, which is how I know a few inside secrets of Wall Street. For example that hedge funds - aided and abetted by prime brokers - made a lot of money crushing the Gamestop bubble on the short side when it hit $400+. However, the most recent crop of Wall Street analysts were all in preschool during the Dotcom bubble so it's not hard to understand why they have not even the slightest clue what's going on. As far as anyone over the age of 40 who are now claiming "No one knows what's going to happen", their only "good" excuse is dementia. This is all deja vu.

The 1990s stock rally at the time was the longest rally in U.S. history. Born out of the 1990 recession, it began to accelerate in 1995 with the nascent Dotcom boom. Fed Chief Alan Greenspan famously declared that stocks were caught up in "irrational exuberance". He had no idea that was nothing compared to what was coming. The bubble accelerated from that point forward, but hit a hiccup in 1997/1998 with the Asian financial crisis which was a currency crisis caused by the strong dollar. Sound familiar? The contagion spread worldwide, leading to Russian debt default and the LTCM hedge fund collapse in October 1998. The Fed which had been on a tightening path, then eased to assuage markets. That easing set off the Dotcom blow off top. The Fed stayed too loose for too long because they were concerned about the Y2K millennial date change event.

The Y2K date change event forced companies to invest large amounts of money on Technology equipment in order to replace older software and hardware with newer systems. This set-off an IPO "Dotcom" bubble of companies seeking to cash in on the bonanza. The surfeit of new startups further fueled demand for new Tech equipment. It all frothed higher until early 2000 when the Fed slammed on the brakes post Y2K date change. We knew early on New Year's Day that planes were not falling out of the sky in Australia.

After New Year's 2000 the Fed did an abrupt u-turn on monetary policy and the Nasdaq collapsed by March 2000. Still, most of Wall Street predicted the Tech boom was NOT over. It was John Chambers of Cisco in December 2000 who officially said that demand had fallen off a cliff, something the stock market had already figured out. The Nasdaq bear market lasted two years longer. Down -80%.

Good times.

Fast forward two decades. Pre-pandemic, this was already the new longest stock market rally in U.S. history: Lasting from March 2009 to February 2020. Aided and abetted by continuous monetary bailout at the zero bound. When the pandemic struck, global central banks eased on a level never before seen in human history. The pandemic lockdown forced companies to invest large amounts of money in Technology equipment in order to create the "Virtual Economy" for their work from home workforce. This setoff an IPO bubble of companies seeking to cash in on the bonanza. Over 1,000 new IPOs debuted in 2021, the most by far for any year in history. The surfeit of new startups further fueled demand for Tech equipment. Sounds familiar.

The wheels started coming off the bus in early 2021 when the meme stock pump and dump frenzy came to a head with Gamestop. Record newbies flooded into markets where they were quickly bilked of all their capital in meme stocks and crypto Ponzi schemes. The majority of Tech stocks peaked and collapsed. However, mega cap Tech remained bid due to the passive indexing super bubble. All the way up until a year ago, October 2021, when the Fed slammed on the brakes on "lower for longer" and abruptly U-turned to a policy of "higher for longer" going into 2022. Still, most of Wall Street has yet to acknowledge that Tech demand is now falling off a cliff.

Good times.

Big Cap Tech is now trading like a brick. For Amazon, Facebook, and Google, they face an outright decline in earnings. In the case of Microsoft and Apple, those companies are seeing an abrupt down shift in growth. They are ALL massively overvalued relative to the rest of the market.

In summary, we don't know what is going to happen, we only know what is happening all over again.

Which is only something "different" in an Idiocracy.

Friday, October 21, 2022

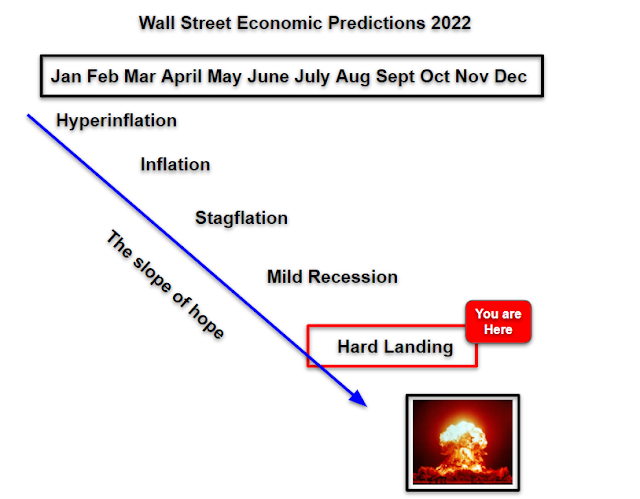

Bounding Down The Slope of Hope

The story of 2022 is that the news flow keeps getting worse, hence Wall Street predictions keep becoming more ludicrous. This week, Bloomberg Economics posited a 100% probability of official recession. Meanwhile, terminal Fed rate hike expectations continue to ratchet higher which is pushing long-term bond yields higher in lockstep. The Fed's mantra last year was "lower for longer". This year their mantra is "higher for longer". Because what could go wrong.

When the year started, there were 0% odds of recession and four rate hikes projected for ALL of 2022. Now, the odds of recession are 100% and the Fed's terminal rate is projected to be 5% by early 2023.

October 20th, 2022:

Anecdotally, I would say that half of today's pundits believe the Fed should keep tightening and the other half say the Fed is making a colossal error by over-tightening. So it can come as no surprise that mass confusion reigns supreme.

For it's part, the bond market is agreeing the Fed is making a historically massive error. Inflation expectations as imputed from Treasury Inflation Protected (TIP) bonds are LOWER than they were in 2007 and 2000. Which you see in the top pane of the chart below.

There has never been this much divergence between the CPI and TIP expectations (not shown). All compliments of the fact that the Fed itself is the major source of inflation due to its elevated balance sheet and now elevated interest rates. The cost of carry for a newly purchased average home has risen 150% year over year (lower pane).

This is DOUBLE policy error.

What's even more bizarre is that the set-up is very similar to 2008 when commodity prices were keeping the CPI artificially elevated at the end of the cycle.

The Treasury MOVE index which measures T-bond volatility is the highest since 2008 as indicated in the lower pane of the chart below. Clearly there is now a massive divergence between the MOVE and the stock market VIX.

Basically, the bond market has priced in the end of the cycle whereas stocks remain in La La Land. There is a prevailing belief among stock market investors that inflation will remain elevated indefinitely.

The Equity Risk Premium (not shown) is the lowest since the 2007 market top.

What it all points to is that the Fed is essentially blowing up the global housing market.

Global currency collapse is forcing other central banks to tighten in lockstep with the Fed. The notable outlier of course is Japan where the $USDJPY just broke the 150 level overnight.

The Yen carry trade has turned into a one way freight train.

However, what is NOT priced in is a BOJ policy change and/or global RISK OFF.

When a butterfly flaps its wings in Thailand this house of cards will explode.

Any questions?

Back in the casino, several Wall Street analysts are calling for an end of year melt-up. Which is convenient now that there is just over two months left until bonus season. A rally now is the only hope for Wall Street to get a decent payday this year.

From a technical standpoint, the market was oversold at the recent lows, however since that time it has been going nowhere. As I showed on Twitter, relative to the breadth oscillator this has been the weakest rally of 2022.

What happens when a market should rally and doesn't?

It crashes with extreme dislocation. And no one sees it coming.

What happens when we get down there? All of Wall Street's forward earnings projections will FINALLY be updated. To include a minus sign.

What will they say then? We were wrong.

Heads we win, tails you lose.