It's that time again when bulls play Russian Roulette with their life savings. What could go wrong?

First off, the Fed is now hiking at TWICE the pace as in 2003-2006. The Fed rate is currently at 3%. If the Fed hikes two more times this year as markets expect, the number of 1/4 pt rate hikes will equal 17, the same as between 2003-2006.

In 9 months vs. 18 months.

Two massive policy errors, two years in a row.

Hedge funds have a severe case of end of year bonus FOMO, so they are continually front-running the pivot. On Tuesday, the S&P became as overbought as in January 2019 which was AFTER the Fed pivot. This time they are front-running an event that is at least two months into the future.

This is the third oversold pivot rally in 2022 and any blind man can see it's the weakest. It's clearly three wave corrective, which I will discuss further below.

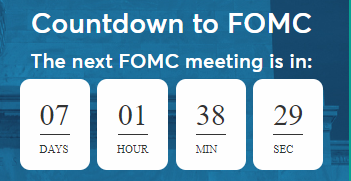

On Thursday this week, the ECB is widely expected to raise rates by .75% for the second meeting in a row, to quell inflation. Even though the economy is entering recession. Then next week, the Fed is expected to also raise rates by .75%.

World markets are at the precipice.

China has been in meltdown mode ever since the Chinese Congress meeting wrapped up last week. The general message from the Chinese government to investors is don't expect any more bailouts.

Ironically, for the first time in 2022 bulls and bears agree that the Fed will soon be forced to pivot. The only thing they disagree upon is at WHAT LEVEL the Fed will pivot AND what happens after that. Bulls are of the belief that this will be another 2018 type of pivot soft landing.

Unfortunately, they have zero margin of error because the 200 week moving avg. was just tested two weeks ago. Which was where the Fed pivoted in 2018.

Doh!