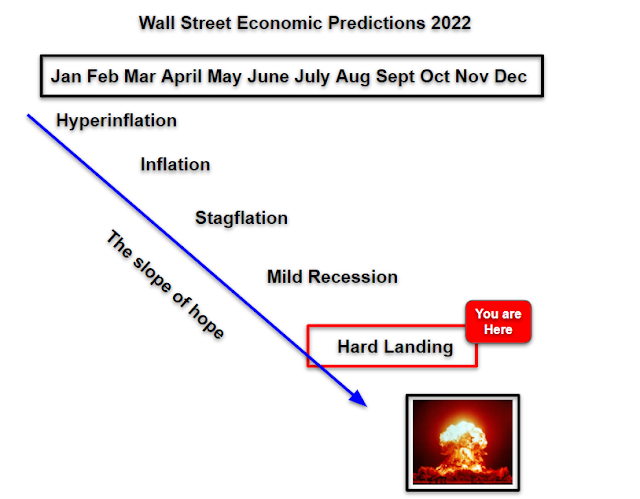

The story of 2022 is that the news flow keeps getting worse, hence Wall Street predictions keep becoming more ludicrous. This week, Bloomberg Economics posited a 100% probability of official recession. Meanwhile, terminal Fed rate hike expectations continue to ratchet higher which is pushing long-term bond yields higher in lockstep. The Fed's mantra last year was "lower for longer". This year their mantra is "higher for longer". Because what could go wrong.

When the year started, there were 0% odds of recession and four rate hikes projected for ALL of 2022. Now, the odds of recession are 100% and the Fed's terminal rate is projected to be 5% by early 2023.

October 20th, 2022:

Anecdotally, I would say that half of today's pundits believe the Fed should keep tightening and the other half say the Fed is making a colossal error by over-tightening. So it can come as no surprise that mass confusion reigns supreme.

For it's part, the bond market is agreeing the Fed is making a historically massive error. Inflation expectations as imputed from Treasury Inflation Protected (TIP) bonds are LOWER than they were in 2007 and 2000. Which you see in the top pane of the chart below.

There has never been this much divergence between the CPI and TIP expectations (not shown). All compliments of the fact that the Fed itself is the major source of inflation due to its elevated balance sheet and now elevated interest rates. The cost of carry for a newly purchased average home has risen 150% year over year (lower pane).

This is DOUBLE policy error.

What's even more bizarre is that the set-up is very similar to 2008 when commodity prices were keeping the CPI artificially elevated at the end of the cycle.

The Treasury MOVE index which measures T-bond volatility is the highest since 2008 as indicated in the lower pane of the chart below. Clearly there is now a massive divergence between the MOVE and the stock market VIX.

Basically, the bond market has priced in the end of the cycle whereas stocks remain in La La Land. There is a prevailing belief among stock market investors that inflation will remain elevated indefinitely.

The Equity Risk Premium (not shown) is the lowest since the 2007 market top.

What it all points to is that the Fed is essentially blowing up the global housing market.

Global currency collapse is forcing other central banks to tighten in lockstep with the Fed. The notable outlier of course is Japan where the $USDJPY just broke the 150 level overnight.

The Yen carry trade has turned into a one way freight train.

However, what is NOT priced in is a BOJ policy change and/or global RISK OFF.

When a butterfly flaps its wings in Thailand this house of cards will explode.

Any questions?

Back in the casino, several Wall Street analysts are calling for an end of year melt-up. Which is convenient now that there is just over two months left until bonus season. A rally now is the only hope for Wall Street to get a decent payday this year.

From a technical standpoint, the market was oversold at the recent lows, however since that time it has been going nowhere. As I showed on Twitter, relative to the breadth oscillator this has been the weakest rally of 2022.

What happens when a market should rally and doesn't?

It crashes with extreme dislocation. And no one sees it coming.

What happens when we get down there? All of Wall Street's forward earnings projections will FINALLY be updated. To include a minus sign.

What will they say then? We were wrong.

Heads we win, tails you lose.