Everything is playing out just as it did in 2011, except far worse. Market mass complacency has now backed up into the U.S. Congress where used car salesmen are now going on holiday believing that they can implode this house of cards economy with impunity.

Thursday, May 25, 2023

FLIRTING WITH DISASTER

Everything is playing out just as it did in 2011, except far worse. Market mass complacency has now backed up into the U.S. Congress where used car salesmen are now going on holiday believing that they can implode this house of cards economy with impunity.

Monday, May 22, 2023

NEVER GO FULL CIRCLE JERK

Thursday, May 18, 2023

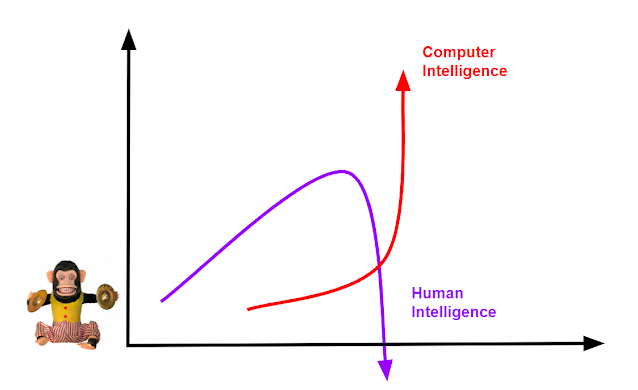

ARTIFICIAL INTELLIGENCE IS A CROWDED TRADE

Monday, May 15, 2023

NO WAY OUT

The longer this market denial persists, the worse will be the final outcome...

I posted this chart of the 1930 Dow v.s. the S&P 500 today on my Twitter feed about a week ago. The duration of the initial decline is different, but the rebound rally and bank run is eerily similar, as is the mass complacency taking place right now. Back in 1930, pundits generally believed that the worst was over even though under the surface the economy was imploding. The Dow decline in 1930 was not as steep as the 1929 crash however it ultimately took the Dow down -90% by 1933.

I predict this impending decline will be much steeper than the one in 1930, but the total downside will likely be less once the Fed finally panics. After all, they didn't have QE back in those days. Nevertheless, downside in the range of -60% to -70% in a short period of time will evoke massive turmoil. And shatter confidence in "markets".

The key bull argument for the past six months is that the Fed will pause and then a new bull market will begin. Many believe a new bull market already began at the October lows. However, this entire pause rally assumes the Fed is done raising rates. Which is far from certain. In other words, bulls are hoping for a recession so the Fed can be done raising rates.

The problem with the pause theory - aside from all of the black swan events that are taking place - is the fact that the Fed is still tightening their balance sheet at TWICE the pace they tightened in 2018. Back then, the pause rally was stalling by mid-year so the Fed cut rates three times (1/4 pt) and ended QT. That kept the market bid until the end of the year.

This time, the stimulus crash is taking place without Fed bailout.

The other problem with hoping for a recession as part of the bull market case is that it will very likely lead to deleveraging:

"It has been a long time since we had a proper credit cycle," Oleg Melentyev wrote to clients on Friday, pointing to the credit cycles beginning in 1981, 2000, and 2007. Those cycles were upended by a dramatic tightening of credit conditions, leading the three-year default rate on US corporate default debt to soar to around 15%"

"We think it is reasonable to argue that that the default cycle, whenever it starts, should add up to a lower peak around 8%"

Sadly, that is wishful thinking.

What the Fed is doing now is tightening credit conditions by imploding banks, which I regard to be questionable policy.

First off, they are raising money market rates which is incentivizing deposit outflow. Secondly they are flattening the yield curve which makes banks less profitable. As we see below, in 2008 the Fed steepened the yield curve so that banks could "run off" their bad assets. Using their quarterly profits to cover up their balance sheet losses. This time around, the Fed is doing the opposite, making it impossible for banks to make money. That in turn leaves banks with less money to lend to insolvent companies and consumers. Thereby tightening credit conditions into a recession.

What we are witnessing is the end of an almost fifteen year debt binge at 0% interest rates, which was capped off by the pandemic stimulus consumption orgy. Attended by the belief that we successfully borrowed our way out of the 2008 debt crisis.

Now, banks are very quickly returning to the 2009 origin amid the widespread belief THIS will be the easy way out.

Thursday, May 11, 2023

THE SUPER CLUSTERFUCK

You knew this was coming...

I am officially calling this event "The Super Clusterfuck". It consists of unprecedented fiscal and monetary tightening and massive misallocation of capital to a Tech bubble into a financial meltdown that is obviously well underway...

On Tuesday, Biden met with Congressional leaders to discuss the debt ceiling. They met for one hour. In the first ten minutes they laid out their polar opposite positions and during the last :50 minutes they waited for the hour to end. It was pure charade. Both sides are hardening their position ahead of the impending "x" date.

On Wednesday Trump said that the GOP should force a U.S. default if Biden doesn't accept major spending cuts:

“I say to the Republicans out there — congressmen, senators — if they don’t give you massive cuts, you’re going to have to do a default”

The fact that Trump - who has been wiped out financially several times - is giving debt advice is merely a sign of the times. We've reached level '11' idiocy and we're now in sudden death overtime.

Sadly, for markets there is no sign that Biden & Co. are going to cave on spending cuts, certainly not of the scale envisioned by the Freedom Caucus. Which means that markets will now decide the fate of the debt ceiling.

Which gets us to monetary policy because the CPI came down a mere .1% annualized (4.9% v.s. 5%) from March to April. However, markets were bid on the belief that this CPI print will ensure the Fed pause. If the Fed pauses here then it's very likely that inflation will re-accelerate because that's what happened in 2008. However markets went into meltdown mode which caused inflation to collapse. It's also what happened to Volcker in 1980 and he was forced to raise rates even faster later in the year.

In either scenario markets will implode. Sooner or later.

However, what is never discussed in the lamestream media is that rate hikes of 5% STILL have not brought inflation under control. Why? Because the Fed balance sheet is 95% correlated to the CPI and lately it's been rising again to counter the incipient banking meltdown.

THIS balance sheet is the epicenter of the Fed's policy error dating from 2020 to now. It increased 100% during the pandemic and it has only come down 5% since the Fed started tightening. It is the SOLE source of monetary inflation. Only a dunce assumes that a 1.5% reduction in interest rates in March 2020 caused 40 year high inflation. Especially now that rates are 3x higher than they were pre-pandemic.

Hence, that is the fatal consensus and it's totally unquestioned.

Which gets us to Tech domination in stock markets. Bulls have already forgotten that Tech stocks were at the epicenter of the pandemic bubble. They've forgotten about the record 1,000 IPOs/SPACs of mostly junk Tech stocks in 2021. They've forgotten about the pull forward of investment in Cloud technology so everyone could work from home. Therefore they're seeking shelter in a sector that has an earnings decline of -10% year over year. Yes you read that right.

Tech domination was inevitable at this stage of the cycle, due to the imploding economy and the attendant end of rate hikes. However, Tech is only a good bet in a recession IF it's not the last and largest market bubble.

Tuesday, May 9, 2023

BULL TRAP

"There is no political solution to our troubled evolution"

Bulls are trapped in a latent Idiocracy with no way out and no way of knowing the risk they are taking. Each side of the political aisle is cheering on their own stooge leaders. Waiting for the big political "win" when they push the economy off the fiscal cliff.

The pandemic was the largest combined fiscal and monetary stimulus in world history. Followed by the largest fiscal and monetary reduction in history.

Meaning, we are right now enduring the largest boom and bust in history.

The largest asset bubbles in the past 100 years were 1929, 2000, 2008 and 2020 when measured statistically relative to historical baseline.

"All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.Today in the U.S. we are in the fourth superbubble of the last hundred years"

Does anything strike you as odd about these years: 1929, 2000, 2008, and 2020? It should.

Fully 70 years lapsed between the Great Depression and Y2K, then in a span of 20 years there were THREE 3-sigma superbubbles in the U.S. That is statistically impossible assuming a normal distribution. Therefore we live in an era of unprecedented Black Swan tail risk. Meaning this is the riskiest market period in world history without comparison.

This is why I had to start writing my own blog. Because we live in an era of statistically impossible boom and bust, and yet today's bullish pundits all assume that the next 100 years will be just like the last. They ignore the fact that in this era it is totally impossible to extrapolate a bullish market future from the recent past.

Take a look at the chart above and in particular 1980 aka. "Morning in America". That was the Reagan revolution and it was kicked off by the Volcker gambit. Meaning Fed chairman Paul Volcker used high interest rates to kill the 1970s inflation and then markets took off, unleashing a two decade stock rally that culminated with the Y2K superbubble. Volcker's gambit worked, because that was demand side inflation driven by the strongest middle class in U.S. history. Today's inflation is driven by rampant corporate profiteering which is relentlessly imploding the weakest middle class in history when measured by labor share of GDP, benefits, job security etc. Meanwhile, Volcker had an 19% Fed rate to cushion the inevitable massive recession. He used 10% of that on the way down. This Fed has a 5% Fed rate to cushion the downside of this impending recession that is imploding what is left of the middle class after three successive boom and busts in two decades.

What we are witnessing in real-time is the END of Globalization which has been the dominant economic force for the past 100 years. Which is what makes Warren Buffett so ridiculously out of touch with reality. He is extrapolating his own 93 years since 1930 into the indefinite future.

As if there will be ANOTHER middle class to implode.

Therefore it's fitting to watch our political leaders push this Titanic off the cliff with their fiscal gong show. As we see below, the debt always rises in recession. It exploded after 2008 and again during the pandemic. And yet here they are actively pushing the U.S. into recession out of their fake concern for the national debt.

In summary:

"What the wise man does at the beginning, the fool does at the end" - Warren Buffett

Saturday, May 6, 2023

1930 DEJA VU

"When the tide goes out we find out who's been swimming naked"

- Warren Buffett

This weekend Warren Buffett is holding court in Omaha Nebraska at the Berkshire Hathaway annual meeting. With respect to the banking crisis he is telling his disciples don't worry, be fat dumb and happy:

"The core problem, as Buffett sees it, is that the public doesn’t understand that their bank deposits are safe, even those that are uninsured. The Berkshire CEO has said regulators and Congress would never allow depositors to lose a single dollar in a U.S. bank, even if they haven’t made that guarantee explicit"

That is what's called tempting biblical fate.

Let's begin with the fact that Warren Buffett was born in August 1930. Which means he was born at the nadir of the worst financial crisis in history and his entire life has BEEN the largest bull market in human history.

Buffett's assertion that ALL deposits are safe is 100% delusional and below I will go into the latest specifics we have on this matter. Suffice to say that this geezer has lost his grip on reality. By that I mean of course political reality. He's ignored everything that has transpired politically since 2008, which will render his theory of unlimited bailout, history's most expensive dumbass assumption.

"What gives you opportunities is other people doing dumb things. During the 58 years we've been running Berkshire, I would say there's been a great increase in the number of people doing dumb things"

Got that? His entire strategy is predicated upon exploiting sheeple for maximum profit. So much for the "win win" economy.

Be that as it may, bailing out rich assholes is by far the dumbest thing that dumb people have been doing. But, only the greatest fool assumes that will continue. Because those who know their history know that the 1930s saw extreme ideological warfare between capitalism and communism. The crash of 1929 and subsequent depression was fertile ground for sowing societal animosity towards capitalism. As is this era we are going through right now. Our CEOs of the financial Titanic have done everything possible to ensure this has the worst possible outcome. The pandemic and central bank response massively increased the chasmic gap between rich and everyone else. Now we are enduring rampant profiteering which today's useful idiots conflate as "inflation".

However, where Buffett really gets it wrong is in NOT realizing that the policy response to date has been a direct replica of the mistakes made in 1930. Don't take my word for it, this is straight from the Federal Reserve:

“Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again.” -Ben Bernanke

"The Great Depression began in August 1929, when the economic expansion of the Roaring Twenties came to an end. A series of financial crises punctuated the contraction. These crises included a stock market crash in 1929 and a series of regional banking panics in 1930 and 1931"

"The Federal Reserve implemented policies that they thought were in the public interest...an example is the Fed’s decision to raise interest rates in 1929...another example is failure to act as a lender of last resort during the banking panics that began in the fall of 1930"

This chart shows Global Financials today. The Fed is raising rates while watching regional banks implode left and right.

This era has already seen three of the four largest bank failures in U.S. history.

In the chart below we see the Fed's own Financial Stress Index. The peak in this index came back in September 25th, 2008 10 days after Lehman failed and at the same time Washington Mutual failed, September 25th 2008.

In 2023 we've already seen three of the four largest bank failures in U.S. history and yet the Fed stress index is still NEGATIVE?

The chart of financials above clearly shows that the third wave meltdown has already begun. Which means we are about to see mass bank failure and the inevitable failure of the FDIC aka. the Fictional Deposit Insurance Corporation. Which now has less than 1% of bailout capital relative to total deposits. Yes, you read that right. As Buffett explains above, the fund is implicitly backstopped by taxpayers, whom he assumes will always come to HIS rescue. Because he is not a student of history.

99% of all deposit accounts are LESS than $250k. Remember that percentage because it was on protest signs in 2010 and it will be on protest signs again very soon.

This past week, the FDIC was trolling Congress for a bailout the size of which is TBD, but could be in the trillions. They don't have have enough money to backstop $10 trillion of INSURED deposits much less $7 trillion of uninsured deposits. Meanwhile, the Freedom Caucus has already stated they are AGAINST universal deposit insurance.

So what's going to happen next is this:

1) Many more banks will fail

2) The FDIC will fail and then ask Congress for a bailout

3) Congress will backstop the FDIC to $250k per account

4) $7 trillion of uninsured deposits will be vapourized aka. 5x subprime

5) The Fed will cut rates and financials will be bidless

6) Global markets will explode

7) The T-bond yield will be 0% by the end of 2023