"When the tide goes out we find out who's been swimming naked"

- Warren Buffett

This weekend Warren Buffett is holding court in Omaha Nebraska at the Berkshire Hathaway annual meeting. With respect to the banking crisis he is telling his disciples don't worry, be fat dumb and happy:

"The core problem, as Buffett sees it, is that the public doesn’t understand that their bank deposits are safe, even those that are uninsured. The Berkshire CEO has said regulators and Congress would never allow depositors to lose a single dollar in a U.S. bank, even if they haven’t made that guarantee explicit"

That is what's called tempting biblical fate.

Let's begin with the fact that Warren Buffett was born in August 1930. Which means he was born at the nadir of the worst financial crisis in history and his entire life has BEEN the largest bull market in human history.

Buffett's assertion that ALL deposits are safe is 100% delusional and below I will go into the latest specifics we have on this matter. Suffice to say that this geezer has lost his grip on reality. By that I mean of course political reality. He's ignored everything that has transpired politically since 2008, which will render his theory of unlimited bailout, history's most expensive dumbass assumption.

"What gives you opportunities is other people doing dumb things. During the 58 years we've been running Berkshire, I would say there's been a great increase in the number of people doing dumb things"

Got that? His entire strategy is predicated upon exploiting sheeple for maximum profit. So much for the "win win" economy.

Be that as it may, bailing out rich assholes is by far the dumbest thing that dumb people have been doing. But, only the greatest fool assumes that will continue. Because those who know their history know that the 1930s saw extreme ideological warfare between capitalism and communism. The crash of 1929 and subsequent depression was fertile ground for sowing societal animosity towards capitalism. As is this era we are going through right now. Our CEOs of the financial Titanic have done everything possible to ensure this has the worst possible outcome. The pandemic and central bank response massively increased the chasmic gap between rich and everyone else. Now we are enduring rampant profiteering which today's useful idiots conflate as "inflation".

However, where Buffett really gets it wrong is in NOT realizing that the policy response to date has been a direct replica of the mistakes made in 1930. Don't take my word for it, this is straight from the Federal Reserve:

“Regarding the Great Depression, … we did it. We’re very sorry. … We won’t do it again.” -Ben Bernanke

"The Great Depression began in August 1929, when the economic expansion of the Roaring Twenties came to an end. A series of financial crises punctuated the contraction. These crises included a stock market crash in 1929 and a series of regional banking panics in 1930 and 1931"

"The Federal Reserve implemented policies that they thought were in the public interest...an example is the Fed’s decision to raise interest rates in 1929...another example is failure to act as a lender of last resort during the banking panics that began in the fall of 1930"

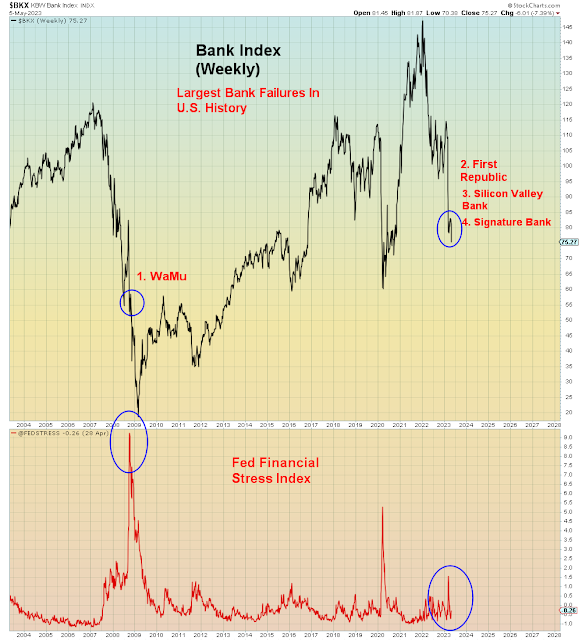

This chart shows Global Financials today. The Fed is raising rates while watching regional banks implode left and right.

This era has already seen three of the four largest bank failures in U.S. history.

In the chart below we see the Fed's own Financial Stress Index. The peak in this index came back in September 25th, 2008 10 days after Lehman failed and at the same time Washington Mutual failed, September 25th 2008.

In 2023 we've already seen three of the four largest bank failures in U.S. history and yet the Fed stress index is still NEGATIVE?

The chart of financials above clearly shows that the third wave meltdown has already begun. Which means we are about to see mass bank failure and the inevitable failure of the FDIC aka. the Fictional Deposit Insurance Corporation. Which now has less than 1% of bailout capital relative to total deposits. Yes, you read that right. As Buffett explains above, the fund is implicitly backstopped by taxpayers, whom he assumes will always come to HIS rescue. Because he is not a student of history.

99% of all deposit accounts are LESS than $250k. Remember that percentage because it was on protest signs in 2010 and it will be on protest signs again very soon.

This past week, the FDIC was trolling Congress for a bailout the size of which is TBD, but could be in the trillions. They don't have have enough money to backstop $10 trillion of INSURED deposits much less $7 trillion of uninsured deposits. Meanwhile, the Freedom Caucus has already stated they are AGAINST universal deposit insurance.

So what's going to happen next is this:

1) Many more banks will fail

2) The FDIC will fail and then ask Congress for a bailout

3) Congress will backstop the FDIC to $250k per account

4) $7 trillion of uninsured deposits will be vapourized aka. 5x subprime

5) The Fed will cut rates and financials will be bidless

6) Global markets will explode

7) The T-bond yield will be 0% by the end of 2023