The debt ceiling is not priced in, it's priced out.

Further rate hikes are not priced in, they are priced out.

Recession is not priced in, it's priced out.

How do we know? Because the most overvalued sector is now deemed a "safe haven" from risk. You can't make this shit up:

"Mega-cap tech behemoths like Apple, Microsoft, Alphabet, and Amazon are returning to their safe haven status"

First off, how could bearishness be at the highest levels of the year if Tech is the most crowded trade. To read this one would think that Tech stocks are safer than cash. In what world is the most crowded trade a safe haven?

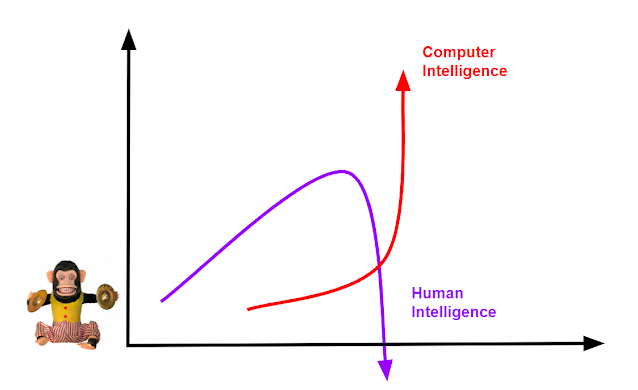

The world of artificial intelligence.

Here's another factoid from the article:

"Investors most long growth vs value stocks since July 2020"

July 2020 is an interesting timeframe because back during the pandemic recession - as short as it was - investors were rotating to mega cap Tech stocks which were perceived safe havens. When that rotation ended, there was a very sharp selloff and mass rotation out of mega caps. This past week, Apple once again has eclipsed the entire small cap stock sector in market cap. This impending selloff in mega cap Tech will be taking place in a bear market unlike 2020 which was a Tech bull market.

The S&P Tech ratio now exceeds the pandemic and Y2K.

Which gets us to the temporarily suspended bank run. We also learn via the article above that another consensus crowded hedge fund trade is short banks. Which means that this week hedge funds are getting squeezed on their short trades while become massively longer their Tech trades.

A recipe for mass deleveraging.

Meanwhile banks are now three wave corrective at all degrees of trend, so once hedge fund short-covering ends, they will explode lower.

This week, Home Depot reported the worst quarterly revenue miss since the Y2K recession and the biggest drop in quarterly revenue since the 2009 recession. Confirming that the consumer is imploding.

Today, Walmart "beat" on earnings because their biggest sales category is groceries which are the last consumption item people stop buying. They also said that sales eroded continuously throughout the quarter.

Which gets us to the impending debt ceiling debacle. The article above states that more than 70% of investors believe the debt ceiling is no big deal:

"Investors appear to have little concern about the ongoing debt ceiling showdown in Washington, D.C. According to the survey, 71% of surveyed investors expect a US debt ceiling resolution before the X-date, which the Treasury Department estimates is June 1"

In summary, Tech is over-crowded, bank shorts are unwinding and there is little concern over the debt ceiling. Whereas institutional investors believe that all risk is priced in, it turns out that NO risk is priced in because they all believe that everyone else is bearish. Therefore they can own the riskiest stocks in the market while the economy implodes in real-time.

We have achieved peak artificial intelligence.