It's Davos 2023, amid peak market hubris. What could wrong?

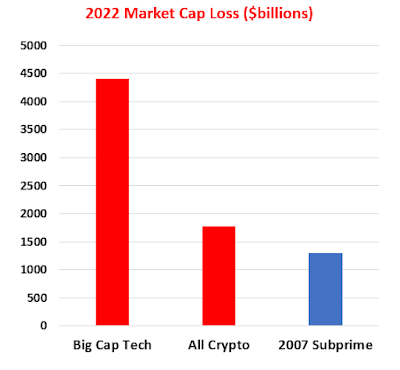

The central bank gambit of increasing the wealth of corporate oligarchs at the EXPENSE of everyone else reached new lethal levels of inequality in 2022. According to Oxfam, the ultra wealthy almost doubled the $ wealth increase of the remaining 99%. For those who know their history - few to be sure - this does not end well:

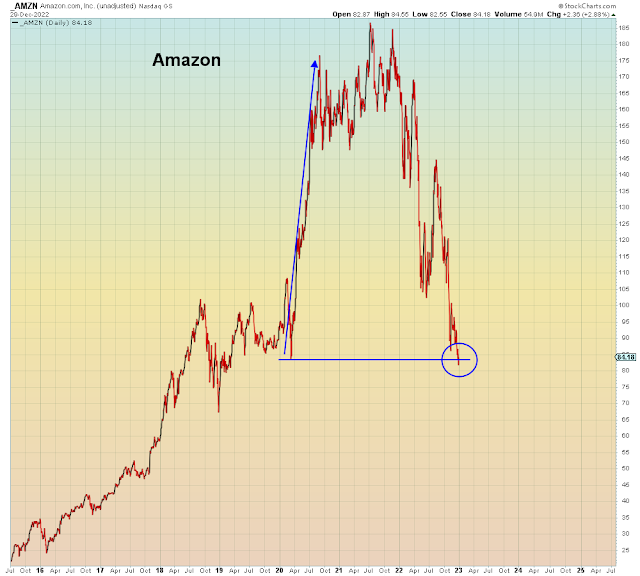

Go back to the aftermath of 2008 when the Occupy Wall Street movement started to protest bailouts for the ultra-wealthy while the middle class imploded. Fast forward one decade to the pandemic and this time around it was Millennials "democratizing markets" with their Reddit-ordered pump and dump schemes and Crypto con jobs.

The central bank policy of inflating capital wealth while imploding the middle class further escalated in 2022 as they kept their balance sheet unchanged year over year while DOUBLING mortgage rates. Rates now on everything are far higher than they were pre-pandemic.

And yet, complacency reigns supreme.

This set-up is starting to look a lot like the one that preceded the pandemic in early 2020. First a melt-up and then a meltdown.

Then, as now, gamblers were front-running central banks and not worried about the pandemic. FOMO was running wild.

Now however, the greatest risk that investors face is not a pandemic, it's central banks themselves. In other words, investors are embracing the cognitive dissonance of ignoring central bank-caused tightening by believing in central bank bailout. Nothing quite as obviously asinine has ever been believed in market history.

Let's take a trip down memory lane circa February 2020.

This headline states that the pandemic melt-up - that unbeknownst at the time preceded meltdown - was due to investor FOMO:

Feb. 5th, 2020:

Sound familiar?

The riskiest stocks surged ahead of the pandemic lockdown, as they are surging now:

In addition, to moral hazard and belief in central bank invincibility, what fueled this parabolic rise into meltdown? For one thing, China was ALREADY easing massively and their markets were leading global risk assets.

As they are right now. Except this time, the risk to markets and the economy is the risk posed by policy makers as they take down all of the supports put up during the pandemic. Recall, it was China that led the way with tightening of lending conditions for real estate a year ago.

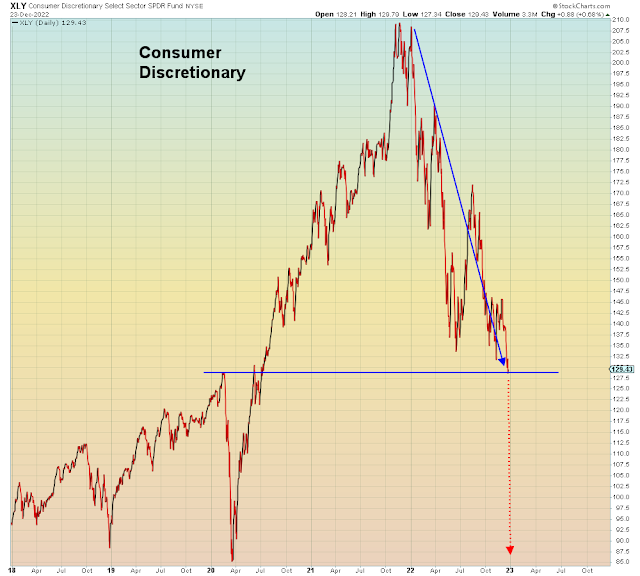

In addition to the above risks, what we are witnessing across many sectors is a scenario in which stocks are trading AGAINST the fundamentals. Meaning fundamentals are imploding, but stocks are going higher. This is because investors are "looking across the valley" to the other side of bailout. The most obvious examples are in housing stocks, oil stocks, retail stocks, financial stocks, and of course Tech stocks.

Here we see homebuilders usually peak LAST. Right before the crash. And of course pending homes sales lowest in history:

Oil stocks, which normally trade in lockstep with the leading indicators, are decoupling massively as they did in 2008.

For a time.

Oil services are not just decoupling from the leading indicators, they are now decoupled from oil itself:

Nothing could be more asinine however than Wall Street's prevailing view that earnings will grow in 2023. A prediction that is TOTALLY decoupled from consumer sentiment and Fed policy.

Now recall one thing about March 2020 - it was the largest combined fiscal and monetary stimulus in human history. Dwarfing 2008. And yet, U.S. markets STILL crashed -30%. There were six overnight limit down S&P futures gap opens in two weeks.

I say remember that fact because this time around the amount of stimulus will be a fraction of what abided in March 2020.