It's bulls versus the Fed. Get some popcorn and stand back...

On first glance this past week's FOMC statement appeared dovish, leading to a manic melt-up algo rally. However, at the press conference Powell threw cold water on the rally when he said there is more work to be done on rate hikes. That's all it took to implode the most recent "Pivot" rally. The remainder of the week was highly volatile due to options unwind and the jobs report which was hotter than expected but not as bad as feared.

It's clear these pivot rallies have been making the Fed's job of bringing down inflation, that much harder. As a result, these rallies keep pushing out rate hikes, so it's Powell's job to come in every FOMC meeting and pound markets back down. The Fed has finally realized that inflated asset prices are driving economic inflation. While it's true that options algos have been pounding volatility down, at the same time the Fed keeps pounding stocks down. Which means they are on a collision course, and I suggest the Fed will win.

The Fed is not going to stop raising rates when they can see that their Financial stress index keeps going down with every pivot rally:

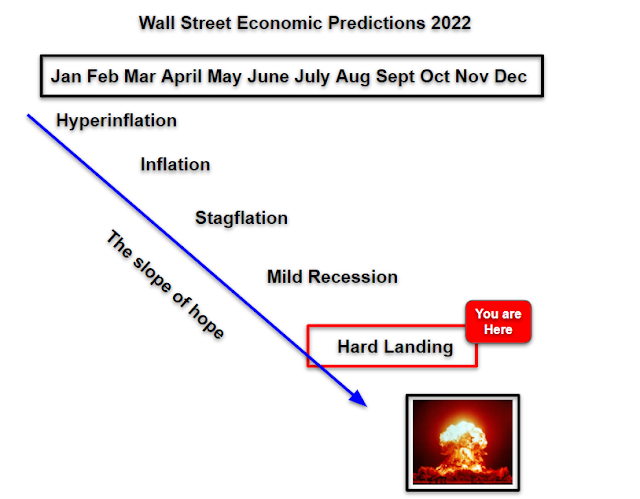

In addition, we learned this quarter that Tech earnings are imploding. Which means that the entire growth/deflation trade is now going bidless, which happens to also be the pivot trade. Therefore if/when the Fed does pivot, there will be no leadership in the market. Putting it all together and the Fed will tighten until they break markets, and then everyone will be shocked at how quickly this house of cards explodes.

We are seeing very unusual action in the Nasdaq VIX market lately. There have been seven flash crashes in the Nasdaq VIX in the past twenty days. And only 18 total flash crashes in the past 27 years.

In summary, the Fed is going to break some shit, and bulls have conflated that meltdown moment with their long awaited bailout.

The inevitable consequence of being told for 14 years straight that bad news is good news.