Monday, April 4, 2022

Q2: THE MAIN EVENT

Thursday, March 31, 2022

THE GOLDEN AGE OF FRAUD

This is a society with a lethal case of hubristic dementia. What we are witnessing is a centrally managed collapse in broad daylight. The Sheeple are eagerly following their trusted psychopaths deja vu of 2008...

This society has survivor bias on steroids. No matter how many people go under the bus, the mainstream message remains rinse and repeat. The ultra-wealthy beneficiaries of fraud continue to push the standard narrative at the expense of the silenced majority.

U.S. policy-makers are trapped in a past that no longer exists. In a stimulus dependent economy, conventional economic models no longer work. The U.S. is now at record economic policy divergence vis-a-vis Japan and China. Those two countries have already learned to respect deflation, and they are both currently in easing mode. Whereas U.S. policy-makers are operating on the basis of extreme hubris in a torrent of disinformation at the end of the cycle.

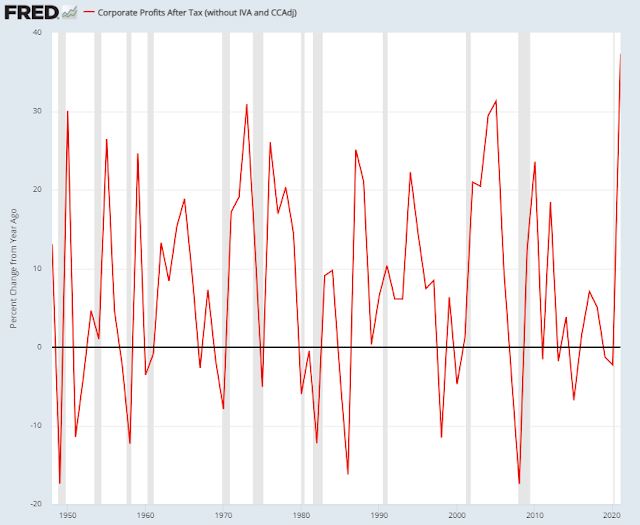

In the meantime, today's CEO salesmen are delighted to push the stagflationary hypothesis to record profit. Stagflation is a call to buy everything - durable goods, cars, homes, stocks, cryptos, gold. Which is why after tax corporate profits just grew the most on record, going back to 1948. It's called profiteering from inflation hysteria, also known as "Shock Doctrine". Never let a good crisis go to waste.

"When taxes are factored in, last year’s corporate profit increases were even more of an outlier. They soared 37% year over year, more than any other time since the Fed began tracking profits in 1948"

Of course to believe today's business pundits, the only "bad" inflation is wage inflation. They are more than happy to turn a blind eye to rampant profiteering. And therein lies their blindspot. They fail to see a consumer on the verge of collapse as prices of EVERYTHING skyrocket at the same time.

Wages are up 8% versus profits up 37%.

Meaning that none of this end of cycle consumption orgy is the least bit sustainable. Somehow it never occurs to these people that THEY bid up all of these prices.

It gets far worse on the market side, because this stagflationary hypothesis which was also extant in 2008 has caused an EPIC misallocation of capital. And ironically it's this misallocation of capital that has emboldened the Fed to embark on the fastest and most brutal tightening in history.

In Q1 global bonds experienced their worst selloff in history. Meanwhile, the Fed stress indicator which includes metrics such as credit spreads, credit conditions, and other risk premia, just this week collapsed to the lowest level on RECORD. The divergence versus 2020 and 2008 is asinine:

Here we see gamblers crowding into commodities and Google searches for "stagflation" are the highest since 2008.

Bubble denial is rampant

"It’s highly anomalous for housing prices to rise over 32% in a span of two years, and so the trend is causing some economists to start worrying about a possible bubble"

The growth rates we are now seeing exceed those immediately preceding the Great Financial Crisis"

The article goes on to rationalize away bubble risk by saying that in this era there are no "shady lending practices taking place" unlike last time. What happened after 2008, is that large banks were forbidden from making "risky" loans to marginal borrowers. So a new industry of shadow banking hedge funds sprung up to be the intermediaries between the banks and the low quality borrowers. These intermediary lenders have "pristine" balance sheets because they were created AFTER the 2008 financial crisis. However, they are borrowing bank money as a pass through to subprime borrowers. I know all this because for two years out of business school our middle son worked for one of these companies, which will remain nameless. He said that just before the pandemic, many of his portfolio companies were running out of cash and were about to get cut off from funding. The pandemic saved them by allowing them to borrow MORE money. In other words, in this cycle credit risk is "hidden" behind a layer of obfuscation, but it's still there and banks are still very much exposed.

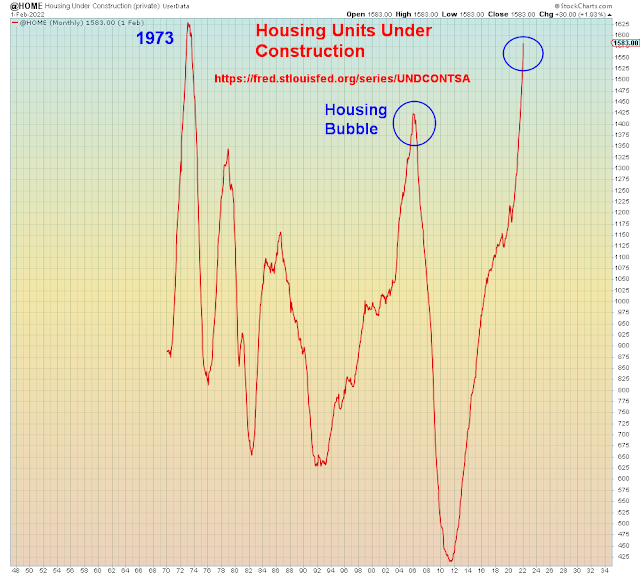

Another thing the article asserts is that this entire melt-up price move is due to the "mismatch" between supply and demand. We heard the exact same argument during the last bubble. When demand reaches a hyperactive state because everyone assumes prices can only go up, that is not sustainable. In addition, in-process supply is at decade highs:

Today's pundits are sanguine because despite yield curve inversion which is now widely discussed - meaning long-term yields are lower than short-term yields - pundits believe that recession is at least 12 months away. For that conclusion they are data mining prior recessions.

However, what they are ALL ignoring is the asset crash risk which will pull that timeframe forward by 12 months.

The impending asset crash will bring recession forward to NOW.

In summary, stonks just ended the worst quarter since March 2020, despite the fact that all risks got bought with both hands:

I call it the "We love rate hikes rally". Which will be followed by the "bidless market collapse".

Tuesday, March 29, 2022

THE END OF THE PONZI CYCLE

In this market, when one fraud ends, another begins. Bulls have an insurmountable advantage in the war of words - not only do they have the full weight of deception on their side, but they have an audience of eager accomplices. Meanwhile, us critics of criminality are the enemies of all that's fun in manipulated markets, and hence perma-boring...

Sadly, as they will all learn the hard way, having your head up your own ass is not a Black Swan event.

There's a scene in the movie Sling Blade where the father (Robert Duvall) excoriates his son (Billy Bob Thornton) for killing the wife/mother for cheating on him. So the son kills the father too.

Here we are - there are no innocents left in these markets. There can be no defense from the supposed unpredictability of a "Black Swan" event as so many have done in previous selloffs.

This is Q1 in a nutshell:

Highest CPI in 40 years (which led to recession in 1980)

Largest oil shock in 50 years (which caused recession in 1973)

Largest global bond collapse on record

Fastest Fed tightening on record (which preceded EVERY recession)

War in Ukraine

And yet all bought with both hands. The ultimate example of moral hazard. Far too many bailouts have led the masses to run towards risk.

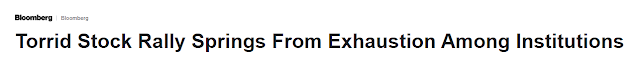

Which is why markets just made a round-trip of record deception. Institutions sold, while retail investors bought the dip with both hands:

Individual investors have purchased a net $39 billion of stocks since January, the largest at this point in at least five years"

Institutional selling at market tops has been a "feature" of every end of cycle bull market in history. And late stage retail bagholding has also been a "feature". It's called distribution - and it means large investors selling stocks to the masses.

If at the beginning of the year anyone told you those above risks would abide in three months, would anyone believe the "market" would still be near all time highs? Of course not. This is now entirely about misallocation of capital.

Deja vu of last year when the growth stock led deflation trade melted up and imploded spectacularly in Q1 - we just saw the exact same melt-up in the reflation trade, led of course by commodities. The war was the catalyst for the manic blow-off top, however the reflation rally had been gaining steam since the election, vaccine rollout, and global re-opening in late 2020.

Which is why for the first time in this entire rally since the March 2020 lows, BOTH the NYSE and Nasdaq are now overbought at the same time.

You will note that S&P breadth (top pane) made a large leap up in June 2020 which was accompanied by a record breadth thrust in the NYSE (mid pane). Now we see another surge. Also last year saw the manic melt-up in growth stocks, followed by this echo surge. Anyone can see however, that overall S&P breadth has basically collapsed.

So what we are witnessing is an end of cycle melt-up in ALL risk assets at the same time, amid daily increasing odds of recession. All accompanied by mass denial that it's the end of the cycle.

Many pundits have been saying recently that as long as the twos/tens didn't invert that the rest of the yield curve inverting did not mean recession. Well, now they are wrong, because twos and tens just inverted:

"Some analysts say that the Treasury yield curve has been distorted by the Fed's massive bond purchases, which are holding down long-dated yields relative to shorter-dated ones"

[There is only one problem with that hypothesis which is that the Fed is no longer buying bonds]

"Analysts say that the U.S. central bank could use roll-offs from its massive $8.9 trillion bond holdings to help re-steepen the yield curve if it is concerned about the slope and its implications"

This last part is the dumbest thing I've read in a while. The Fed's asset purchases aka. QE inflate markets and increase reflation expectations. The Fed's asset unwind aka. QT does the opposite - it tanks asset markets and it increases deflation expectations. So how could it possibly steepen the yield curve?

But here is the key takeaway all bulls were waiting for:

"The time delay between an inversion and a recession tends to be, call it anywhere between 12 and 24 months"

Still plenty of time for gambling, so says Wall Street.

Which gets us to the casino:

At today's close, the NDX (not shown) was RECORD overbought going back to 1998.

Here is the Nasdaq Composite with the Nasdaq breadth oscillator:

As I said above, NYSE breadth is the most overbought since June 2020. Which is the last time bond yields spiked this amount. After that reflation trades (Energy, Financials, Industrials, Transports) imploded.

Crude has tested the 50 dma twice. If it breaks, next support is -25% lower at the 200 dma. With far greater potential downside if that breaks.

Recession stocks are leading the end of cycle rally.

Go figure.

In summary:

Here we are back at multi-year overbought. The epic risks of the last three months were sold by the smart money institutions who raised cash. Therefore knowing what we know now. Buy or sell?

If you had been bearish and you wish you had been bullish, here's your chance. And if you had been bullish, and wish you were bearish, you can now flip.

BUT, this time EVERYONE knows the risks.

Sunday, March 27, 2022

THE GLOBAL MINSKY MOMENT

Today's policy-makers are racing full speed towards the Minsky meltdown:

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate"

The pandemic and its *special* bailout programs allowed companies that were essentially insolvent to rollover their debts.

One, more, time.

The Fed missed their window to raise rates, and now they are tightening into a deleveraging phase:

Amnesia or dementia? Of course it will make no difference in the end. Except with respect to the treatment for the impending mass mental health breakdown.

This society specializes in doubling down on failure. Not only are the Dotcom Tech bubble and 2008 Housing bubbles long forgotten, but every policy mistake in between as well. To believe in this fraud one must forget the 2018 Fed implosion. The 2015 China meltdown. The 2014 oil collapse. And the 1998 Russian default.

This monster is the SUM TOTAL of all of that, now accelerated by a Fed hellbent on implosion. This tsunami of risk is so large that its gargantuan magnitude is imperceptible in open water and will only be visible when it breaks on shore and obliterates everything in its path.

The Fed is flooring their rate hike plans while keeping their eyes firmly locked on the rear view mirror of stale and irrelevant data. They are in Thelma & Louise end of cycle policy disaster mode. What hubris they had keeping QE and rates at full throttle for FAR too long, they are now repeating by cutting liquidity FAR too fast.

Unfortunately, today's pundits squandered their credibility telling everyone for months that the Fed is behind the curve. So now they are trapped by their own consensus of idiots.

For their part, the sheeple are just massively confused. They are being constantly told to ignore all mounting risk. Which is why social mood is collapsing. Never before have we seen such a large collapse in consumer sentiment BEFORE an asset crash and before Fed rate hikes. One can only imagine what depth of despair awaits this crime scene when asset collapse stirs the profoundly stoned masses from their narcoleptic coma.

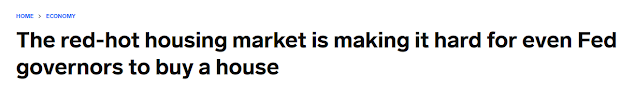

"Home prices soared 18.8% through 2021, marking the largest annual gain since at least 1988

Still, for all the wild price gains in the housing market, the landscape doesn't share the risks that emerged during the late-2000s bubble, the Fed governor added"

Below we see the University of Michigan current economic conditions. This is the mid-month (interim) reading, which is the lowest since 2008. In the bottom pane I show the 30 week % change in the 30 year mortgage. Combined we see these are the worst correlated readings since Paul Volcker pulled the plug on inflation in 1980.

Thelma and Louise are about to go through the windshield:

Even before the Russian war in Ukraine, global risks were mounting inexorably. In the meantime, China Evergrande and its derivative dominoes have been spreading throughout the Chinese economy. This week, China is experiencing its biggest COVID lockdown in TWO YEARs. For those who still think they invented this virus, you have mistaken idiocy for a conspiracy.

Russian default is coming around again in early April:

"The last payment was a small investment in credibility, but when Russia has to start writing billion dollar checks it’s a different calculation”

The Fed's implosion of the global bond market is a Black Swan event in broad daylight. It's not only Russia and China that are caught up in this meltdown.

This is the worst quarter for EM dollar bonds since the Russian debt default in 1998:

What does this all have to do with the Casino?

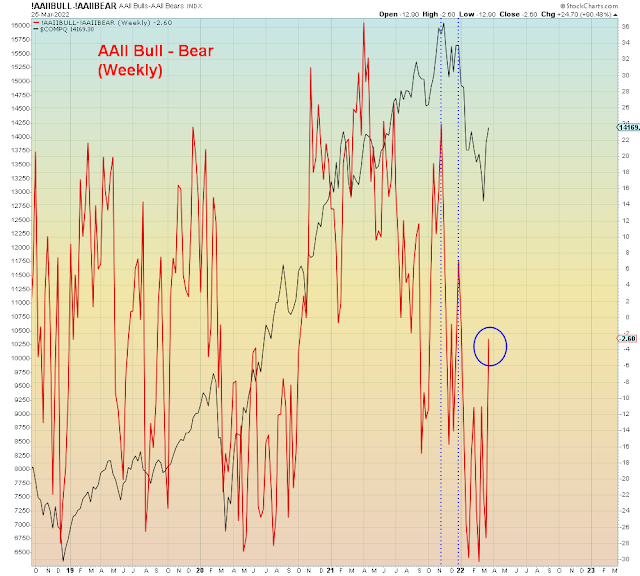

Right now bulls believe there is too much bearish sentiment for stocks to go down. Unfortunately, as we see via the AAII survey, bearish sentiment does not prevent the market from sliding down the slope of hope:

Anyways, sentiment is just opinion polls. Only positioning matters, and positioning of course is FAR too bullish to mark any sort of tradable bottom yet.

The equity call/put ratio remains near pre-pandemic highs:

In summary, the full force of Wall Street criminality is arrayed against the public right now. They are intentionally being kept in the dark and fed bullshit. As far as the masses are concerned, they wouldn't have it any other way.

No one wants inconvenient facts and data to get in the way of their cherished opinions, or to interfere with their daily subscription bullshit enema.

Thursday, March 24, 2022

The New Permanent Plateau Of Delusion

"Whipsawing commodity prices and eye-watering margin calls are forcing traders to reduce their activity, driving liquidity out of markets and exacerbating price swings, according to some of the world's biggest trading houses."

Wednesday, March 23, 2022

Front-Running Collapse

History will say the Ukraine war hid the collapse of the global economy behind an end-of-cycle commodity shock. Wall Street now has their excuse to run the herd over the cliff with the Fed now tightening into depression. With their only question being...

"What stocks should I buy in a nuclear depression?"

"WASHINGTON — Senators reacted with alarm to a new report that suggested Russian President Vladimir Putin could deploy a small, targeted nuclear bomb as his troops get bogged down in a costly, drawn-out battle against defiant Ukrainian fighters"

Where to begin...

First off, I will discuss the "nuclear" economic option of a Russian oil embargo:

A commodity spike at the end of the cycle is ultimately deflationary, because it's yet another shock to an already tapped out consumer. First consumers endured all of the pandemic-related supply chain shocks for the past two years, next they endured interest rate shock for the past six months, now we're having commodity shock. There is only so much pain consumers can take, which is why recession odds are sky-rocketing. When people see high prices they view it as inflationary, because they assume these prices will stay high forever. However, the definition of "inflation" is not prices that spike and collapse. When oil spikes, it means less purchasing power for other parts of the economy.

The West's Russian oil embargo drove oil prices to a manic peak two weeks ago. However, that "embargo" turned out to be a soft embargo, because most of Russia's oil is still expected to reach the market whether through Europe, India, or China. Which is why many speculators got dumped when commodities crashed -27% into bear market. Now commodities are making a second lower high.

In addition, we can see that crude oil demand in the U.S. is beginning to roll over in line with collapsing consumer sentiment. The hyperinflationary depression fantasy propagated by Putin and Zerohedge, is running on glue fumes.

aka. "Pravda"

Nevertheless, all of today's pundits are ignoring the bond market and yield curve inversion. The stagflation hypothesis is consensus. Even the Fed believes it now.

Which is why a hard landing is becoming far more likely:

The Fed is collapsing the global bond market, but they are not concerned because investors are still in RISK ON mode and hence collapsing risk premiums. Which is why market duress is not showing up in any of the Fed's key indicators. That lack of market stress ironically makes further rate hikes and further market collapse likely. Investors are in what I call a "Moral Hazard" death spiral. They are front-running the Fed into collapsing markets on the basis that the Fed will bail them out.

Meanwhile, the Fed is using their positioning as a rationale for tightening liquidity:

March 23rd, 2022:

If the Fed raises rates .5% in May this year, it would be the first double rate hike since May 2000. Back then the Fed kept raising rates until the DotCom era Nasdaq was collapsed -80% and the economy was in recession.

Looking at the chart above, it's hard to believe the Fed will get that opportunity, this time around. The market is way ahead of them on rate hikes as we see below with the two year now above the Lehman level of 2 year minus Fed rate:

Which gets us to the casino:

Three waves are now becoming visible on the S&P 500. Confirmation is provided by NYSE new lows and the breadth oscillator.

This is a very weak retracement, but it's also a long retracement in terms of duration. When it started the S&P was two years oversold. And now it's two years overbought:

As one would expect, the Nasdaq is in far more dire condition. This wave count which is similar to the S&P's is extremely weak. And yet it's confirmed by the volume oscillator as a three wave correction. Normally wave 'b' above wave '1' and wave 'c' is above wave 'a'.

In summary, this decline and correction has been more about time than price. However, the next leg down should be more about price than time.

Gamblers who wait too long, are going to find out it's their bailout that gets delayed this time around.