Monday, January 3, 2022

2022: The Banquet Of Consequences

Saturday, January 1, 2022

Denial Of Japanification

The U.S. has been in a Japanified environment for at least 13 years, more likely as far back as the DotCom bubble. And yet, policy-makers and the public at large remain in total denial. The current fear of "inflation" is exhibit A of rampant denial...

First off what do I mean by Japanification? I mean mired in a permanent state of structural deflation. Japan first entered this state 30 years ago and they've been stuck in it ever since. The "good news" is that they appear free to use monetary and fiscal policy to extremes previously considered impossible. The bad news is that their economy is totally stagnant.

The U.S. has been sliding down the deflationary slope since 1980. Free Trade and Supply Side economics solved the stagflation of the 1970s by exposing the economy to wide open global trade. Since that time the twin deficits consisting of the trade deficit (current account) and U.S. budget deficit have been growing faster than the domestic economy itself. The demolition of the middle class due to free trade and open immigration has been papered over with debt. The corporate sector has been the primary beneficiary of this easy way out from U.S. lack of manufacturing competitiveness that began in the mid-1970s. Now the U.S. is totally dependent upon other countries (aka. China) for manufactured imports.

All of which conventional economics would predict spells inevitable doom for the U.S. dollar. However, Japan has been doing this for decades and their currency is still considered the SAFEST on the planet. Even safer than the dollar. Why is that? It's because during boom times Emerging Markets borrow from the lowest yielding economies i.e. slowest growing, which is where they can find the lowest interest rates. That "carry trade" continues throughout the economic cycle until such time as the Minsky Moment occurs and EM currencies implode. At that point in time all of that borrowed money must be returned post haste to the lender. Which is why the Japanese Yen always catches a massive bid during global margin calls. It's not really due to implied solvency, it's more due to lack of concern over Japanese inflation. No one is worried it will ever get out of control, because it's structural.

I first became disillusioned with U.S. economic policy in the aftermath of the Dotcom bubble when the Fed lowered interest rates to 1.5% and recommended that home buyers start using adjustable rate mortgages. They were clearly trying to offset the implosion of the Tech bubble by stoking another one in real estate. And it "worked". For a time.

Nevertheless, after 2008 and zero interest rate policy "ZIRP", the rules around "markets" changed dramatically. For one thing "valuations no longer matter". Meaning they are no longer useful as a timing mechanism with any precision measured within years. In addition, similar to Japan, the U.S. is now "free" to overuse fiscal and monetary stimulus on a level previously considered impossible. All as a proxy for a real economy.

However similar to Japan this newfound profligacy does not necessarily portend the imminent demise of the U.S. dollar. In fact, the U.S. dollar is now a carry currency of choice similar to the Yen. During the March 2020 meltdown, the U.S. dollar skyrocketed. Anyone who IS worried that the U.S. dollar demise is imminent, should buy gold. However, don't be surprised if better prices lie ahead.

What this monetary and fiscal monster now portends is larger and less stable asset bubbles over time. The largest of which to date we are witnessing right now. To believe the pundits of the day we too would have to ignore this latent fragility that I wrote about in detail this past week. The mega asset bubble and attendant continual monetary bailout has ensured that the next global RISK OFF event will implode the machines that create this carefully fabricated new permanent plateau of delusion.

Here we see S&P (eMini) futures open interest as a proxy for the current level of liquidity, is at the lowest point in this cycle. This is the consequence of automating markets to the point at which human market makers have been replaced by HFT algos front-running Robinhood gamblers. Someone on my Twitter feed said they don't think the Fed will go through with taper. It already started, and it will accelerate in January. The goal is to be wrapped up by the end of March - from $120 billion/month down to $0/month.

This chart shows that the global reach for risk peaked way back in February and hit a second lower high aka. second wave retracement in November. Then the market tanked into early December which was the first (minor) wave of third wave down. The subsequent retracement in December was minor ii. I show the Bitcoin Trust because it has the clearest wave structure, and because all risk assets are now correlated to the downside, as we see via Nasdaq lows in the lower pane. For those not familiar with Elliott Wave Theory, at its most elemental level it's merely pattern recognition. Beyond that it's the belief that greed and fear ultimately control markets, NOT central banks as so many people today assume.

If this wave count is accurate then indeed third wave system test is near at hand.

We must acknowledge that this society has an overriding need to believe that NOTHING has changed over these decades and therefore they are free to extrapolate the past 70 years of stock market returns into the indefinite future. Which is what they are actively doing right now. To their minds, nothing dramatic has changed to the underlying economy which would indicate that "stocks" are outside of historical bounds. In other words, those who don't believe in any form of market timing, now rely solely upon extrapolation of a 70 year volatile trend by assiduously ignoring the experience of the past twenty years. Millennials at least have an excuse not to see this coming. No one else has an excuse other to claim they are functionally brain dead.

Friday, December 31, 2021

The New All Time Crack High

Wednesday, December 29, 2021

Systemic Risk Update

Tuesday, December 28, 2021

Timing The Mega Crash

Whenever people ask me when will the market crash, I say it's inevitable. The next question: When is that? After all, in the year that saw the launch of an actual 'FOMO' ETF, no one wants to leave the casino before it explodes...

The two key determinants of the magnitude of a crash are positioning and point in the cycle. Today's investors have been well-conditioned to believe they can get bailed out from any type of "Black Swan event", including one caused by Fed policy error itself. Which is why they are now taking far more risk at this latent juncture than at any time in the past even while knowing the Fed is now in the midst of a likely policy error. All the inevitable consequence of moral hazard.

"lack of incentive to guard against risk where one is protected from its consequences"

"Our clients are fearful, but none of them are at the point of getting out,” he said. “They haven’t got the guts to pull out"

What are you going to do? Dump all your large-caps and invest in all emerging markets stocks. No one is doing that”

he has told investors sitting on huge gains in stocks such as Microsoft that it is time to sell some of their holdings. That’s not a conversation he says has always gone well"

There is no alternative,” he said. “From what I see investors are more skittish, but they are not acting on it"

Got that? It takes guts to get OUT of this market, not in. Cash is trash, and sheeple forget that after Y2K Microsoft was dead money for 15 years after losing -60%. Right now they're all waiting for Apple to eclipse a $3 trillion Germany in market cap to propel the S&P higher. I predict Tech will go down -80% and it won't come back for decades. It will be a total disaster for today's dumb money investors who learned nothing from Y2K. It took until 2015 for the Nasdaq to overcome its 2000 era high. Now they're all piled back into it like it's the Fort Knox of investments.

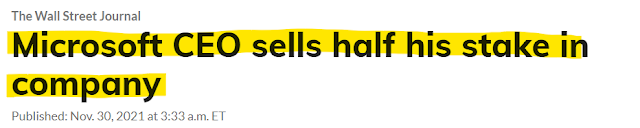

Insiders on the other hand are not "skittish" about getting out. Satya Nadella dumped HALF his shares in a two day period.

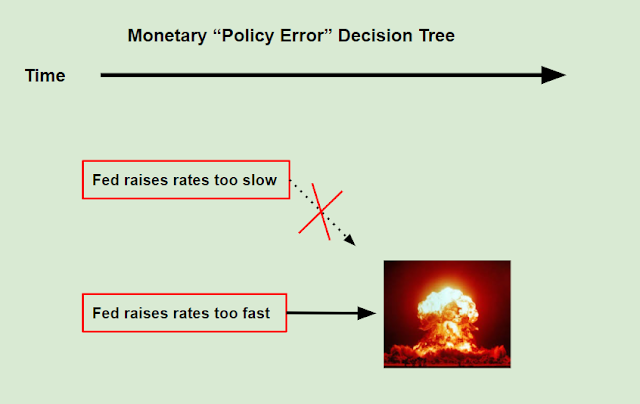

We all know that when this latest Fed taper explodes, pundits will blame Fed policy error, for legal purposes. Whereas they have been blaming the Fed for being too slow in raising rates, soon they will "pivot" to blaming the Fed for being too fast in raising rates. What they want is a Goldilocks market, not too hot and not too cold. And if it all explodes, they expect instantaneous bailout.

Unfortunately, the two main determinants of the magnitude of a crash are positioning going into the crash and where we are in the cycle. In this case, investors are positioned record aggressively for this point in the cycle. What is extremely ironic is that today's pundits evince supreme confidence in Fed control over the cycle, and now the Fed is actively tightening, yet investors are STILL leaning into risk. Why? because they have a bi-polar view that Fed incompetence creates buying opportunities, and Fed omnipotence prevents them from getting out of control. A theory that will not sound as intelligent after the fact as it does now.

Worse yet for today's morons, is that the Fed has been warning all year about elevated risk asset prices:

"Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year"

Fed Chairman Jerome Powell has repeatedly said that as long as interest rates stay low, the valuations are justified"

"Across most asset classes, valuation measures are high relative to historical norms. Since the May 2021 Financial Stability Report, equity prices rose further"

The share of investment-grade issuance with the lowest investment-grade ratings remained at historically elevated levels"

A steep rise in interest rates could lead to a large correction in prices of risky assets"

Sunday, December 26, 2021

2022: END OF THE PONZI CYCLE

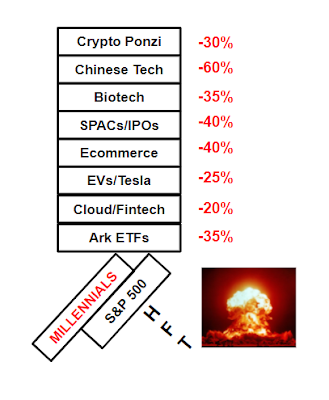

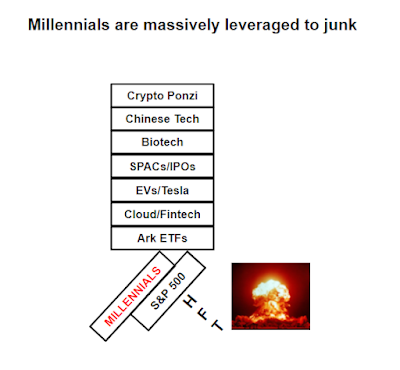

It's that time of year when all pundits make predictions, so I offer mine as a counterpoint to this era's mass delusion and mass deception. 2021 was the year of MAXIMUM pump and dump: The epic transfer of wealth from the working class to the ultra-wealthy under the auspice of "democratization of markets". In other words it was the traditional end of cycle distribution of stock from wealthy insiders to the final bagholder public. Going back a year I never predicted this much criminality would ensue during 2021, starting with the Gamestop debacle. I didn't envision Millennials embracing end of cycle fraud on record margin. Therefore, I don't buy into today's standard view of "good news more people got conned" democratization of deception. I believe that Millennial margin call, along with end-of-cycle inflation-driven panic buying and Fed double taper will combine to create the hardest landing in history, without any comparison...

In addition to lethal doses of monetary heroin, this era's excess stock market returns are a function of an aging society reaching peak retirement. Passive "dumb money" inflows have been creating their own Ponzi-like market returns. We are now told that "valuations no longer matter". There has never been an asset class in human history wherein valuations don't matter. When asset valuations are predicated strictly upon inflows they temporarily detach from their intrinsic values and then they ultimately crash back down to reality. The greater the distance back to reality, the harder the fall. At the end of the longest uninterrupted profit cycle in U.S. history, it's a long way down. Therefore it can come as no surprise that I disagree with today's mainstream predictions. I just read this 2022 prediction and I agreed with all of the facts, yet I arrived at the exact opposite conclusion:

"In recent years, traditional valuation metrics like price-to-sales and market- capitalization-to-GDP have rocketed beyond historical highs...Passive strategies are valuation-agnostic and buy whenever new money arrives"

Just like in 2018, when required year-end selling caused an illiquid stock market to plummet over 9% in December, Required Minimum Distributions (RMDs) may not be done wreaking havoc in 2021"

Curve flattening is an indication of a Fed policy mistake, namely, boosting rates into an environment where economic growth is slowing"

Does this mean U.S. stocks will end 2022 in the red? Probably not"

Got that? Valuations no longer matter. Meltdowns are opportunities, and a slowing economy is good reason to buy stocks. Somehow I see those exact same risks as ending horrifically badly.

First off, today's inflationists believe that the policy error was keeping rates too low for too long. But what if they're wrong and the bond market is right? It would mean the inflation they fear is cyclical not secular and therefore the panic buying feedback loop and resultant Fed hawkish pivot occurred at the worst time in the cycle. Deja vu of 2008. The author above believes that the Fed can quickly pivot to a dovish stance and bail out all markets at the same time. Picture J. Powell juggling pies while stumbling down the stairs - it's sheer and total fantasy. For one thing, Millennials are ALREADY on the verge of margin call and when that happens the dislocations will spread far faster than subprime in 2008.

Granted this fraud has continued at such a manic rate that even Michael Burry of "The Big Short" fame already capitulated earlier this past Fall.

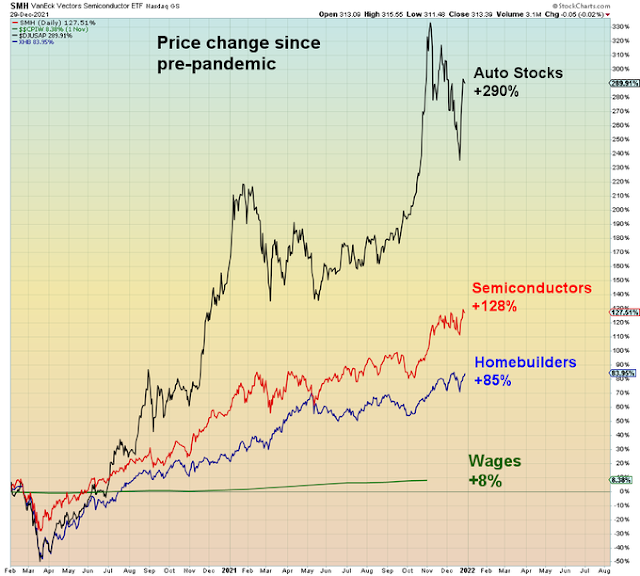

My prediction is that we have now seen peak consumption orgy and the hangover will be BRUTAL. In this late cycle we saw above average retail sales, durable good sales, home sales, and car sales. All far above trend in both price AND quantity. All driven by inflation hysteria and of course the central bank wealth effect. Both of which factors are highly correlated on the upside AND the downside.

Here we see retail sales have been far above trend since the pandemic started:

Whereas 2021 saw the removal of all pandemic supports for the working class, 2022 will see the removal of all pandemic supports for the investor class. What I call welfare for the rich. And my overriding assumption is that they are not going to like it.

Which will bring about MOAC: Mother Of All Crashes. Given the level of current risks, this implosion will very likely set the record for speed and depth of crash from an all time high. Granted, none of my outcome predictions are new. However, what's changed over recent months is the Fed policy stance, record market inflows, record risk positioning, record speculation, AND the beginning of bubble collapse. In other words, the passive-index bubble has hidden all of these burgeoning risks from the masses, leading to mass complacency.

The last two times the Fed tightened in December - 2018 and 2015 they were forced to quickly reverse policy in January. In both those times the market was down -20% before they reversed. My view is that once the crash begins they won't have as easy a time of it as they did the last two times.

In momentum markets such as this one, the buyers are above the market and the sellers are below the market. When there are long periods of time without selling then the sellers all hit the market at the same time on the way down. This creates a bidless market. We have already seen this in many of the speculative asset classes, but we have yet to see it in the major averages.

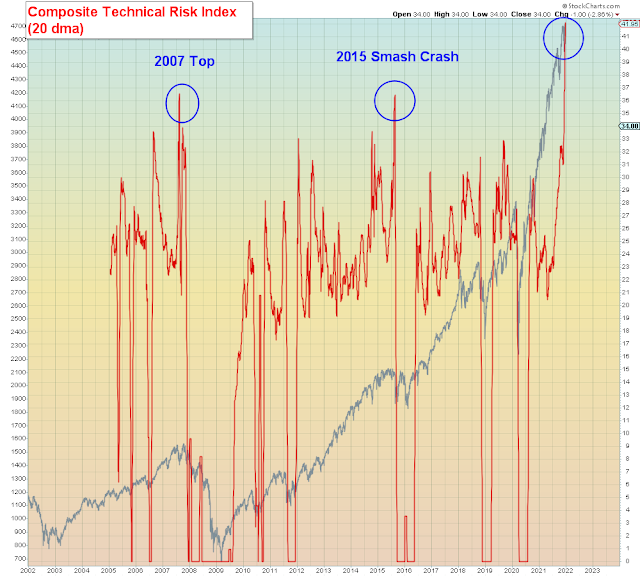

This week I created my own composite technical risk indicator. It combines % bullish S&P 500 stocks, % Nasdaq above 200 dma, % NYSE above 200 dma, NYSE highs-lows, and Nasdaq highs-lows. I converted each indicator into an index between 0-100 for relative comparison across time periods. And then I created a composite index and compared to time periods when the S&P 500 was above the 200 day moving average.

What we find is that this particular indicator hits extremes only on very rare occasions. In this case only three times in 14 years. However, in each of the prior instances, the market rolled over. In 2007 it rolled over from the all time high into a steep bear market. In 2015, the market rolled over and crashed in a matter of a few days.

When we zoom in on the 2015 crash, we see that the indicator peaked only days before the actual crash. We also see in the lower pane that NYSE breadth was in a sideways correction and unable to breakout to the upside. Similar to what we are seeing now.

As another gut check circa 2015/2016 we see that when the Fed raised rates in Dec. 2015, the market imploded. However, Nasdaq highs-lows now are ALREADY at the same level as they were back then with the market down -20%. In addition, RISK ON positioning is far more aggressive this time around.

Which is why I predict far greater dislocation this time around. The market is as bifurcated as the economy.

The bottom line is that the Fed can't bailout everyone from their bad investments at the end of the cycle. Here we see GAAP corporate profit (inflation-adjusted) now compared to prior cycles. Clearly, there has been no "reversion to the mean" for corporate profit for a long time.

Unfortunately, this society only discovers "right" when wrong explodes. Their sanctimonious outrage is stoked by their Ponzi scheme losses. Always looking for someone else to blame. What's coming in 2022 is what the Chinese now call "common prosperity". Meaning, first asset markets must crash and THEN there will be more political consensus about prioritizing people above corporate profit. It all starts with what I call "shared consequences".

After this era explodes, the definition of "retirement" will change from the Suze Ormanesque multi-millionaire retirement to something more basic and realistic given the acknowledgement of zero sum returns implied by 0% interest rates.

Just remember, the Fed's own so-called "RISK" model is constructed in such a way as to view extreme yield seeking and speculation as "low risk".

Why?

For maximization of profit and minimization of legal liability.

At the end of the Ponzi cycle.

Wednesday, December 22, 2021

The Pandemic Wealth Hypothesis

What we have witnessed throughout this pandemic is the largest transfer of wealth from the working class to the ultra wealthy in human history. All under the ubiquitous premise that the pandemic improved the economy and increased overall national wealth. This entire con job is now massively levered to a generation that has gorged itself on junk assets. When they explode, multiple generations will learn the lesson of a lifetime...

Wall Street and its acolyte financial service industry makes its money from RISK ON positioning. In a 0% world, they make nothing from RISK OFF. Which is why they never advise investors to take down risk and why they NEVER see any type of financial dislocation ahead of time. And STILL the financial media at large refer to these people as the experts.

Throughout 2021 risks have grown steadily all year. It started with a growth stock melt-up at the beginning of the year liquified by record global monetary stimulus. And now fittingly, it's ending with a growth stock meltdown amid the withdrawal of monetary stimulus. And yet, the predictions of financial pundits have remained the same throughout this entire time. They saw no risk in the melt-up and they see no risk in the meltdown.

They are experts at ignoring risk.

And why would wealthy insiders warn of a massive wealth transfer taking place in broad daylight when in fact it's been taking place for decades and only went into overdrive during the pandemic?

It's Shock Doctrine on steroids.

It's amazing the amount of risk people can ignore, when they've been conditioned their entire lives to believe that extreme imbalances are normal. The continuous decay of society has become their "steady state", because to their eyes it's imperceptible.

Consider the fact that John Glenn orbited the Earth back in 1962 and yet this year multi-billionaire Jeff Bezos visited the edge of space for a few minutes in what the media reported as a major accomplishment. Now that is frightening. In the Planet Of The Apes the people became so dumb, the apes took over. At this rate that movie is starting to look like a documentary.

Getting back to this epic wealth transfer, it's now a done deal. The "stocks" today's bagholders now own are saddled with record amounts of corporate debt at the end of the cycle. Meaning the stock market has now turned into a massive call option on global RISK OFF which is long overdue.

And so it is that all of the risks of 2021 have coalesced into the end of the year. Which means that Wall Street is now getting paid out record bonuses for leading a pump and dump scheme the explosion of which will make the Housing Crisis seem like a picnic by comparison.

Record issuance of junk stocks during a pandemic and not one pundit sees anything wrong with this. They are corrupted to the soul.

Which gets us to the Santa Rally which officially begins next week and carries two days into the New Year. Historical odds are high that in this low liquidity environment stocks remain artificially pinned to the new permanent plateau of mass deception. Of course, past performance is no guarantee of future results.