Saturday, August 14, 2021

Human History's Biggest Sucker's Bet

Wednesday, August 11, 2021

Shock Doctrine 3.0: END GAME

"Government officials and health experts are leaning on the private sector to lead the U.S. out of a coronavirus surge caused by the highly infectious Delta variant"

Monday, August 9, 2021

Don't Worry, Be Fat, Dumb, And Happy

Friday, August 6, 2021

Building The Perfect Ponzi Scheme

Today's bullish pundits can take pride in the fact that they have successfully participated in creating human history's biggest Ponzi scheme. All of the fraud and criminality from the past two cycles is rolled into one massive mega bubble. In doing so, they fully exploited the younger generations who have not the slightest clue how this level of fraud ends. They told them they were democratizing markets when all they were doing was democratizing bagholding. Today's ubiquitous sociopathic salesmen succeeded in leveraging a pandemic to create buying panics in everything that can be bought and sold from toilet paper to ammunition to McMansions, crypto Ponzi schemes, Ark ETFs, commodities, SPAC frauds, IPO garbage and of course S&P 500 stonks...

There are few if any pundits questioning this hyper bubble anymore. Skepticism peaked months ago. Why? Because from their point of view this Ponzi scheme is now flawless. It has achieved perfect extreme over-valuation and ALL IN risk positioning. In their minds, this Ponzi bubble has done nothing "wrong". On Twitter, I made the analogy of the Olympics - we celebrate the winners while ignoring the majority losers going home empty handed. It's called survivor bias. One troll asked recently if I ever make money. My response was never in Ponzi schemes. So far I have accurately predicted doom for crypto currencies, gold trades, Ark ETFs, Chinese stonks, and SPAC junk. In addition, I correctly predicted the rollover in bond yields which is something no mainstream pundits saw coming. Of course, the one prediction that remains elusive is that of the collapse of the major averages. Why? Because even as one after another sector dominoes collapse, the averages are seeing constant sector rotation. However, now we are witnessing breadth collapse in BOTH the NYSE and Nasdaq at the same time. And in addition, breadth has failed to rally during this latest "new high" in the S&P. The internals of the market are now the perfect analog for this speculative casino - a handful of winners and a majority of losers:

One thing we've learned in spades is that a society bereft of dignity and virtue will never appreciate dignity and virtue. Instead they flock to all of the various charlatans who will gladly exploit useful idiots to their own means. The definition of "inflation" is that prices can only go higher. Even at this late stage, the specious inflation narrative remains dominant. We have achieved inflation sans middle class. Even the Fed believes it now.

Here we see the velocity of money peaked twenty years ago when GDP growth and employment peaked in the U.S. The velocity of money measures the speed at which each dollar circulates throughout the economy. In an inflationary economy, the velocity of money sky rockets as consumers dump cash to hoard merchandise.

In summary, the magnitude of this fraud is directly proportional to the moral collapse of a decadent society in late stage self-destruct mode. ALL of the criminality of the past two decades has now been exceeded in this past year. A super Tech bubble with record junk IPO issuance. An even bigger housing bubble. Regulators asleep at the wheel, and of course wanking fucking bankers.

Wednesday, August 4, 2021

A Manic Reach For Explosion

We are now learning that the sole purpose of Monetary policy is to stimulate greed in an ultra greedy society. Central banks are keeping the spigots wide open to support the economy which is driving greed-addled gamblers to buy record inequality...

Another Nasdaq Hindenburg Omen yesterday - the third in less than two weeks, indicative of a bifurcated market disintegrating in real-time:

This greed-addled society has long since forgotten how this movie ended the last two times. The COVID ultra bubble makes the Dotcom bubble and Housing bubbles seem minor by comparison. COVID exposed Globalization's economic frailties which are now sending markets and the economy in opposite directions. Central banks are keeping the spigots wide open ostensibly to help the economy, but the only effect is driving economic inequality to ludicrous levels. Yesterday we learned that household debt is exploding at the fastest pace since the 2007 top. Too many people forget that debt follows asset prices higher, BUT not lower. When assets crash they turn into liabilities. Debt is deflationary. Underwater debt is lethal.

Trolls and other low life criminals now abound, exhorting everyone to engage in maximum Ponzi. The greed-fueled inflation thesis jumped the shark from risk asset markets to the economy and back again. No fool should be left behind. The concept of financial and economic responsibility is an abandoned relic of a bygone era. Deemed to be of no value in the golden age of printed money.

Unfortunately, nothing could be further from the truth. As Japan and China have already learned the hard way, all of this central bank driven speculation brutally turns back into a deflated pumpkin overnight.

As the economic data continues to weaken, gamblers are attempting a last ditch rotation back to Tech stocks which are approaching another melt-up high. This time amid chasmic breadth divergences.

Here we see breadth attending this latest all time high:

Yesterday another Hindenburg Omen on the Nasdaq (lower pane):

Semis are leading this latest Tech melt-up. The Rydex ratio (lower pane) keeps making new highs indicating a manic reach for risk:

This is all very reminiscent of August 2015 when Chinese authorities used monetary policy to inflate the stock market in the face of an imploding economy. Shockingly, it didn't work. It was the end of imagined realities.

Guess whose turn it is this time.

Monday, August 2, 2021

A Denialist Paradise

False optimism is the new religion. Today's Kool-Aid dispensing cult leaders of denial are its false prophets...

As far as doom porn it doesn't get any better than this summer from climate change hell. It's a denialist paradise. The same people who have decided they are more intelligent than the entire healthcare profession are likewise ignoring the worst wildfires and droughts in history while partying like it's 1929 in the summer of COVID liberation.

Things are so bad on the environment I am not sure whether to continue blaming the hairless monkey or blame God for creating such a miscreant species. I'm on the fence right now. Until I see this Roman Circus explode in every direction, my faith will be tested.

From the center view I take exception with both the left and the right for their own uniquely selfish view of this bastardized economy. Help wanted signs abound in blue states and red states alike, giving lie to the alt-right view that Biden's unemployment program - now defunct in all red states is at the center of this unemployment disaster. There are many reasons that the underpaid and overworked hospitality sector is now struggling to meet the needs of a country on vacation, not the least of which is the fact that foreign workers still have not been able to return to this country. It's a year without Mexicans and come to find out the problem isn't that they are "taking all the jobs", the problem is that they aren't taking ANY jobs. And that is a recipe for disaster for the true believers in this system of mass exploitation. Why? Because $15 per hour which was once viewed as a generous minimum wage for foreign born immigrants is now looking like the poverty-inducing stipend it represents to the U.S.-born population. Certainly in no way enough to entice the millions off the sidelines from their newfound COVID-induced "retirement".

It gets worse, because now the work-from-home liberals are using this Delta variant as an excuse to NEVER return to the office, as company after company now moves back their planned office re-opening. Stay tuned for future events because CNN will ratchet up the COVID pandemonium to meet the needs of their pampered work from home audience who require validation for their self-serving virus hysteria.

I have to come down on the side of commonsense on this matter of perpetual hysteria. Would this continuing "crisis" really exist if the economic impacts were falling upon all parts of society equally? If the 401k monetary hyper bubble millionaires counting their riches from home were equally impacted by this ongoing saga, would they be so willing to throw the economy under the bus? Of course not. They love the virtual economy.

Which is why all signs point back to the Grand Casino, because until it explodes, no one will be on the same page. And instead we will have this denialist paradise which is now human history's biggest global Ponzi scheme. And linked to it is a massively leveraged way of life that has the carbon footprint of an extinction level event.

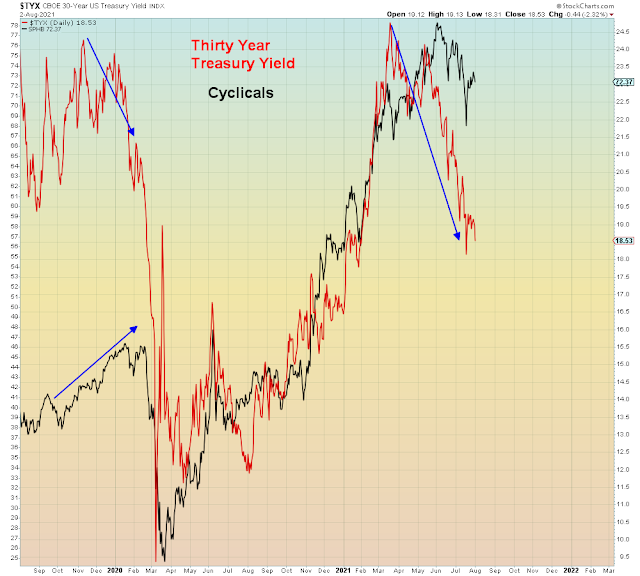

Which gets us back to markets. Last week, lost amid all of the FOMC hoopla, all of the economic data came in weaker than expected. Which is why this week bond yields are beginning to roll over again:

Picture this chart in a global RISK OFF scenario:

Banks are carving out the same top as last year, pre-pandemic:

Last week's new S&P high was attended by a miniscule number of NYSE new highs:

There were two Hindenburg Omens on the Nasdaq in the past six trading days (Fri. June 23rd, and Mon. June 26th). Here we see Nasdaq breadth is three wave corrective:

In summary, this is an extinction level event for true believers in bullshit.

Friday, July 30, 2021

Democratizing Fraud

This society faced two choices - get smarter and fix the mistakes of the past. Or get dumber and double down on the mistakes of the past. We know which path was taken. This society has conflated perpetual decline for exceptionalism...

Traveling the country this long hot summer, one can't help but face the reality that so much of today's false optimism is predicated upon false advertising. A buffoonish sense of over-confidence that now pervades all aspects of society. Those who do not reject this lethal modern Potemkin lifestyle will be destroyed by it sooner rather than later. One way or another.

Consider the fact that the leading companies in this virtual economy make most of their money propagating disinformation. Their hyper lucrative business model is false advertising. Yes I am referring to Facebook and Google. Amazon's main line of business is bypassing the U.S. economy. Likewise, all of Apple's products are now made in China. And Microsoft presides over a software monopoly. Meanwhile, the real economy stocks trade in a wide trading range, going nowhere. The Potemkin stock market mirrors the Potemkin economy and society. None of which would have any inflated value were it not for continuous monetary bailouts.

Consider the fact that stock buybacks will drive the majority of S&P per earnings "growth" this year as companies buy back record stock at record valuations. They are creating an illusion of profit growth solely by shrinking their outstanding share count. Most companies will further impair their bloated balance sheets to do so. These major corporations are now call options on the longest debt/leverage cycle in U.S. history. They are aided and abetted by record leveraged speculators bidding up the stocks of record leveraged companies.

Here we see corporate debt, annual $ change. The optimists would have us believe this pandemic-driven debt binge will not overshoot like last time.

Therefore, it's very fitting that this society just launched the IPO of a company that bilks Millennial investors out of their life savings in the name of "democratizing finance". Literally nothing could be further from the truth. Robinhood is a Candy Crush front-end to the largest HFT dark pool on the planet - Citadel. Is it the top? We will find out. As I showed on Twitter, the Coinbase IPO was the exact top for the Crypto Ponzi market. It also happened to be the day that Bernie Madoff died.

The biggest and most ignored story of the week was the obliteration of Chinese and Hong Kong stocks. Deja vu of July 2015 the PBOC stepped in to stem the decline of mainland markets. Back in '15 they finally halted the decline at -60% after several weeks of failed attempts.