"The ISM survey's measure of prices paid by manufacturers rose last month to the highest reading since July 2008, when the economy was in the midst of the Great Recession. That bolsters expectations for higher inflation this year"

Wednesday, May 5, 2021

All Signs Point To Weak Recovery

"The ISM survey's measure of prices paid by manufacturers rose last month to the highest reading since July 2008, when the economy was in the midst of the Great Recession. That bolsters expectations for higher inflation this year"

Tuesday, May 4, 2021

The Post-Pandemic Investment Hypothesis

According to this novel hypothesis, mass unemployment, record deficits, small business obliteration, and soaring corporate debt are all factors that make stocks more attractive. If this all works out, we can look forward to the next global pandemic buying opportunity. I'm sure Redditors are hatching a global Ebola epidemic as I write.

Monday, May 3, 2021

The New Cryptocracy

Saturday, May 1, 2021

April 2021: Official Month Of Ponzi

April was the month in which the re-opening "recovery" con job became record overbought and overbelieved. This past month markets went FULL Ponzi in honour of Bernie Madoff, a man before his time...

Bitcoin peaked on the exact same DAY (April 14th) that Madoff died. You can't make this shit up. Now it's three wave corrective.

Scanning all of the various "alt-coins" with their asinine names, including Dogecoin the crypto that started as a joke and then became more valuable than Ford Motor Company - I've noticed that only Ethereum is making new highs. The rest have a very similar corrective wave pattern:

Here is DoggyCoin on the hourly making its third lower high:

Now, you may be wondering why am I looking at all of these pump and dump Ponzi coins? I am wondering the same thing myself.

It's because I believe they are the least highly manipulated markets if you can believe it. Crypto Ponzi schemes are LESS manipulated than stonks. Therefore I think that they are the clearest indication of social mood.

Case in point, the Google search term "Crypto" continues to be extremely popular. And we see it peaked back in 2018 with the Global Dow, and of course with the crypto bubble.

Also in the category of extreme RISK ON sentiment (positioning), the 5 day moving average Rydex ratio has been hitting new all time highs this past week.

The other big story in April was corporate earnings. This past week saw Tech earnings from all of the big names: Microsoft, Apple, Google, Facebook and Amazon. All of these stocks ramped during the month of April, as we see by this island formation in the XLK. We've seen this movie before - where algos use earnings season to catapult mega caps into orbit on non-existent volume. Now past earnings, the insiders are free to begin selling shares again, which they have been doing with wild abandon lately, particularly in Tech stocks. I am sure they would like to take advantage of these new all time high prices. In other words the convenient volume collapse that took place in April, may not continue.

Semiconductors in particular are repeating their pattern from February:

The real point of all this market manipulation is to keep the IPO/SPAC issuance market running at a record level. 2021 already surpassed 2020 for IPO issuance. Which looks like this on an average monthly basis:

In summary, during April the stonk market officially became the most overbought in history.

"During 18 sessions this month through trading on Thursday, 95% or more of the index’s members traded above their 200-day moving average. That’s the most days ever observed in a single calendar month and double the previous high of nine days in September 2009"

"There is only one precedent in history for such a rapid doubling, when U.S. stocks doubled between June and September 1932,” Deluard says. “A 40% correction quickly followed, and then another 100% + rally in a confusing sequence of brutal bear markets and dazzling rebounds which lasted until the battle of Stalingrad turned the fate of World War II"

Friday, April 30, 2021

Alchemy Only Gets You So Far In Life

We are witnessing record market manipulation by central banks, momentum algos, Reddit chat rooms, industry con artists, and of course Wall Street psychopaths. All of it is taking place in broad daylight and is assiduously encouraged by a populace desperate for this delusion to continue by any means necessary. When this super bubble explodes, regulators will be dealing with a collapsed Tech bubble, a collapsed echo housing bubble, a debt crisis, and a wiped out generation of Millennials who were too young to see the first renditions, so now they believe they are invincible to all of it...

Just remember: "No one did anything wrong"

Thursday, April 29, 2021

The New Utopia

Wednesday, April 28, 2021

EPIC HUBRIS At the Pinnacle Of Fraud

We are seeing a level of central bank adulation that is beyond the asinine. An entire society convinced that printed money is the secret to effortless wealth. Those who believe this contrivance will find their future is forever stained by the epic fraud that defines this era...

We talk about the financial consequences of this rolling pump and dump scheme all the time. Buy this bubble or that bubble and get out ahead of everyone else or explode in place. Those are the choices.

However, the other major consequence of this era will be measured in lost credibility, damaged reputations, and destroyed careers. Don't worry about Wall Street, I doubt there will be one after this event - their primary line of business pumping junk IPOs/SPACs/subprime mortgages into public markets will be regulated out of existence. This era will separate those who bought and believed the largest fraud in human history versus those who wanted nothing to do with it. Sadly we see that the pressure to capitulate to mandatory optimism is overwhelming. No amount of intellect can prevent those in the financial services industry from succumbing to the primary economic imperative which happens to be blind optimism for the future. Why? Because 90% of the time, optimism is richly rewarded. However, 10% of the time it proves to be lethally fatal. Sadly we are in the sudden death overtime phase of the richly rewarding era. The muscle memory of the past is now guiding the extrapolation of delusion into the indefinite future.

Somehow today's con artists have convinced the public that a massively leveraged post-pandemic re-opening is the strongest recovery in history. Meaning, the exact same businesses that were forced to shut down last year, will now partially re-open and economists will hail that as a record recovery. All because they base ALL of their economic metrics (metricks?) off of year over year comparisons. Last year being dire depression, this year being greatest economy in history. No other profession could get away with this level of incompetence.

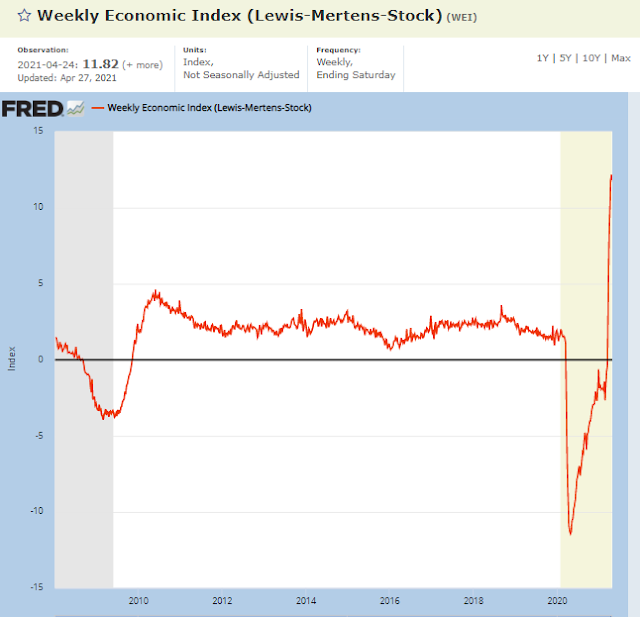

According to the Fed's own economic model, these are the leading indicators based upon one year rate of change relative to a locked down pandemic:

Here we see, the "greatest recovery in history" attends U.S. payrolls at a level first seen five years ago:

The recent passing of Bernie Madoff at the pinnacle of the largest global Ponzi scheme in human history will this weekend be matched by the spectacle of "The greatest investor of all time" holding court at his annual confab.

It's called tempting fate.

With a straight face Buffett will regale his acolytes with tall tales of his legendary success. There is only one problem, it will be all bullshit. Since 2008, Buffett and his billionaire cohort have been bailed out by non-stop monetary intervention. So much so that monetary policy is no longer having ANY effect on the economy. Its sole use is to prop up the wealth of multi-billionaires at public expense. Monetary policy is now the method by which wealth passes from the middle class into the hands of the ultra-wealthy on its way to offshore bank accounts.

From an economic standpoint, the situation we face was last faced in the 1930s - a liquidity trap. A scenario in which interest rates reach a point at which there is no one left to borrow. Looking back, historians will say that the pandemic lockdown concealed a liquidity trap that was deemed to be temporary, but turned out to be a permanent scarring of consumer confidence.

"A liquidity trap is a contradictory economic situation in which interest rates are very low and savings rates are high, rendering monetary policy ineffective"

Here we see that consumer sentiment has in no way recovered back to its pre-pandemic levels, notwithstanding the biggest asset bubble in human history.

As it stands now, central bank alchemy still "works" to the extent that it inflates asset bubbles. However, in the experience of Japan (and China), when these bubbles deflate, even that "super power" will be rendered useless.

And then, the underwear will be mighty stained.

Sorry Warren. Been there, done that.