Saturday, April 24, 2021

Bernie Madoff's Market

Thursday, April 22, 2021

ALL WARNINGS IGNORED.

Wednesday, April 21, 2021

Nothing Matters Until It Explodes Spectacularly

Tuesday, April 20, 2021

Pigs To The Slaughter

In what can only be described as human history's biggest mass con job, central banks have systematically desensitized gamblers to all risk. They are now cycle high fat, dumb, and happy. I call it monetary euthanasia...

Compliments of central bank alchemy, the shortest bear market in history yielded the best one year market gain to an all time high in market history. In addition, inflation expectations are the highest since the end of the last cycle, retail investor speculation is cycle high, and now we learn that the market is two decade overbought.

All late cycle indicators peaking at "the beginning of a new cycle".

One of the indicators I haven't shown recently, shows the ratio of mid cap stocks to the large cap Dow. What we see is that mid caps peak relatively early, they underperform for a while and then they burst higher at the end of the cycle due to short covering. In addition, commodity stocks (second pane) outperform at the end of the cycle and of course inflation expectations are highest at the end of the cycle:

This fraudulent recovery which is based solely upon asset inflation has seen some ludicrous moves in asset prices. However, few sectors are as insane as the retail sector which was blighted by the pandemic. And yet, it's the top performing sector over the past year. This entire sector has been "Gamestopped" higher amid record store closures.

Which has fulfilled the circular mirage of "recovery" based upon capital misallocation.

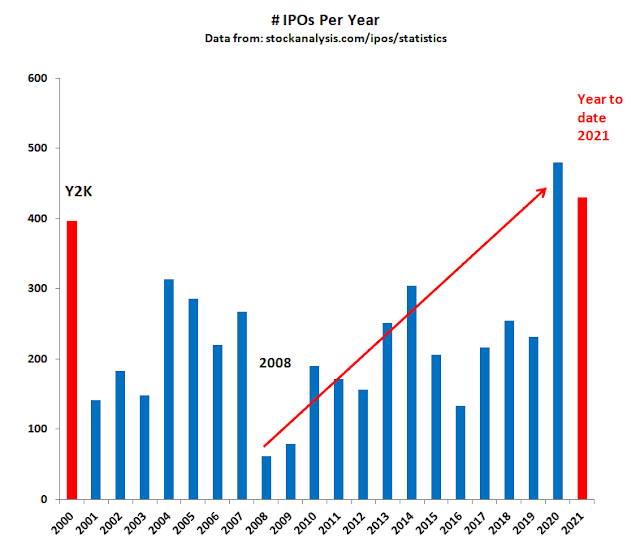

Another thing you don't see at the beginning of a cycle is cycle high IPO/SPAC issuance:

Herein lies the problem:

Over the course of this 12 year continuous monetary bailout cycle, investors have become more and more complacent. I use a ratio of NYSE down volume over up volume to show the degree of panic selling.

Back in 2008 when it was the end of the cycle, panic selling peaked. Subsequently, we have seen lower peaks over the course of the cycle. We are to believe that the lowest level of selling in the entire cycle marks the beginning of a new cycle.

Sure.

What we are about to witness is 12 years of pent up selling, which will make 2008 look like a picnic.

And then everyone will know what we know. It's the end of the cycle.

And this is no time for bullshit from the same proven assholes who lied last time.

Monday, April 19, 2021

This Orgy Of Excess. Is Leveraged To DogeCoin

We still don't know why the cryptos crashed. It could be that the last fool was found. Like Gamestop, cryptos are uniquely suited to the Congressionally approved Ponzi investment strategies hatched on Reddit...

The intended design behind Bitcoin and other cryptos is to create scarcity. As price moves higher, the amount of supply becomes increasingly constrained by the mining algorithms, difficulty level, and available hashrate/computing power. Therefore, liquidity becomes constrained as well. These were precisely the conditions that attended the massive Gamestop short squeeze. However, the scarcity factor for Gamestop came from the fact that hedge funds had borrowed the shares and were forced to buy them back. Low liquidity is a critical requirement for parabolic price moves, but unfortunately it cuts both ways. Which is why Bitcoin is known for its two way volatility. It will never be a stable currency. It's a speculative toy. The rest of the cryptos are even worse. There are now over 6700 cryptos and they are proliferating like rabbits. The fact that they are all 100% correlated should serve as a warning sign to speculators.

New "flash loans" are allowing crypto speculators to use cryptos as collateral to buy other cryptos. In the same way that 2007 era subprime CDOs were built upon other subprime CDOs creating instantly exploding CDO "squared", which had the shelf life of a rotten banana.

We now have a similar thing in Crypto Ponzi schemes:

“In a way, flash loans make everyone a whale” said Nikola Jankovic, community manager at flash loan provider DeFi Saver, referring to the crypto industry nickname for large investors who are often able to move markets by themselves."

Leveraged cryptos are the ultimate form of speculation. It's the crack cocaine of gambling, so it should come as no surprise that the crypto bubble is one of the last and largest speculative bubbles to burst.

Ponzi King Mike Novogratz warned last week that we are seeing a blow-off top in crypto speculation:

"I've seen a lot of weird coins like dogecoin and even XRP have huge retail spikes, which means there's a lot of frenzy right now."

"In the next week, certainly we could have some volatility because of the excitement around Coinbase."

Indeed, we have already started to see some volatility. I showed this chart below on my Twitter feed which overlays the Google trends search term "Crypto", onto a graph of the Global Dow. As we see, they peaked simultaneously in 2018. This time, crypto searches peaked back in February with the Nasdaq and is having a double top now with the Global Dow. We also see that margin debt peaked in early 2018 when the crypto bubble exploded. This time however, a "washout" in crypto could have carry-over effects into mainstream financial markets. Why? Because now, BitCon has gone mainstream and is the "most crowded" hedge fund trade of 2021. In addition, Robinhood now allows stock gamblers to buy cryptos on their platform.

It's the equivalent to linking the U.S. banking system to the subprime housing market in a speculative housing mania. It's a bad idea, considering there is now record margin debt AND crypto is a $2 trillion market cap - almost three times larger than in 2018. It's a disaster wanting to happen.

The way I see it, the same way Gamestop fueled a manic reach for risk that exploded in February, the Coinbase IPO fueled a manic reach for risk that is peaking now.

The question on the table is if a $20 billion pump and dump scheme almost crashed the market, what does that portend for a $2 trillion pump and dump scheme that is 100x larger?

Feb. 17th, 2021:

April 17th, 2021:

“It’s reminiscent of GameStop”

Indeed.