Sunday, March 7, 2021

A Generational Meltdown

Friday, March 5, 2021

Reversal Of Fortune 2021

"Net issuance of Treasury bonds and notes are set to hit an all-time high of $414 billion in March, almost the twice of the previous record"

Thursday, March 4, 2021

Denialistic Self-Implosion Is A Consensus Trade

Exactly one year from the COVID meltdown and gamblers have converged on the lethal consensus that the pandemic is over and a new cycle of delusion has begun...

The all things Tech "work from home" trade is officially over. Cramer said so himself just today. Unfortunately, the world's most overbought and overowned Tech fund is already in a bear market. Wednesday's close triggered the first Nasdaq Hindenburg Omen since February 2020:

"A rise in the 10-year Treasury note yield to around 1.47% on Wednesday has underpinned the rotation out of tech and tech-related companies and into energy and financials, which are expected to perform better as the economy recovers from the COVID-19 pandemic"

Wood told CNBC recently that she’s not perturbed by yields and is anticipating a pullback, vowing to double down on some bets"

This chart is a reminder as to what ALWAYS happens to over-crowded consensus dumbfuck trades. They work great on the way up, and then they give up three months of gains in two weeks on the elevator ride down. You can see via volume by price (side green/red bars) where most of the dumb money is trapped. At the top:

This chart below shows how quickly the Nasdaq morphed from record overbought back to one year oversold. The last time breadth was this weak was the first week in March 2020, just before the wheels came off the bus.

Good times.

Whereas Technology stocks were officially the most crowded trade of 2020, the most crowded trade of 2021 is of course the reflation trade and economic cyclicals - retail, banks, industrials, hotels, airlines, and of course energy stocks. Energy was the worst performing sector in 2020 and so far in 2021 it is the best performing sector.

There are several seminal reflationary events taking place this week. First off, Fed chief Jerome Powell is speaking today which is always good for boosting inflation expectations - he did not disappoint:

"Powell did acknowledge the rapid rise in rates recently caught his attention, but said the Fed would need to see a broader increase across the rate spectrum before considering any action"

In other words, the Fed is going to let inflation run hot, and in the meantime Tech stocks and other deflation trades will spontaneously implode. Which includes the bond market of course.

The second major event this week was the OPEC meeting which just concluded with a decision to maintain current output levels. This is the best news possible for oil and energy stocks, meaning that the best case scenario is now getting priced into the best performing sector of 2021:

In addition, there is the Biden stimulus package which is now heading for the Senate. The goal is to have it passed and signed by the end of next week. All indications are that it will pass.

Next, there is the monthly jobs report for February which is Friday morning. All of which is setting up a no win situation. More reflation expectation implodes the Tech trade, bonds, and Emerging Markets. A weak jobs report implodes the most crowded consensus trade of 2021.

"Emerging-market bonds are becoming increasingly vulnerable as Treasury yields climb with the level of 2% on the U.S. 10-year note likely to trigger major outflows"

The velocity of the moves in U.S. Treasury yields are now intensifying at a time when both hard currency and local emerging-market bonds are more vulnerable to such a move,”

In summary, the risks of this ALL IN gambit, now extend across global stocks, bonds, and currencies.

You can't make this shit up:

“The product is a little mind-blowing,” said Tyler Gellasch, executive director of Healthy Markets. Gellasch thinks that the ETF “appears to be capitalizing on what could very well be determined by SEC and FINRA to be market manipulation,”

What could go wrong?

Tuesday, March 2, 2021

An Unrequited Faith In Printed Money

The beginning of every new cycle has always been a leap of faith for investors. However, this time it's a fatal one. What was once standard business cycle investment strategy has now been reduced to Fed sponsored mass deception, at the happy intersection of Wall Street conflict of interest and rampant denial...

The wolves of Wall Street are using the cycle playbook against rube investors and those who should know better, under the fake auspice of a whole new cycle. The question they are all ignoring: Are inflation pressures greatest at the beginning of the cycle or the end of the cycle? At the end obviously. And yet we are seeing cycle high inflation expectations right now. The highest since the end of the last cycle:

"Early inklings of inflation were evident in data from the Institute for Supply Management this week: Measures of prices paid jumped to their highest levels since 2008"

Which begs the question, can massively over-leveraged credit markets and the global pandemic housing bubble really afford this recovery?

The answer ironically, is of course, no. We must remain in a permanent state of deflation OR else we will explode the credit market. This current path of ever-growing fiscal stimulus packages is the path of greatest explosion.

Historically, central banks increased monetary stimulus at the beginning of the cycle to reliquefy markets and buy time until the economy caught up with asset prices. Taking their cue from central banks, markets have always responded ahead of the underlying economy. The leap of faith has been that the economic recovery would follow. In the good old days, monetary policy stimulated BOTH markets and the economy.

This time however, the Fed has no interest rate ammunition left. Therefore, beyond bidding up asset prices to asinine levels, the only "economic" function of monetary stimulus is to finance never-ending Federal stimmy payments now fully conflated as "GDP". In other words, the role of monetary policy is now to assist with the illusion of recovery.

This of course is all Japan-o-Nomics on steroids. The overuse and abuse of recurring stimulus gimmicks, preventing any and all policy changes that would be necessary to rebuild the economy. Levitated markets merely provide the illusion that it's all working.

And why would otherwise sane money managers buy into this fraud? Because they have no choice. Global interest rates are so low that money managers are on a constant hunt for "yield" and markets pinned to all time highs give the illusion of perpetual yield. Be that yield from bonds, from dividends, from selling options, selling volatility etc. It all works great as long as the bubble never explodes. Because below the fragile veneer of Disney markets is the dead zone of imploded yield seeking. Which means that "strategies" that work great in an up market, spontaneously explode when capital losses exceed the recurring gains from yield pickup strategies. Today's money managers are nothing more than call options on the cycle. A cycle which in their minds must continue indefinitely via continuous central bank fraud or whatever means necessary.

We have now taken the first inexorable steps down the path towards universal basic income. And the bond market is starting to wake up to this fact. What we saw one year ago in March is that it took substantial effort and several weeks for the Fed to get the Treasury bond market under control in the Japanese tradition. In the meantime, the Fed has ceded control of the bond market to reflationary forces. For all of the talk of QE controlling markets, Fed bond purchases have already failed to keep a bid under their target asset class. All of which means that leaving aside the economy, the first order financial paradigm shift we face is for the Treasury bond market to come to terms with unlimited Treasury bond issuance. A feat they have abjectly failed to accomplish to date, and one they will need to achieve DURING a global market liquidation. Suffice to say, the pikers on the NY Fed bond desk will have their hands full.

I predict it will be an epic gong show. Deja vu of last year we will see extreme two way volatility in the T-bond market. However, ultimately, the Fed will get the market under control. Even if they have to buy all new issuance for the first time in history. In the meantime while the Fed is preoccupied with the Treasury market and the overnight repo market and the basic financial plumbing, all other risk asset classes will spontaneously explode - for no other reason than being too far from the printing press. Contrary to popular belief, Go Daddy and other Tech stocks will not be safe havens from extreme deflation. If you notice in the background of the chart below is Momo Tech (gray). These stocks have been correlated to rising yields since last March.

Last year, T-bonds were record bid in early March and then they imploded mid-month when the Fed panic cut rates to 0% and launched QE infinity (March 15th). The next day the stock market was limit down at the open. Between March 9th and March 18th the period during which the Fed initially panicked, the T-bond ETF crashed 40 points.

This year, T-bonds are already back down to the March 2020 lows. You don't have to be a genius to see what could happen if the T-bond market crashes from these levels. EVERYTHING is priced off of Treasuries.

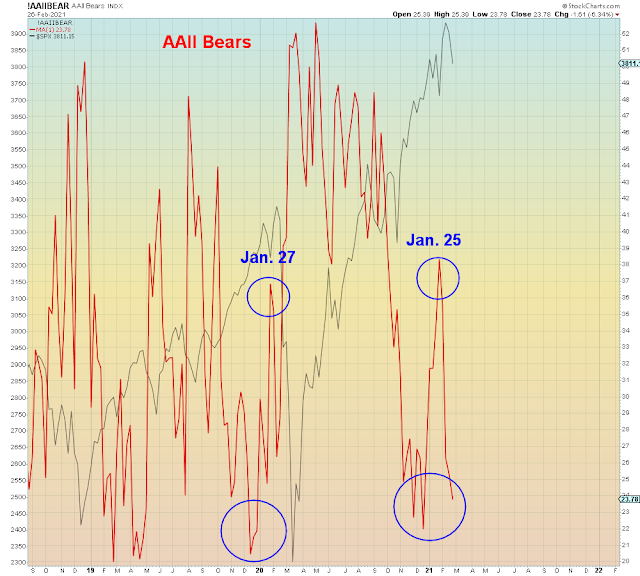

When Gamestop almost crashed the stock market, that was the sign to get out of Disney markets.

Monday, March 1, 2021

Global Implosion Is Ahead Of Schedule

One thing all of today's economists, analysts, and market pundits have in common is that they are looking in the rear view mirror while driving forward. A dangerous way to live...

Using the Dotcom March 2000 analog, the 2021 meltdown is ahead of schedule. According to last year's implosion it's right on time.

Here we see the Nasdaq circa Y2K - melted up from November '99 to March 9th, 2000. Imploded, had a three wave rally (2) and then crashed. For those who are not familiar with Elliott Wave theory, three wave retracement rallies are not bullish.

While most pundits today are still busy upgrading their price targets for 2021, the Nasdaq peaked two weeks ago. Similar to Y2K, the melt-up began in November, but this time it peaked in February. During the past two week selloff, breadth collapsed back down to early March 2020 levels (lower pane), which has led to this oversold bounce. Last year's initial oversold bounce (circled) lasted four trading days. This bounce is on day five, having launched last Tuesday:

A three wave correction is not visible on the Nasdaq chart above, as the rally is too weak, however, three waves are becoming evident on Momentum Tech, as speculators have piled back into the highest momentum stocks.

New S&P highs never confirmed this was a durable top. Just another headfake - the least credible one we've seen to date:

Here we see the Nasdaq highs - lows. This is the fourth fake rally we've seen in three years. Each crash has been of greater magnitude. This one will be epic.

It's clear that central banks enjoy pump and dumps, since they are never the ones left holding the bag:

People always want to know, what would make me bullish?

Extreme panic on the part of gamblers and central banks. And prices at least 50% lower. And my broker still online.

Sunday, February 28, 2021

Brace For Rampant Deflation

So many fools today are worried what happens if yields keep rising, that they are ignoring the real risk - what if they don't keep rising? While copious dullards are on the lookout for inflation, they are about to get trucked by deflation. Starting with asset deflation which will bring about uncontrolled economic deflation. Central banks will be powerless to stop it...

I wrote this article in response to this Zerohedge post:

Most pundits today believe that all it takes to create inflation is Fed balance sheet expansion. If that were true then Japan would have extreme hyperinflation by now. The Yen would be worthless. However, despite having the most aggressive QE program in history Japan has been mired in deflation for over thirty years. In addition, the BOJ is Japan's largest stockholder. And yet, the Yen is STILL viewed as the ultimate safe haven, safer than the U.S. dollar. Globalization is inherently deflationary. It's not meant to create middle class wealth, it's intended to monetize the middle class to mint new billionaires. A dubious "capability" that reached record wealth inequality over the past year, in what can only be called the biggest billionaire bailout in history. And yet they STILL don't see the inherent deflation risk in this "system". Nothwithstanding this deflationary track record for forty years straight, deflation remains the least expected outcome on Wall Street.

Once again, the reflation trade is the most crowded trade on Wall Street right now. As we see via the graphic above, the consensus belief currently is that the vaccine rollout is leading to inevitable recovery which will accelerate in Q2. In the meantime, the ongoing stimulus is "building a bridge" to full recovery. The reflation narrative assumes that the record asset bubble continues growing unchecked, to infinity. However, in my view the asset bubble is the biggest risk to this fairy tale. When the Dotcom bubble exploded in March 2000, the Fed had 6% of interest rate buffer to cut to offset recession. They used 4.5% of it. This time, the Fed has zero % interest rate buffer. Which means that "stimulus" is entirely dependent upon a fractured Congress who can't agree on anything. Even within the Democrat party, fault lines are now appearing between fiscal moderates and the radical left.

The pandemic has made economic reflation far less possible than it was one year ago before the crash. Post-pandemic, we now face too much unemployment, too much debt, too much corporate insolvency and of course far too much asset speculation. Central banks have ALREADY lost control of risk asset markets, which have been levitating vertically towards a lethally overbought condition. A correlation of "1" in which all unhedged speculators are on the same side of the ultra crowded reflation trade - across stocks, bonds, and currencies. Fittingly, by pushing asset valuations to unprecedented levels, speculators have made their expected outcome far less likely to occur.

Today's pundits who make the least sense are the ones who acknowledge the insane asset bubble AND who predict imminent hyperinflation. Do they not understand what inflation does to interest rates and bond markets? It explodes them. It ends the economic cycle as it has every other time in U.S. history. As it's doing now - reflation continues just long enough to create a credit crisis:

Of course the current back up in yields is minor compared to what we have seen in the past. Only now, yields are back to December 2019 levels, after $7 trillion of combined monetary and fiscal stimulus aka. 30% of the economy.

Here we see the oil market as a proxy for global recovery aka. lack thereof.

The fact that central banks no longer have control over risk markets will soon be evident to even the most stoned of gamblers. They have been fully willing to ignore the risk as long as overall markets were marching higher. When it all explodes lower, they will not be quite as complacent. What took five weeks one year ago to get markets under control will likely take even longer this time. However, the real problem will be economic, as policy-makers won't have the ability to adequately stimulate the over-leveraged economy.

Given all of these risk factors, I currently don't see any serious prospect for sustained reflation on the horizon at this time.

Gold is confirming what I see right now - stoned gamblers chasing risk in the biggest bubble in human history while making up stories about economic reflation to justify asinine valuations. They are reaching for maximum leverage going into an economic depression.

A lot of hot air, just waiting to explode.