"Chief Justice John Roberts twice saved Obamacare, and he appears ready to uphold it again. But Roberts is growing weary of it all"

Wednesday, November 11, 2020

The Invisible Hand Of Implosion

"Chief Justice John Roberts twice saved Obamacare, and he appears ready to uphold it again. But Roberts is growing weary of it all"

Tuesday, November 10, 2020

Goldilocks And No Bears

We have no economy, no stimulus, no vaccine, and no president. So instead we get bedtime stories with happy endings, in the Wall Street tradition...

The great rotation to value continued for the second day today. How many times just in the past year alone have we heard this story? Recall not even a month ago, the entire "blue wave" fantasy was going to bring endless reflation. Then, that crashed ahead of the election, as the odds of a contested election increased. Last week, we got the Goldilocks fairytale via Zerohedge:

Friday, Nov. 6th

"So what about the reflation rotation - is that dead? Well, according to BofA, yes"

That prediction had a shelf life of hours. Not to be outdone, Barron's had an article over the weekend saying that Tech stocks are the new safe havens. That trade has been getting monkey hammered this week.

Now, of course all of the dumbfucks have raced BACK to the other side of the boat. Embracing the vaccine reflation trade and dumping Tech deflation trades en masse.

Fast Money started out with a segment tonight on where bond yields are headed. The unanimous consensus was higher. Meaning buy banks, industrials, hotels, airlines etc. Every time Tech pulls back, the value rotation hypothesis comes back in fashion. Go figure.

CNBC: Prepare for Bond Yield Breakout

Anyone who trusts people who can invert their entire bedtime story in a matter of hours deserves their fate.

So, what's the answer, deflation trades or reflation trades? The answer is NEITHER. Cash is king.

First, I will revisit the reflation trade which I touched upon yesterday. Here we see the thirty year yield with Treasury bond shorts (lower pane). As we noted last week this is the most crowded trade in human history. The net speculative as of the most recent CFTC data is from one week ago. However, anecdotally one could make the case that this is still a crowded trade.

All it would take is one state-wide lockdown and this trade will explode, meaning bond yields will fall.

Backing up this hypothesis is the fact that the equity option call/put ratio is back at the all time high from June, which is when the entire reflation trade spiked and then exploded:

Of course, when the reflation trade exploded back in June, there was a MASSIVE rotation back to Tech stocks. Because those are safe havens, remember? Why can't that happen this time around?

After June, Tech continued climbing and then had a blowoff top back in September. Since that time, the sector has been trending down. Each rotation to "reflation", has led to a lower high in Tech.

We learned today that Millennials are now doubling down on work from home stocks as they take profit in cyclicals.

Which explains why there has been no panic. Yet.

All of which leaves Utilities holding up the Casino:

Gamble at your own risk.

Monday, November 9, 2020

Winter 2008 Deja Vu

After more than a decade of monetary Japanification topped off with four years of Circus Donny, one thing we've learned with certainty is that an aging society can no longer accept the truth...

The World's handling of this pandemic has been all wrong from the start. Trump's handling of it was the worst in the world. I seldom agree with Bill Gates, but he has said from the start that testing was key to keeping the economy open. He was spot on. However, Trump in his infinite denialism put all of his eggs in the vaccine basket. And many people believed it would be a silver bullet panacea. Even now, with Pfizer's most recent 90% efficacy indication, it won't prevent the winter from hell. What it will do however, is allow people to let their guard down and assume the pandemic is ending. Which will increase the spread further.

As Gates has said, if we had focused our efforts on instant testing, most of the economy would be back open by now. However, denialists don't like testing because it "causes" the case load to skyrocket. Which looks bad for Trump. Denialism strikes again.

Which gets us to the casino and the 2008 paradigm.

People forget that there were many false dawns in that fateful Autumn leading into winter. The largest rallies are always in bear markets, which caused a lot of people to assume the worst was over.

The last false dawn was a fake reflation rally that put a massive bid under cyclicals and in particular small cap value stocks which had been beaten down the most. Nevertheless, like all things Wall Street, it was an ephemeral end of cycle blow-off top. Bought and believed by the majority, solely due to the misallocation of capital and short-covering.

Last week starting on election eve, Wall Street put on a massive Tech trade and shorted the Russell 2000 under the auspice of the Goldilocks gridlock trade.

Now all we are seeing is that trade get monkey hammered due to one vaccine headline. In Disney markets consensus trades are lethal.

Zooming in to this year's view, Regional banks are leading this last rally amid a familiar spike in bond yields. June was the mid-point of the rally and this is the end:

Due to mass delusion, most people today are of the brainwashed belief that this economy is stronger than the one in 2008:

"Joe Biden is returning to the White House to lead the United States in the midst of an economic crisis after beating President Donald Trump in Tuesday’s election, a turn of events likely to conjure an eerie sense of deja vu for the Democratic former vice president."

Unlike in 2008, when the country elected Democrat Barack Obama and his running mate Biden as the global economy teetered from the sub-prime mortgage crisis and collapse of the Lehman Brothers investment bank, the worst of the current economic downturn may have passed already, economists and analysts say."

Got that? The worst is over.

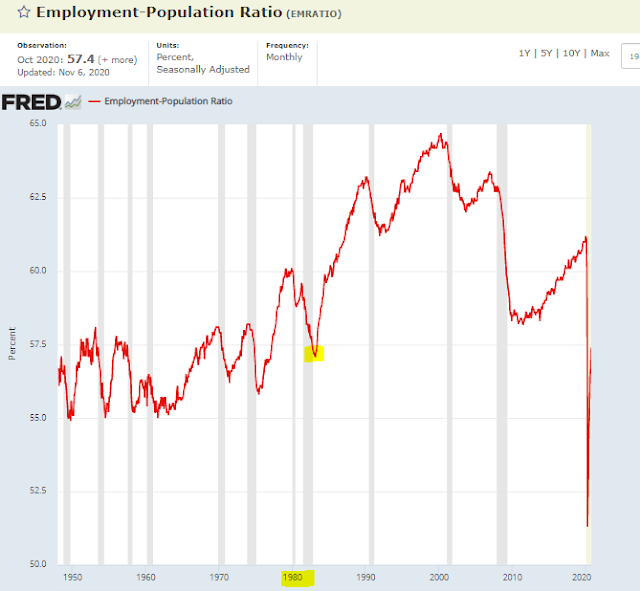

There is literally no basis to compare today's imploded economy to the one in 2008. Today, there are millions more unemployed than at the peak in 2009. Today, combined fiscal and monetary stimulus is DOUBLE what it was in 2008.

Here we see the employment/population ratio is at the lowest level in four decades. Large companies are crushing small business, and society is ignoring the consequences.

Oil demand is a good proxy for economic activity. This economy just lost three decades of oil demand.

Emerging Markets peaked almost three years ago near the beginning of the MAGA fantasy. Now they are soaring back on the belief that the worst is over.

When in reality, the worst hasn't even started yet.

EMs are a good proxy for global social mood, which is three wave corrective:

In summary, we have a v-shaped recovery in delusion. Wall Street is like every other American Dream factory - Disneyland, Hollywood, Faux News - it's 100% fraudulent. And yet people accept the lies over and over again.

Right now, we are watching the final capitulation to fantasy. A movie some of us remember, and most want to forget.

Sunday, November 8, 2020

Front-Running Collapse

Saturday, November 7, 2020

The MAGA Kingdom Is Rigged To Explode

Friday, November 6, 2020

Running With The Bullshit

Over the past 12 years stoned gamblers became addicted to monetary heroin. Over that time, the dumbest money enjoyed the biggest (unrealized) gains, until there was no smart money left to find. COVID ended that paradigm; unfortunately there's no one left to get the memo. Now there is universal belief that printed money is the secret to effortless wealth. Because everyone knows that 7 billion morons can't be wrong...

What was astonishing on election eve via the futures market was the MASSIVE rotation to the monetary heroin (QE) trade and the simultaneous dumping of the reflation trade, as the blue wave got priced out. The Nasdaq 100 and the Russell 2000 were polar opposites of green and red. It was the exact reverse of four years ago when Trump got elected and the reflation bid was put on in size.

Below we see via the Nasdaq futures that the election rally came at the mid-point of the three wave rally:

This week, the Nasdaq 100 returned to the same level from two weeks ago at the blue wave high.

Year to date, the Nasdaq 100 has seen the largest inflows in two decades:

What happened that night of course was the story of the week, and the year:

"A strange thing happened on the way to the biggest post-election surge in modern stock-market history. On Wednesday, while the S&P 500 was tacking on $600 billion of fresh value, most of its members fell.

How the index still managed to gain so much altitude is the story of the week and of the year: a reigning oligarchy of market behemoths, soaring past everything else"

...it was the first time in at least six decades that the S&P 500 jumped more than 2% as more volume flowed into declining securities than advancing ones on the New York Stock Exchange"

Here on a weekly chart we see that the virtual economy was down for the two weeks prior to the election. And then enjoyed the largest up volume EVER this past week. And yet the index (ETF) never made a new high:

Rotation into an imploding Tech bubble is only part of the bull trap that took place this week.

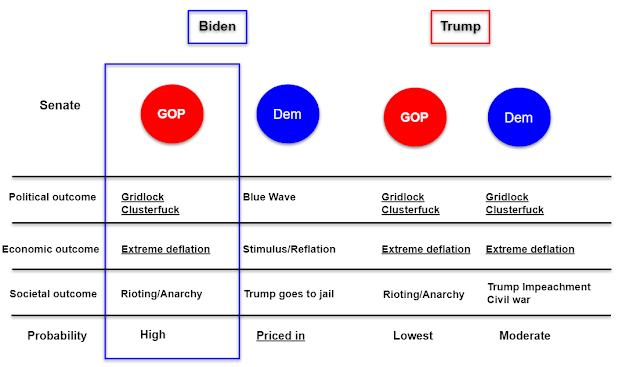

Prior to the election, along with every other pundit, I posited the various election scenarios. Going in, the blue wave was priced in. However, I gave this current gridlock SNAFU a probability of "high". I said the outcome would be deflationary and rioting would be pending the end of stimulus.

Nevertheless, Wall Street being what it is - an asset allocation machine with a bedtime story to follow, has rotated to the QE asset reflation narrative in size. Zerohedge does a great job of explaining the new narrative, while questioning absolutely none of it. How could something that worked so well for over a decade, fail now? Won't the stock market diverge from the economy forever?

When the usual people go under the bus, that's "Goldilocks" in Wall Street parlance. Because the only people who get bailed out in this economy are the criminals who collapse the financial system.

Gold exhibits everything that is wrong with the policy of monetary euthanasia - we have an imploding economy and ubiquitous belief in free money. Gold ETFs have seen record inflows during 2020. The abiding belief is that as long as the monetary spigots are open, gold can't go down. Here we see that from 2009 to August 2011 gold rose along with Treasury reflation expectations. However, when Treasury yields rolled over, gold followed. The QE in 2013 had no effect on reversing gold's downtrend. Fast forward to now and we see that gold gamblers have been front-running reflation for two years now, going back to October 2018.

It's a very crowded asset allocation rally aka. a greater fool's rally.

It should come as no surprise that gold peaked when the stimulus ended in July. Since that time, amid record inflows it has trended lower, until this week:

Meanwhile we already got news that the stimulus impasse we've enjoyed since the end of July is already set to continue:

Those who are wed to their trades and to groupthink narratives will never make it through this impending gauntlet. First they will hide out in mega bubbles that are perceived safe havens, then when those implode they will rotate to cash just when the real money printing gets started. Applying the standard lessons of the past decade will be lethal.

This generation is way overdue a good hard lesson in basic economics. The cost of this deflationary oppression has been falling on the working class every day since 2008, while the Casino class has been enjoying non-stop asset reflation. There is only one way to fix the problem.

Return to the origin, sans bailout.

Base case scenario.