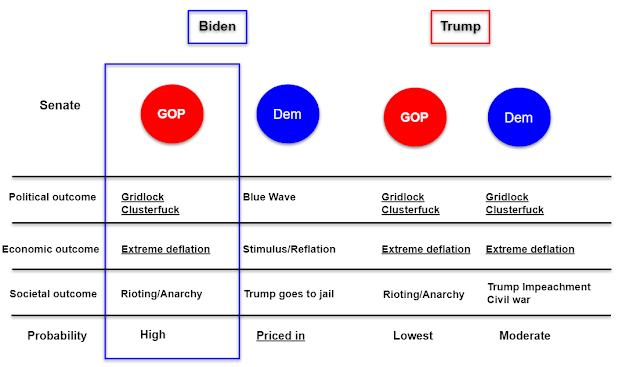

We have no economy, no stimulus, no vaccine, and no president. So instead we get bedtime stories with happy endings, in the Wall Street tradition...

The great rotation to value continued for the second day today. How many times just in the past year alone have we heard this story? Recall not even a month ago, the entire "blue wave" fantasy was going to bring endless reflation. Then, that crashed ahead of the election, as the odds of a contested election increased. Last week, we got the Goldilocks fairytale via Zerohedge:

Friday, Nov. 6th

"So what about the reflation rotation - is that dead? Well, according to BofA, yes"

That prediction had a shelf life of hours. Not to be outdone, Barron's had an article over the weekend saying that Tech stocks are the new safe havens. That trade has been getting monkey hammered this week.

Now, of course all of the dumbfucks have raced BACK to the other side of the boat. Embracing the vaccine reflation trade and dumping Tech deflation trades en masse.

Fast Money started out with a segment tonight on where bond yields are headed. The unanimous consensus was higher. Meaning buy banks, industrials, hotels, airlines etc. Every time Tech pulls back, the value rotation hypothesis comes back in fashion. Go figure.

CNBC: Prepare for Bond Yield Breakout

Anyone who trusts people who can invert their entire bedtime story in a matter of hours deserves their fate.

So, what's the answer, deflation trades or reflation trades? The answer is NEITHER. Cash is king.

First, I will revisit the reflation trade which I touched upon yesterday. Here we see the thirty year yield with Treasury bond shorts (lower pane). As we noted last week this is the most crowded trade in human history. The net speculative as of the most recent CFTC data is from one week ago. However, anecdotally one could make the case that this is still a crowded trade.

All it would take is one state-wide lockdown and this trade will explode, meaning bond yields will fall.

Backing up this hypothesis is the fact that the equity option call/put ratio is back at the all time high from June, which is when the entire reflation trade spiked and then exploded:

Of course, when the reflation trade exploded back in June, there was a MASSIVE rotation back to Tech stocks. Because those are safe havens, remember? Why can't that happen this time around?

After June, Tech continued climbing and then had a blowoff top back in September. Since that time, the sector has been trending down. Each rotation to "reflation", has led to a lower high in Tech.

We learned today that Millennials are now doubling down on work from home stocks as they take profit in cyclicals.

Which explains why there has been no panic. Yet.

All of which leaves Utilities holding up the Casino:

Gamble at your own risk.