So far, so bad...

Only this chart (below) gives a sense of the magnitude of hole that has been dug.

Source:

U.S. Bureau of Labor Statistics, Employment-Population Ratio [EMRATIO], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EMRATIO, June 29, 2020.

The political impasse continues. Barring a last minute miracle, it appears that the $600 additional unemployment benefits will run out at the end of July. At which point "GDP" will collapse.

Since the $2.2 trillion stimulus package CARES Act passed in March, Americans who lost their jobs have been able to collect an additional $600 a week in unemployment benefits on top of what their states have distributed.

That extra money is set to expire at the end of next month if lawmakers fail to act.

Labor Secretary Eugene Scalia said Wednesday on CNBC. “I don’t think that the $600 benefit is the answer going forward,”

Fiscal stimulus is about to be withdrawn and the Fed has been withdrawing monetary stimulus of late as well.

With the stimulus-depleted economy set to implode and along with it all of the fantasy projections on offer from Wall Street, that leaves momentum algos and over-leveraged gamblers clinging to key support:

The last time the Nasdaq (100) broke its uptrend, it fell straight to the 200 day, which is much further away this time around.

Here we see the World ex-U.S. with internet stocks in gray. The same pattern attended the February top as well.

Here we see via the cyclicals the two way headfake. First bears got rinsed when cyclicals jumped the 200 day shark and exploded to new highs. Then bulls got rinsed by the headfake overthrow.

Now back to neutral territory.

There is no reason whatsoever for cyclicals to be rallying right now except due to short-covering and retail speculators high on crack. Banks in particular are weak after the Fed restricted stock buybacks this past Friday, because they predict this second COVID spike will cause more defaults.

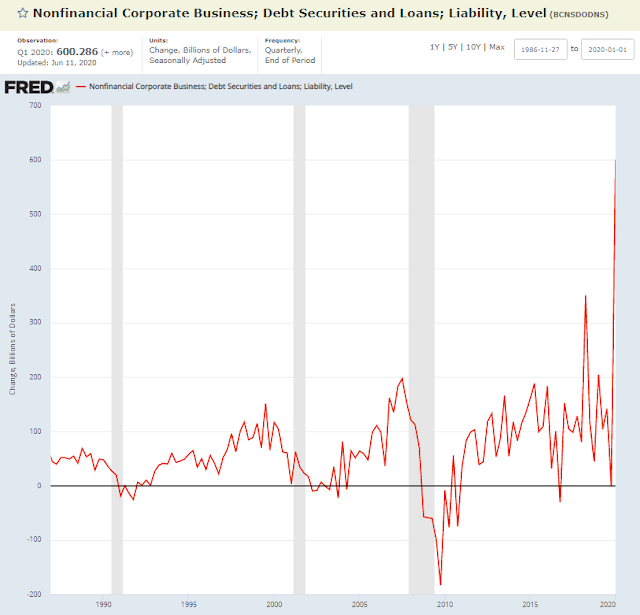

Defaults have been relatively light so far, due to Fed actions, however, that is about to change:

“We are seeing an acceleration in bankruptcies that is unprecedented,” said James Hammond, CEO of New Generation Research, which runs BankruptcyData. For 2020, he says, “I’m pretty confident we will see more bankruptcies than in any businessperson’s lifetime.”

Ranked by assets alone, says Hammond, the magnitude of bankruptcies this year has already surpassed that of 2008"

The company that pioneered fracking, just declared bankruptcy.

Good riddance.

For now, gamblers are ignoring rising credit risk

Stay at home bubble stocks are rolling over

Indeed.

Zooming out to the decade view, we see that the MAGA farce is ending.

Badly

Where gold bugs have piled into the beginning of a monetary-fueled rally, I see the end of one:

In summary, the fireworks are coming, just not the kind that are expected.

This will be the biggest crash anyone has ever seen in any lifetime