I attempt to approximate the political center - people who just want to get on with their lives amid a sensationalist spectacle that has enraptured the media. Ahead of the election, the nutjob level has been turned up to level '11'. Just when we think it can't get any worse, it gets worse.

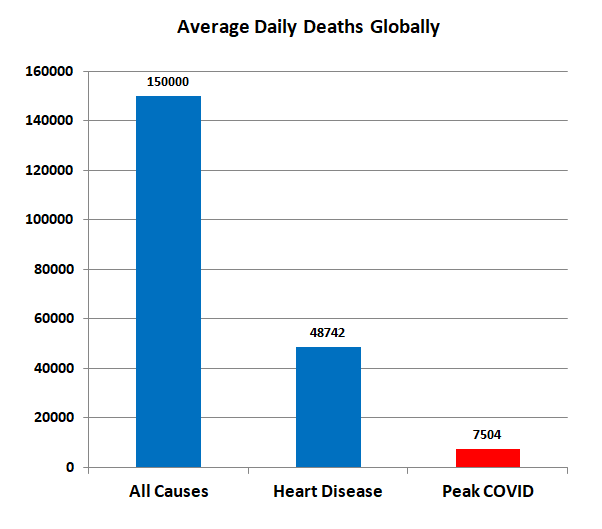

First on the COVID hoax. Via Visual Capitalist, below are the average daily deaths from all causes, heart disease (leading cause of death), and COVID. As the linked facts show, over-consumption is the leading cause of death via the two key vectors of heart disease and cancer.

In other words, McDonald's likely kills more people per day than COVID. But because heart disease and other lifestyle-related diseases are self-inflicted, we ignore those risks. It's clear on the COVID hoax that the old age home panicked. We are constantly told that the shutdown was ordered by the "experts". Which explains why it was officially history's biggest clusterfuck. Every country, state, and locality has different "experts" on pandemics. Recall that the global consensus on climate change was viewed as stifling denialist viewpoints. This gong show is denialist reward for a complete lack of consensus. I hope they're enjoying it.

But don't worry, the re-opening is on the way to becoming the new greatest clusterfuck of all time.

Within the U.S., based upon the average daily death rate, COVID deaths so far equal two weeks of deaths from all causes. Yes you read that right. The worst pandemic in modern history is equal to two weeks of Big Macs. If McDonald's brings back their Supersize menu, the COVID death rate will be a rounding error.

Which is where this gets interesting, because for those who have over-imbibed on the consumption-oriented deathstyle, the fear is very real and rational. It's not COVID that is putting people at risk, it's a lifetime of bad decisions that has put people at risk. Smoking, diabetes, obesity, and alcoholism are the leading complicating factors. This should be called the Super Sized pandemic.

The rest of us are now hostage to the bad decisions made by this panicked corporate Idiocracy:

Per the CDC: "For most people, the immediate risk of becoming seriously ill from the virus that causes COVID-19 is thought to be low."

Another topic I wanted to touch upon is this new censorship drive coming out of Big Tech as part of the George Floyd protest movement. Zerohedge was recently demonetized or demonized however you want to look at it, by Google, due to their politically incorrect conspiracy theories. That can happen when you cede editorial control to random nutjobs. Fortunately, I can't be demonetized, because I have never been monetized. My opinion is that those who comment on markets should eat their own dog food and make money from the markets. If they really know what they are doing.

Anyways, it's not Big Tech that is censoring the alt-right, it's the advertisers behind Big Tech that are realizing they can't have their lingerie ads posted next to neo-Nazi symbology. As a reminder, we live in a corporate Borg of like-minded idiots. They are not capable of accepting the truth or reality. Now this mindless Borg and their corporate overlords are exercising mob control over what they deem acceptable. Shocking, I know.

Again, the irony of corporate media oppression now impinging upon the conservative movement, can't be overlooked. It's ALL self-inflicted pain from a lifetime of bad choices.

Again, the irony of corporate media oppression now impinging upon the conservative movement, can't be overlooked. It's ALL self-inflicted pain from a lifetime of bad choices.

From an economic standpoint, the Black Lives Matter movement will go nowhere until everyone acknowledges that the current economic paradigm monetizes poverty. This model can't possibly fix poverty, because the corporate model is now wholly dependent upon ever-lower labour costs to increase profits and grow stock prices. Going in reverse would implode the stock market. And we all know that Trump Casino is now America's biggest Church with the largest congregation, and Trump as high priest. The economy can wither and die for all they care, as long as the casino keeps going higher.

So instead of any progress fixing economic inequality which happens to be the de facto business model of the day, we can expect more empty talk. Because after all, that's what this society loves most.

Until it all explodes amid epic rage and margined out stay-at-home gamblers shocked that in every bet there is ALWAYS a winner and a loser. And Dave Portnoy has put them all on the same side of the ledger. The side that gets monetized for fun and profit.

If it wasn't him, it would be some other con man that they were following to their logical conclusion. Which is exactly how Trump became GOP leader following the epic failure GW Bush. He was the next lowest common denominator.

Now, let's get down to some hardcore facts and data and leave the bullshit to everyone else we know.

Year to date returns by major sector.

Here we see that mega cap internet stocks are up over 20% on the year and the average U.S. stock is down -20% on the year.

The S&P peaked two weeks ago, since then it's been all mega cap Tech stocks and junk stocks. Here we see Mega Caps up six days in a row:

Here we see the difference between the market low in 2009 versus now.

The crash ratio is currently still in extreme territory and cash balances remain near all time lows:

Biotechs were on fire today, and we now have a new best performing lockdown stock:

Dave Portnoy's latest scrabble pick was "RTX" Raytheon Technologies (United Tech + Raytheon):

I think we all see where I'm going with this.

History's biggest out-of-control ego trip is about to explode with great farce.