Hard choices are at hand. Either COVID cases continue to explode higher, OR policy-makers move to lock down the economy again. Either way, stocks implode.

Florida is exhibit A of a red state run by a denialist idiot.

Florida has the highest percentage of elderly people in the U.S.

AND, it's a swing state.

"In the five weeks since the governor allowed restaurants and stores to go to 50%capacity, Florida has gone from under 500 new cases a day like on May 26, to over 5,000 coronavirus cases on Thursday."

The governor also said Thursday that he agreed with CDC reporting that the virus might be 10 times more prevalent than current testing shows. But he says that’s not enough to close any businesses or repeal any of the other Phase 2 reopening measures."

Stocks had a 90% down day Thursday on "news" that COVID cases are exploding. A casual glance at any local sports field will confirm that social distancing is a thing of the past. The "good news" is that the death rate is falling, as more of the new cases are in young people versus the elderly and vulnerable. Nevertheless, even a falling death rate will very likely attend a spike in absolute deaths if the number of cases continues rising.

Unlike March, this time around there will be no national lockdown. Trump has already made that clear. Of course many of the red states never locked down in the first place. In addition, every state and locality now has their own set of rules for re-opening and we can expect the same response on potential re-lockdown - wholesale clusterfuck.

People who are locked down in one area will merely travel to less restricted localities - a scenario that the CEO of AirBNB said on CNBC has been driving recent bookings. Call it mobile lockdown.

Meanwhile, on the economic front the IMF almost doubled their 2020 global growth decline forecast from -3% in April to -5% now. To be exact, 4.9% for those who enjoy precision without accuracy. This current "forecast" is a mere two months from the last one.

Below is a 40 year chart of global GDP growth, showing why "reflation" is a figment of every gold lover's imagination. For those who say it's unpatriotic to be bearish or bet against the market, I would point out that stocks are now inversely correlated to GDP for the first time in U.S. history. Making mass insanity the new American way.

Drink the Kool-Aid at your own risk.

Drink the Kool-Aid at your own risk.

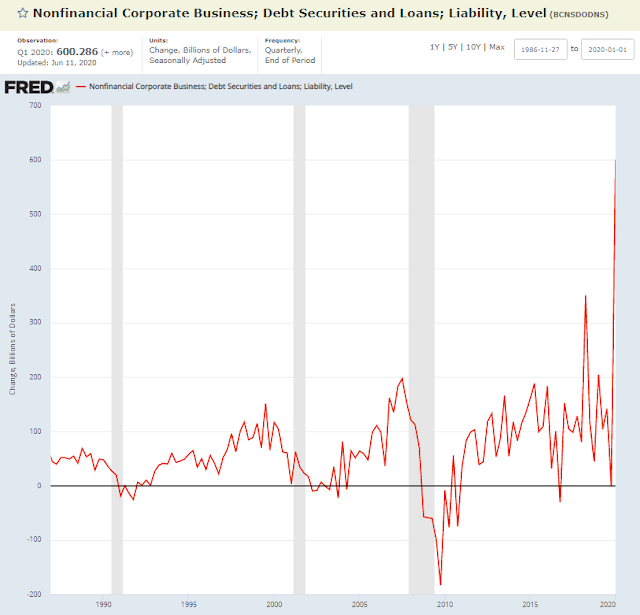

Within the U.S., companies have been buying time literally, by adding to the already record corporate debt load, at the fastest rate in U.S. history. On the topic of lethal Kool-Aid, below we learn that Wall Street has been upgrading companies during this pandemic:

Factset: Have Analysts Lowered Their Ratings on S&P 500 Stocks Due to COVID-19?

"Despite the negative impact on numerous businesses due to the lockdowns caused by COVID-19, the percentage of Buy ratings on S&P 500 stocks has actually increased since the start of the year"

Factset: Have Analysts Lowered Their Ratings on S&P 500 Stocks Due to COVID-19?

"Despite the negative impact on numerous businesses due to the lockdowns caused by COVID-19, the percentage of Buy ratings on S&P 500 stocks has actually increased since the start of the year"

Getting back to the casino, my assumption is that this week will be the peak of the COVID Tech bubble. Here below we see a weekly chart of the S&P Tech sector. Back in February, Tech pulled back hard three weeks before the top and then had two more melt-up up weeks before the crash. So far the pattern is the same, a hard pullback three weeks ago and two parabolic weeks higher. Note however, the difference with the broader market which has already rolled over from a lower high:

“The Nasdaq just had its biggest rally since the fourth quarter of 1999"

Right now the homework on some of these stocks being bought crazily by retail investors shows suboptimal fundamentals, if any fundamentals at all"

Here we see the equal weight on its own, not confirming the Tech bubble. Note the symmetry to wave ii of 1:

Here is another key difference from the last crash. This is the VVIX (VIX of VIX) which indicates that volatility is far more sensitive to moves in stocks this time around.

In my opinion this is because the mega caps are starting to roll over. This society's over-riding faith in technology is about to get system tested. The shock and awe will be epic.

Today's rally was led by large banks celebrating more de-regulated corruption. Which will be the sole legacy of the Trump circus. Mass corruption followed by system meltdown.

"The Volcker Rule, part of the broader Dodd-Frank bill enacted in 2010 following the meltdown of big banks in 2008, sought to crack down on risky behavior by Wall Street firms"

In summary, this society's belief in corruption as usual is about to get system tested. The shock and awe will be biblical.