The overwhelming consensus that inflation is "sticky" and won't easily come down ignores the past 40 years of data, and instead recounts 1979. Sadly, in a circle jerk of like-minded fools there is no strength in numbers...

First off, I am not making a bet on tomorrow's CPI. I wouldn't write an entire blog post around a single data point. Suffice to say that if the CPI continues to run hot it will only make the Fed policy error that much larger. So, for those in the ultra crowded inflation camp, move along this is not for you. Take solace in the fact that you are part of an overwhelming consensus right now that inflation is intractable. My bet is that the inflation consensus is wrong and the consequences will be cataclysmic.

Unfortunately, we must first re-visit the definitions for inflation and deflation before we can reach a prediction for what comes next. At the individual level, inflation and deflation can feel similar - a lack of spending power. Cost of living higher than wages. A declining standard of living.

It's at the macro level where they are nothing alike. Recall that coming out of the pandemic demand greatly exceeded supply due to the demand stimulus colliding with a supply chain shock. Now, I predict those two factors will reverse. Meaning demand will collapse and supply will overshoot. In everything at the same time. Homes, cars, durable goods, crypto currencies, Tech stocks, and commodities. A glut of EVERYTHING at the same time.

Why will this happen? Because the consumer will collapse. Nothing about this is sustainable. And yet Wall Street is convinced it is. Just this week we see these articles:

CNBC:

Bringing Down Inflation Will Take Time

No it won't. It will take sell orders and limit down markets. Not time.

Einhorn:

The Fed Can't Bring Down Inflation

Yes they can. They have every time since WWII and they're going to do an even better job this time.

Suze Orman:

You get the point. Inflation is a broad based consensus at a very lethal juncture.

First off, as I showed in my prior post the economy has changed drastically over the past 40 years. This is now an import dependent economy and therefore the relative value of the dollar has a huge impact on U.S. inflation. Here we see the dollar is at a two decade key breakout level. A break above this level will likely collapse Emerging Market currencies. More on that later.

On a long-term basis, macro deflation is a result of outsourced industries and imported poverty leading to a lack of domestic demand brokered by debt. Debt is deflationary. Now we are seeing the fastest increase in consumer debt in decades.

The net effect of the pandemic was to create a supply/demand imbalance which boosted the prices of everything. But then, policy-makers took away stimulus. So now not only are prices higher, but LIABILITIES are higher as well. Unfortunately, prices can come down but liabilities are contractual. So the middle class is about to get trapped in a deflationary collapse. One in which asset prices collapse and liabilities remain high.

This year will see the largest stimulus removal since the end of WWII, which by the way was a recession.

From almost 20% of GDP last year to less than 5% this year. I can't say when the "official" recession will begin however growth is currently hovering at 0% right now, which means that ex-deficit we are ALREADY in a 5% recession.

This story got ignored today ahead of tomorrow's CPI, despite being a harbinger of what's coming:

"Target is canceling orders from suppliers, particularly for home goods and clothing, and it’s slashing prices further to clear out amassed inventory"

The actions, announced Tuesday, come after a pronounced spending shift by Americans, from investments in their homes to money spent on experiences...That’s a change that arrived much faster than major retailers had anticipated"

Today we also got this deflationary factoid:

At the same time as new mortgage applications are going into meltdown, the annualized % price increase just reached an all time record, AND homes under construction just reached an all time record.

Which equates to the mother of all impending housing gluts.

Worse than last time.

Not to be outdone, we have EM debt going into late stage meltdown mode. A function of EXTREME monetary policy divergence between the U.S. and Emerging Markets.

And strong dollar:

Amid all of this burgeoning risk it's only fitting that the Fed financial stress index just reached an ALL TIME LOW this week. Why? Investor complacency.

AKA. DENIAL.

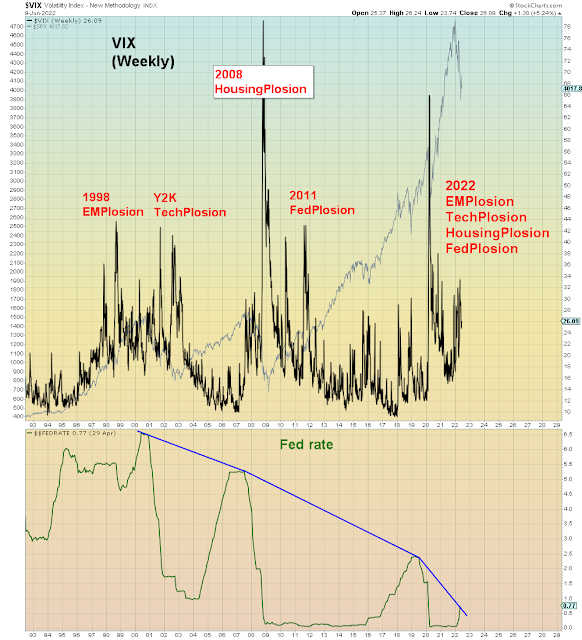

A buffoonish level of over-confidence has given the Fed a green light to double hike the Fed rate next week while reducing the balance sheet at a monthly accelerating rate.

In summary, Millennials who don't believe any of the risks of the past decades were real will now experience all of the risks at the exact same time with no monetary safety net.

This is what happens when you get bailed out for 14 years straight.

You eventually take a lethal amount of risk, sans bailout.

Our so-called leaders are idiots. And they will clearly be the last to know that their reign of idiocy is ending.