"There are four forces working against Apple in the December quarter: An unfavorable comparison, a strong dollar, iPhone supply issues, and a cautious consumer"

Thursday, November 2, 2023

FOMC: FEAR OF MISSING CRASH

"There are four forces working against Apple in the December quarter: An unfavorable comparison, a strong dollar, iPhone supply issues, and a cautious consumer"

Thursday, October 26, 2023

THIS IS CRASH

"Circuit breakers were installed after the October 1987 crash, making a 20% decline "almost impossible"

Thursday, October 19, 2023

HARD LANDING

Tuesday, October 10, 2023

CONDITIONED TO EXPLODE

“If you remember 2017, right before we got into Volmageddon in February 2018, the volatility environment smelled similar to right now”

Wednesday, October 4, 2023

GLOBAL MARGIN CALL

The month of crash has officially begun.

Since the Fed "pause" last week, global bond yields have sky-rocketed. Under this new paradigm, the Fed won't have to tighten again because the bond market is tightening for them.

No one seems to have any answers for why this is happening. Bulls are at a total loss to explain how a Fed pause caused long rates to explode. The most obvious explanation is that the global bond market is now going bidless due to relentless central bank tightening. Real yields are rising which is a sign of central bank policy error. However, central banks are now trapped between the threat of further inflation and the need to support asset markets during an incipient meltdown. Consider the stark difference below between March 2020 and this current situation.

Central bank policies are currently at the opposite end of the bailout spectrum relative to 2008 and 2020. But to hear bulls tell the story, CBs can just flip a switch and instantly bail out everyone. As I said on Twitter, this time there will be a long line for bailout. A long soup line.

Because by the time central banks get the bond market back under control, the stock market will be a smoking crater.

Over the past weekend, the government shutdown was temporarily avoided for six weeks, but it came at the expense of Speaker McCarthy's job. I had predicted a market meltdown if this happened, but instead of course the market rallied.

One more obvious risk to ignore.

It appears that gamblers have yet to consider the implications of a market meltdown with a non-functioning Congress. They seem to forget that in 2008 and 2020, Congress backstopped both the FDIC AND the corporate bond market. So it's only fitting that corporate bonds are currently breaking the lows of last year and soon banks will be at new lows as well.

Which begs the multi-trillion dollar unasked question - at what breaking point does inflation risk morph straight into default risk? And the answer is when the deflationary impulse returns which should be any minute now. Because the deflation paradigm will cause a massive re-allocation of capital from stocks back to T-bonds when everyone realizes that today's earnings estimates are off by a minus sign.

Consider that rotation scenario in the context of Utility stocks that are ALREADY imploding the fastest since 2008.

THESE are the stock market safe havens. Where will investors hide when the rout accelerates.

Netflix?

In summary, in the first week of crash month, it's only fitting that the average U.S. stock has now given back all 2023 gains and is now sitting at a loss for the year. Meanwhile, gamblers remain totally complacent.

Because in a groupthink Idiocracy, the realization that they own an epic clusterfuck will dawn on them at the exact same moment.

aka. Too late.

Thursday, September 28, 2023

OCTOBER: MONTH OF CRASH

The reign of complacency has continued to the end of September, despite the fact that the market peaked two months ago at the end of July. So as we enter the infamous month of October, it falls on those of us who can still fog a mirror to ask, what could go wrong?

Going back one year, stocks bottomed last October on the premise that the Fed was done or near done raising interest rates. There have been two rate pauses subsequently, but overall interest rates have continued to rise.

Throughout the past year, consumers have continued to spend due to the inflationary impulse. In an inflationary paradigm, consumers believe that their increasing debts will be offset by rising wages. Unfortunately, interest rates have risen far faster than wages, which means that the debt burden has increased over the past year, NOT decreased. Which means that they are now trapped with higher debt levels AND higher interest rates at all time low unemployment. Once the deflationary impulse returns, they will be buried under a mountain of unaffordable debt. One can presume that they will not be happy to have been led to believe that the economy is strong.

Meanwhile, the entire stock market rally has taken place under a backdrop of declining profits and rising real interest rates. The worst case scenario for stocks.

Homebuilder stocks are a prime example of the mis-pricing of risk. One year ago, these stocks took off with yields at cycle high on the premise that bond rates were coming down. But since that time, bond yields have gone up.

WSJ: Rising Rates Finally Catch Up With Homebuilder Stocks

I've been showing this same chart all year, showing homebuilders rallying against the backdrop of Fed rate hikes, but nothing mattered.

Until they spontaneously exploded.

This positive correlation between homebuilders and interest rates doesn't seem to make any sense until we look back at the 2007 housing bubble. Then as now, home prices actually rose during the rate hiking cycle and then rolled over when rates came down. Why? Because the economy was imploding.

We can expect the same thing to happen now.

This past week, Zerohedge posited that a "bounce" is due at any time. They also believe that non-Tech stocks will lead the rally from this point forward. I agree that an oversold bounce could occur at any time, but the experience of Y2K informs us that it won't last long. When the Dotcom bubble burst, "short duration" cyclicals outperformed growth stocks on a relative basis, but they still declined on an absolute basis.

In other words, bulls are watching the Tech bubble implode and yet STILL making up excuses to own stocks.

In summary, anyone with amnesia can make up excuses to own stocks right now. But you don't have to just forget 2008 and Y2K, you also have to forget last year when that bear market started the exact same way it's resuming right now. I have yet to read one bullish pundit making year-over-year comparisons. Why? Because if they did they would be forced to conclude that we are heading for the first back to back yearly bear markets since the 1930s. And that their totally fabricated rate pause "bull market" has now reversed back to the breakout level.

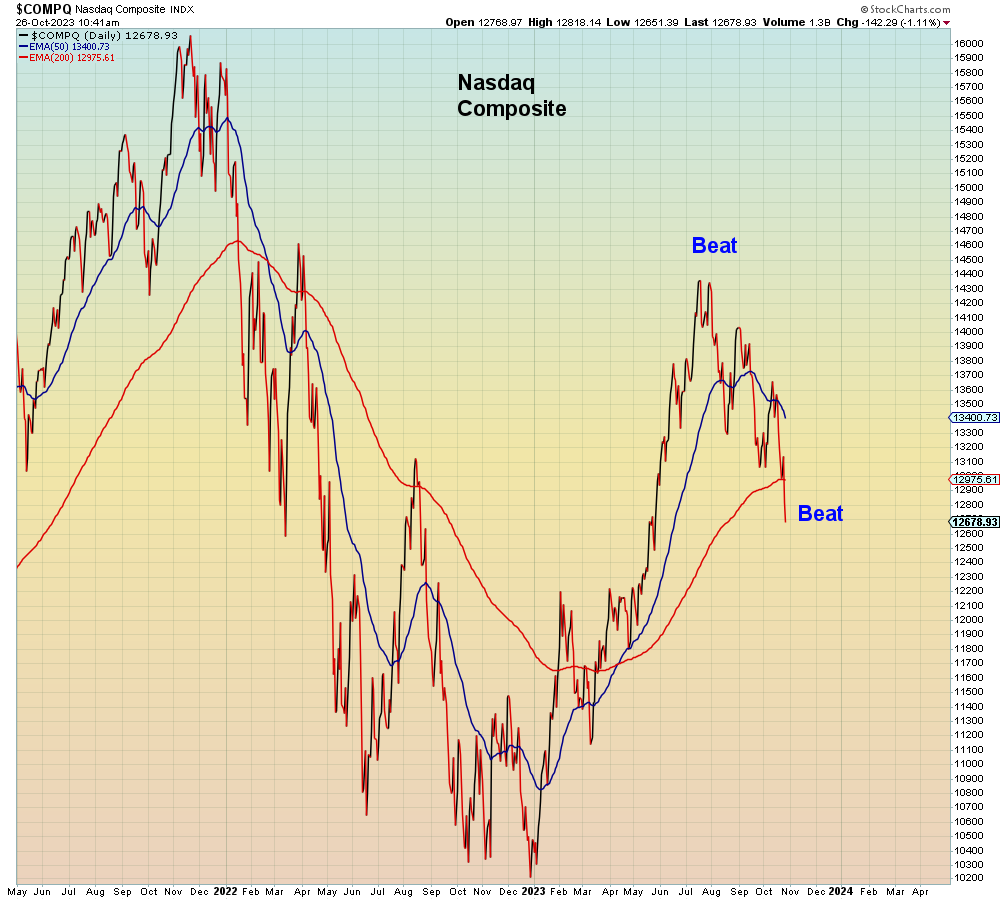

So it is that I make a bold prediction. That by the end of October we are challenging the lows from last October as if nothing had even happened for the past year.

Because guess what, nothing did happen.

Thursday, September 21, 2023

A COMPLACENT MELTDOWN

The week after Lehman anniversary, and markets are doing what was unexpected of them...

Throughout this tightening cycle, global risk markets have been front-running the end of rate hikes. Each rally has proven to be a false dawn. It has never occurred to bulls that THEY are the reason this tightening cycle can never end. Recently, the oil market has been spiking in 100% correlation with every other global risk market. Which is why, as I said would happen, economists are now saying that a higher CPI is assured in the coming weeks. Which, will put the Fed back on the tightening path after only one pause. Deja vu of what happened this past June:

"We already know that due to base effects, the roll-off of the CPI is going to lead to very likely inflation going back up"

On a global basis, recall that last week, the ECB was also hawkish. Today, the Bank of England paused for just the first time in almost two years. Next, we are waiting for the BOJ to render their decision tonight (Friday in Japan).

Also leaning hawkish, Japan is now declaring victory over deflation while being on the cusp of the most deflationary market event since the 1930s.

"We won"

All of this hawkish tightening is finally catching up with markets.

Or should I say, catching down.

Here we see the S&P Tech index has taken out the key support level from August, but we also see that the Nasdaq VIX still signals complacency.

In this chart we see that the Nasdaq (100) equal weight is below where it was in August, but the oscillator is above where it was in August. Which signals the market is not yet oversold.

Away from Tech, here we see that the Industrials rally was a bull trap.

In summary, the VIX has now closed below the 200 day moving average for 128 trading days in 2023. That is the longest streak of reduced financial anxiety since the END of the financial crisis. The only difference is that back then the VIX was coming down from 100. This time around, the VIX is coming down from the March level which was 30.

Which begs the question - do bulls even know what is the difference between the end of a financial crisis and the beginning?

And the answer is $Everything.