Bulls, F.Y.I...

At the beginning of the month, I reminded everyone that October is the notorious month of crash. Ominously, by mid-month, we were told via Ned Davis Research, that the current set-up is eerily similar to 1987, but that is no cause for concern:

"Circuit breakers were installed after the October 1987 crash, making a 20% decline "almost impossible"

There are three regular session stock market circuit breakers which are triggered at declines of -7%, -13%, -20%. On March 12th 2020, at the onset of the pandemic, the first circuit breaker was triggered at the open which paused all trading for :15 minutes. The -13% circuit breaker was almost triggered near the end of that same day, but the rules for circuit breakers prevent them from triggering in the last half hour. Which is why the market was down -13.5% at the close. Which happened to be the biggest one day percentage decline since 1987. So to believe that a -20% decline could not occur again, is wishful thinking. Investors are far more complacent now than they were going into March 2020. And this market keeps on dropping.

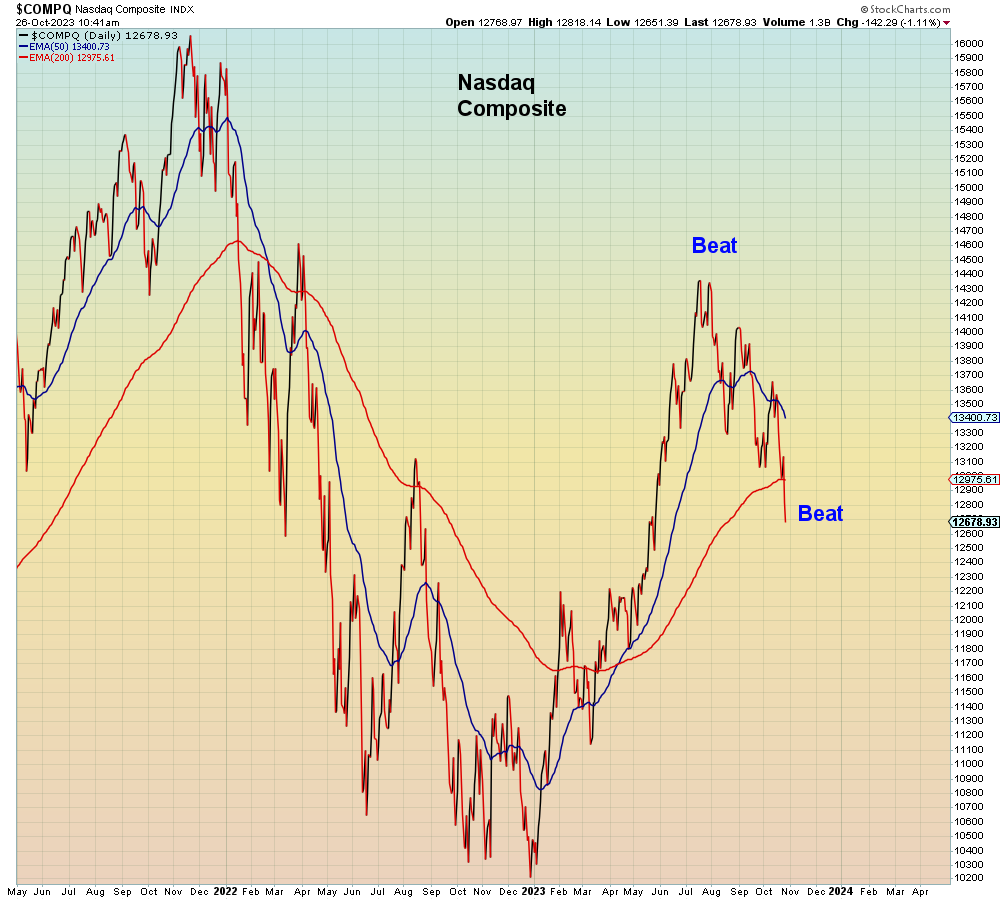

This week, Wall Street earnings "beats" are getting monkey hammered, especially in mega cap Tech. Which means that the charade is over. This negative price reaction proves that fundamental analysis is not a reliable predictor of stock direction. Going into this earnings season, Google, Microsoft, Amazon, Netflix, Nvidia, and Apple all had charts that were predicting impending weakness. I posted several of them on Twitter. Every one so far has reversed to the downside after earnings. In addition, the same price reaction already occurred at the July top - across the board earnings beats for mega cap Tech stocks were met with heavy selling. Which of course is something that Wall Street would never predict, and therefore most gamblers were trapped in bad trades. In other words, technical chart analysis was far more useful as a predictor of impending direction than Wall Street earnings predictions which have the veracity of a Magic 8 Ball.

The Nasdaq is now through all levels of support.

All of which means that as the month has worn on, bulls have become more and more trapped. As a result, BofA (Hartnett) came out this past weekend and said that they were becoming tactically bullish due to the market's oversold condition. They said that extreme bearishness could either lead to a bounce or a crash. Which of course sparked a big rally on Monday:

“Investors are sufficiently bearish” for the S&P 500 to hold above 4,200 points for the next three-to-four weeks...if the index can’t hold at 4,200 with this level of bearishness, then there may be imminent risks of a credit event or hard landing”

Clearly, bulls and bears are on the exact same page now - stocks have ~5% upside, and -50% downside. Which makes this a tradable opportunity for someone with an IQ of a dead gopher. Or hedge fund managers desperate not to underperform the market into year end.

In summary, position accordingly.